In January 2026, the Ethereum ecosystem recorded a surge in staking exercise, with a number of indicators reaching all-time highs. These information may cut back liquid provide and facilitate a possible worth breakout.

Nevertheless, Ethereum Though the worth has remained under the $3,500 stage for the previous two months, analysts consider {that a} breakout could also be nearing resulting from these optimistic on-chain indicators.

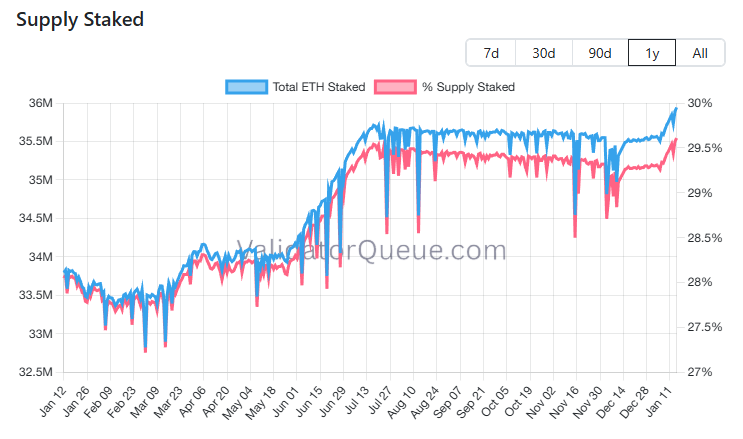

Roughly 36 million Ethereum invested, accounting for nearly 30% of provide.

ValidatorQueue information reveals it’s staked Ethereum reached 35.9 million copies, accounting for 29.6% of the whole circulation. In right this moment’s costs, this equates to greater than $119 billion.

% of ETH stake and provide stake. Supply: ValidatorQueue”>

% of ETH stake and provide stake. Supply: ValidatorQueue”>

whole Ethereum Ratio of staking and provide staking. Supply: ValidatorQueue

This chart reveals a notable spike since early January. Piling out Ethereum The variety of individuals within the nation elevated from 35.5 million to 35.9 million, ending the lengthy flat part that had continued since August final yr.

This progress is Ethereum Since August, costs have fallen greater than 30%. This information displays robust investor conviction over time. It additionally strengthens the safety and stability of the Ethereum community.

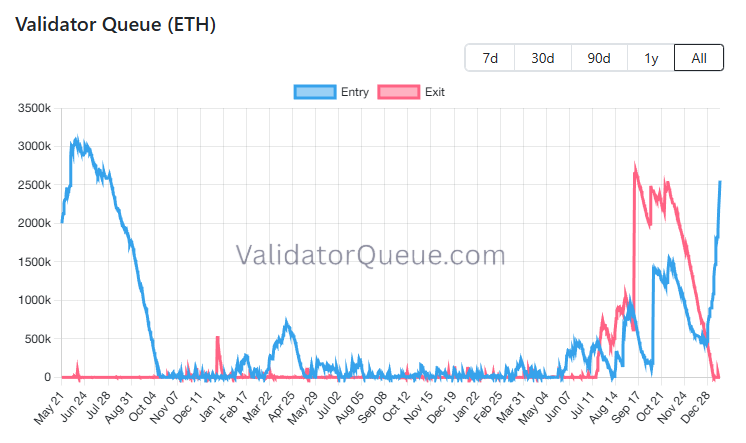

As of January fifteenth, Ethereum Staking queue exceeds 2.5 million EthereumIt marked the very best stage since August 2023. In the meantime, the unstaking queue has decreased to zero.

Ether verification queue. validator queue

These milestones are primarily pushed by staking exercise by main establishments and publicly traded digital asset treasuries (DATs).

Arkham stories Tom Lee’s Bitmine guess an extra $186,500 Ethereumvalue greater than $600 million. This transfer elevated the whole stake Ethereum $1.53 million, valued at over $5 billion. Tom Lee presently has a stake in over 1% of Ethereum’s whole provide.

“Tom Lee is playing with billions of {dollars} value of cash.”Ethereum. He is aware of 100% greater than we do. ” — CryptoGoos commented.

In the meantime, Sharplink (SBET), the primary publicly traded firm to make the most of Ethereum as its major monetary asset, reported producing greater than $32 million from staking actions since June. The full cumulative reward is now 11,157 Ethereum.

Ethereum marked one other main milestone in January, with consumer exercise hitting an all-time excessive. This development displays robust participation in stablecoin transactions and DeFi protocols throughout the Ethereum community.

With these bullish indicators in place, analysts predict that Ethereum may break by the present $3,450 resistance and rally in direction of $4,000. This outlook can also be supported by the cup-and-handle sample forming within the brief time period.

Ethereum post-staking exercise units a number of information – is Ethereum Are you prepared for a worth breakout?The publish appeared first on BeInCrypto.