Bitcoin has soared this week, rising from round $91,000 on Monday to simply over $95,000 on Wednesday. Then again, on-chain information is BTC For main trade wallets.

This dramatic worth motion has sparked debate, with some speculating {that a} concerted shopping for push is happening available in the market.

Enormous quantity of 6 billion {dollars} BTC Bitcoin reaches $100,000 resulting from inflows

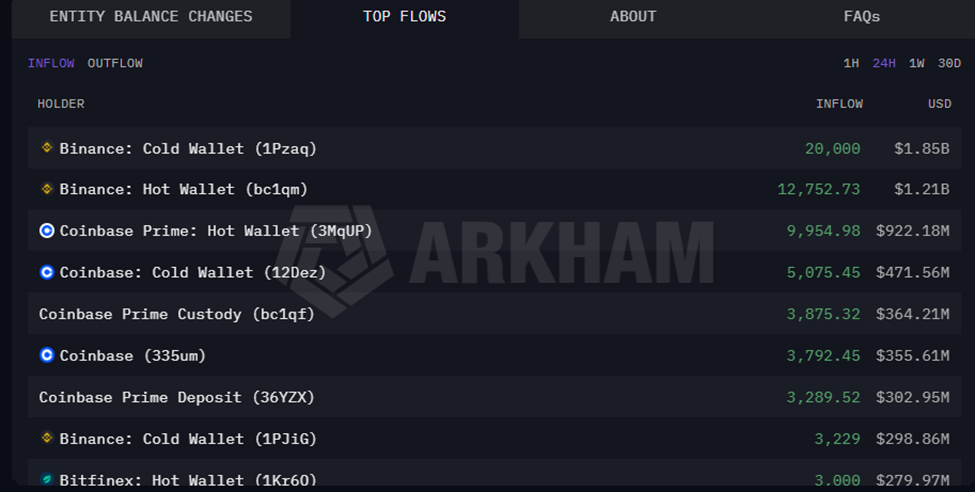

Binance wallets alone noticed a rise of 32,752, in accordance with information from on-chain analytics agency Arcam. BTC Coinbase noticed a rise of 26,486 in each hot and cold wallets BTC.

Smaller exchanges additionally recorded notable inflows, with Kraken and Bitfinex including 3,508. BTC and three,000 BTCrespectively. Collectively, these strikes characterize about $6 billion in buying energy, Arkham stated.

Bitcoin has been flowing into exchanges previously 24 hours. Supply: Arkham

The dimensions of those transfers has fueled debate about whether or not latest worth will increase had been attributable to concerted market exercise. Binance CEO Changpeng Chao addressed the hypothesis and clarified: BTC Deposits mirrored customers’ purchases of their trade wallets, moderately than inside purchases by the trade itself.

Customers of those exchanges bought…

— CZ🔶BNB (@cz_binance) January 14, 2026

Regardless of this clarification, analysts say the info reveals a powerful wave of institutional and high-net-worth investor participation.

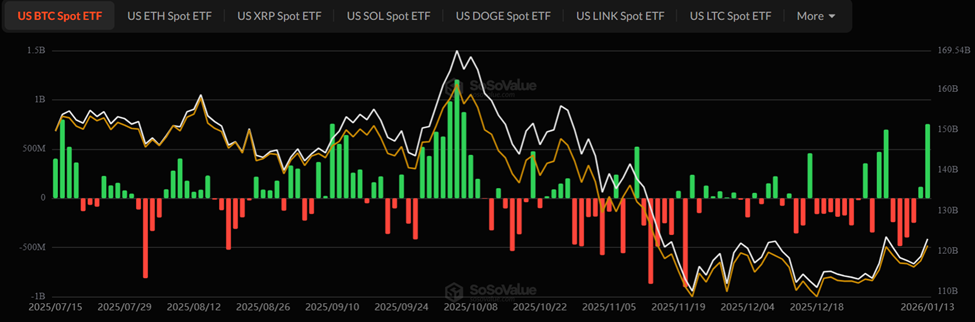

This comes shortly after Bitcoin ETF investments reached $753 million on Tuesday, January thirteenth, with inflows into Bitcoin ETFs reaching ranges final seen in October 2025.

Bitcoin ETF Circulate. Supply: SoSoValue

Constancy’s FBTC led inflows on Tuesday, reaching $351 million, exhibiting one of many strongest day by day demand indicators for institutional buyers. BTC This 12 months’s publicity.

Will the following Bitcoin worth be $100,000?

Silver costs have $100 potential, and Bitcoin is equally racing in direction of $100,000, highlighted by the newest shopping for exercise and widespread bullish sentiment within the crypto market.

Bitcoin is rallying in direction of the $100,000 degree as buyers think about macroeconomic components similar to inflation tendencies and central financial institution liquidity measures, alongside developments within the broader digital asset ecosystem.

This surge strengthens Bitcoin’s attraction as a long-term retailer of worth amid monetary instability and geopolitical turmoil.

Arcam information reveals exercise is targeting main exchanges, which frequently function the primary gateways for institutional purchases.

Such capital inflows have traditionally preceded vital worth will increase, reflecting each elevated demand and provide constraints available in the market. Nevertheless, regardless of the scale of the acquisition, the cryptocurrency market stays unstable and sudden reversals are at all times attainable.

Put up 6 Billion {Dollars} BTC The submit Purchase Spree hits exchanges as Bitcoin worth races in direction of $100,000 appeared first on BeInCrypto.