Bitcoin miners entered early 2026 with a well-recognized however more and more unforgiving setup. Community hashrate has fallen from its highs in late 2025, issue has adjusted with latency, and energy prices stay the laborious constraint that determines which fleets keep on-line and which fleets go darkish.

Because of this, whereas the market seems resilient on the floor, particularly when Bitcoin rallies, it stays susceptible on the margins, the place a single issue improve or regional energy surge can rapidly flip “operation” into “shrinkage.”

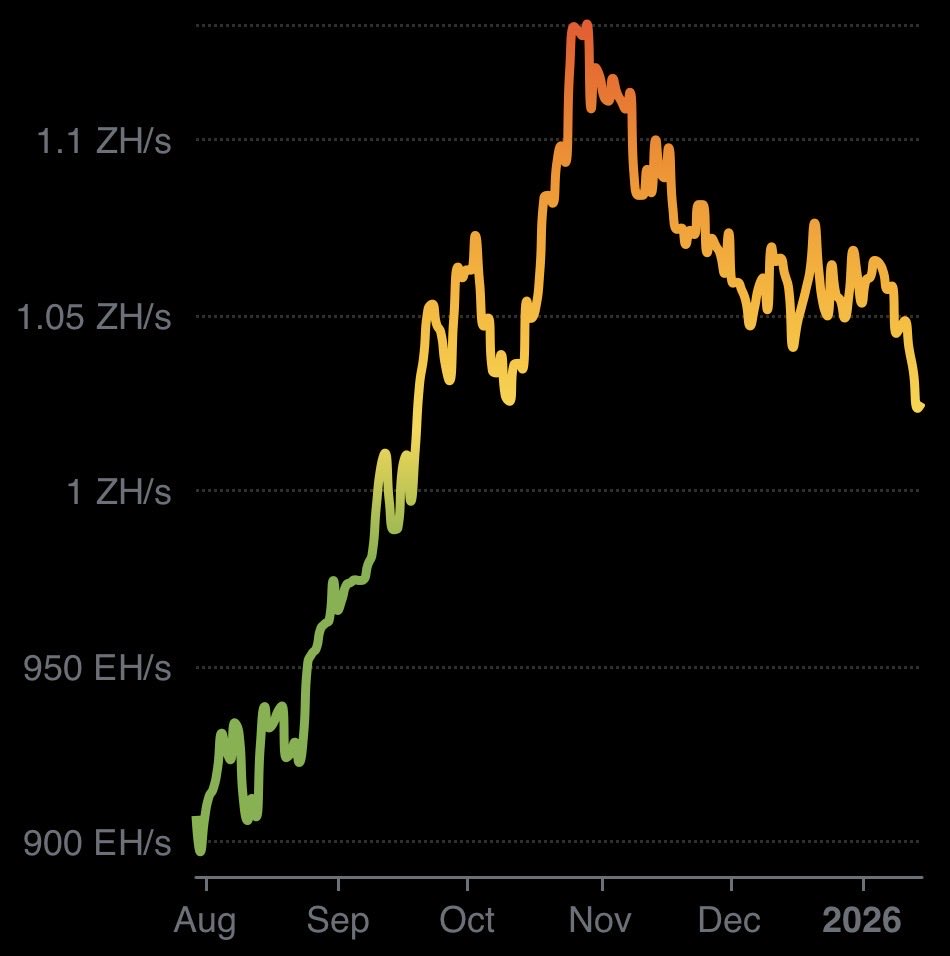

Hashrate is on a downward development after the excessive in late 2025

Bitcoin’s community hashrate has declined from its peak tempo in late 2025 and has not persistently returned to that stage, even in periods of spot power.

JP Morgan reported that Bitcoin’s common month-to-month community hash fee elevated by 5% in October. 1,082EH/secreport month-to-month common in that collection. Estimated following November 1,074EH/secrelatively than a steady continuation, it’s a gradual month-on-month decline.

Since late December, every day forecast values have been unstable, with statistical values swinging between excessive and low values. 1,000EH/sec This threshold is in keeping with miners biking their uptime relatively than increasing easily.

YCharts’ community collection, sourced from Blockchain.com, confirmed each measurements under 1,000 EH/s and rebounds above that stage earlier than and after the mid-January rebound.

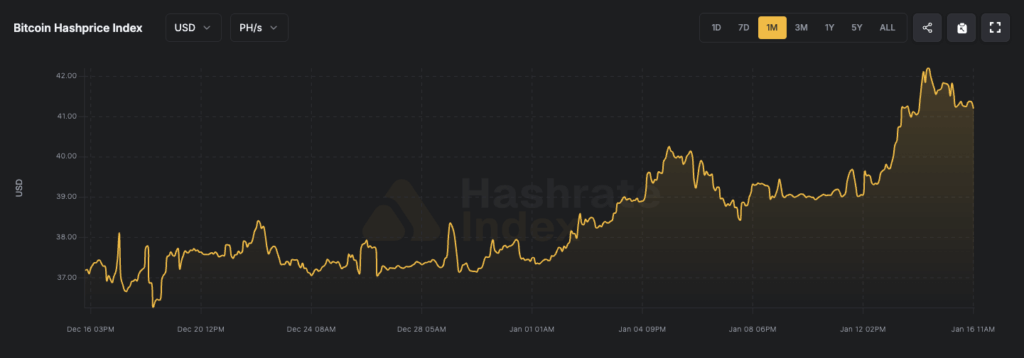

The hash value, not simply the Bitcoin value, influences the choice to close down.

A miner’s actions rely upon extra than simply the spot of Bitcoin. hash valuethe anticipated every day income earned per unit of hashrate. It is a metric that determines whether or not the least environment friendly rigs can function with out draining capital.

In Luxor’s weekly replace dated January 12, the USD hash value fell weekly. $40.23 to $39.53 per PH/sec/dayIt is a stage described as “close to or near break-even for a lot of miners.”

In different phrases, the community might stay unstable even throughout spot rebounds as miners’ profitability might stay compressed.

Luxor additionally reviews Bitcoin decline 2.9% Roughly since final week $91,132 Hash costs grow to be stricter, growing stress on miners whose value base doesn’t transfer on a spot foundation BTC.

In the identical replace, Luxor’s 7-day easy shifting common As a result of the hashrate has decreased 2.8% from 1,054EH/sec to 1,024EH/sec.

The scenario within the second half of 2025 is essential. Luxor’s analysis division beforehand recorded that the problem stage reached its highest stage after a optimistic adjustment of 6.31% on October twenty ninth. 155.97T.

Hashprice then fell in November as charges and costs didn’t offset the upper issue stage, and hashrate index knowledge confirmed that Hashprice fell to near-all-time lows. $36 per day per PH.

The market moved above that backside in direction of early 2026, however not by a lot. For this reason the restoration in hashrate since October has been uneven. Many carriers hover round a degree the place “on” and “off” are separated by a small distinction in energy prices.

A easy actuality test on the machine stage

The sensitivity turns into clearer when changing the hash value into income per rig and evaluating it to the price of electrical energy.

Bitmain lists the Antminer S19j Professional as 92 TH/s and a pair of,714 watts, whereas the S21 itemizing says 200 TH/s and three,500 watts.

The desk under makes use of the next values as hash value enter: $38.2 per PH/sec/dayroughly consistent with Luxor’s cited six-month ahead common.

For electrical energy, we use the U.S. Power Data Administration’s September 2025 business common electrical energy value of 9.02 cents/kWh because the delivered value benchmark. Wholesale costs could also be decrease (or greater) than this, however the miner’s complete value will range relying on contracts, congestion, charges, and discount phrases.

This doesn’t imply that every one miners are unprofitable, however relatively that many miners have significantly better energy costs, demand response revenues, and operational efficiencies.

The purpose is marginal Miners trigger churn, and at such hash value ranges, a maxed-out fleet behaves an increasing number of like a versatile load relatively than an “at all times on” infrastructure.

The issue is delay levers that may blindside miners

Issue adjustment solely each time 2,016 blocks (roughly each 2 weeks), which implies you will not have a right away response to the spot. BTC or fluctuations in hashrate.

This delay might power miners to soak up a complete epoch of weak hash value situations earlier than the protocol recalibrates, compressing margins throughout drawdowns and delaying the return to profitability that some operators count on to reach quickly.

This timing threat is why miners are blindsided by difficulties. The fleet is BTC However it can solely grow to be squeezed if the problem will increase for the subsequent window and the anticipated income per hash can not sustain.

Issue knowledge for early January additionally reportedly decreased by 1.20%. 146.4T Forecasts point out that the January 22 correction might rise into 2026. ~148.20T.

Ahead pricing suggests restricted reduction except one thing adjustments.

Luxor mentioned the futures market is pricing within the common hash value. $38.19 over the subsequent six months. When utilizing spot hash value $39.53this curve means there may be restricted short-term rest except one of many key elements adjustments. BTCgreater charges, much less issue, or cheaper electrical energy.

This new sample is a type of community whiplash. As hash costs are compressed, hashrate softens, difficulties lag behind adjustments, and miners should feed on the economically weak till protocol-level treatments are utilized.

Spot rallies just like the latest rally to $97,000 can quickly masks stress, but when the subsequent issue window finally ends up being greater than what operators have modeled, the squeeze might rapidly return.

Strain is targeting electrical energy prices

If hash value tells miners how a lot the community is paying them, energy determines how a lot real-world operators can preserve.

In our Luxor abstract, we transformed compute income to implied income per MWh throughout fleet effectivity tiers.

This ladder is essential as a result of electrical energy costs aren’t set equally by area or contract kind.

The Worldwide Power Company estimates that the common wholesale electrical energy value in the USA is roughly $48/MWh Within the first half of 2025, the European Union common shall be roughly $90/MWh.

The IEA additionally talked about the EU’s 2026 electrical energy futures. $80/MWh.

Wholesale benchmarks should not have a one-to-one correspondence with delivered industrial charges, however they can assist body regional path and volatility.

For miners working in Luxor 25–38 J/TH layer, the implicit computing income is shut $51/MWh Which means that many websites might be compelled to make cuts rapidly if the price of vitality provided rises, if hedging turns into unfavorable, or if native congestion and charges widen all-in costs.

Detrimental pricing provides one other layer. It might reward versatile hundreds and penalize inflexible sourcing.

The IEA reviews that destructive costs have gotten extra frequent in Europe, and the proportion of time intervals with destructive costs is growing. 8-9% It would launch within the first half of 2025 in nations resembling Germany, the Netherlands and Spain.

This setting favors miners who can quickly ramp up and down, seize demand response funds, and carry out behind-the-meter energy era.

Carriers with out that flexibility might face greater efficient prices in powerful occasions, even when headline wholesale costs are comfortable.

Texas stays an essential mining jurisdiction and coverage wildcard

Texas continues to be one of the vital essential jurisdictions to look at as grid coverage and interconnection competitors form the economics of huge mining hundreds.

texas state legislation senate invoice 6 This might enable ERCOT to order sure giant electrical energy customers to close down or use backup energy era in an emergency.

A report on the invoice says it will apply to new bulk transportation. 75MW Extra connections than later December 31, 2025current amenities are exempt.

In the meantime, ERCOT’s load request pipeline has exceeded 230GW In 2025, 70% Experiences on queues are related to knowledge facilities.

The Worldwide Power Company has additionally warned that knowledge facilities would be the predominant driver of electrical energy demand development by way of 2026.

For Bitcoin miners, this mixture will increase the worth of current interconnections and secure contracts, probably making growth considerably tougher except abatement phrases and grid entry are negotiated early.

What to look at subsequent

- Subsequent 1-2 issue epochs: Issue lag can both ease the squeeze (if it eases) or strengthen the squeeze (if the hash value stays flat and rises).

- Hash value stability: Luxor’s $39-$40 PH/sec/day zone is near break-even for a lot of miners, and the ahead curve round $38 suggests little margin for error.

- Energy variability: Fleets within the 25-38 J/TH tier are notably in danger when the price of provision approaches or exceeds the implied compute income per MWh, or when local-based dangers stretch the all-in value.

- ERCOT Mitigation Danger: Emergency powers below SB 6 might result in sudden, event-driven hashrate declines, impartial of Bitcoin value.

- Information heart competitors: Continued development in grid demand might restrict miners’ entry to lowest-cost capability, additional reinforcing regional disparities in profitability.

For now, the measurable baseline is Luxor’s spot hash value. $39.53 per PH/sec/dayin parallel with Bitcoin’s weekly decline to approx. $91,132 The 7-day common hashrate is 1,024EH/sec.

This mixture units a reference level because the community approaches the subsequent issue window. The miner then decides once more whether or not to run, scale back, or look ahead to a rebalance that arrives solely after the protocol’s built-in delay.

And what’s JP Morgan? 1,082EH/sec Whereas October’s month-to-month benchmark nonetheless stands as a latest report for that collection, the subsequent essential query is straightforward.

Will the economics of the miner be capable of help sufficient sustained uptime to return to that tempo, or will troublesome delays and energy constraints make it much more troublesome? BTC Keep sturdy?