Bitcoin was buying and selling between $94,869 and $95,115 per coin as of 9:00 a.m. EST on January 18, 2026, whereas derivatives merchants weren’t taking any breaks. Futures and choices markets are experiencing crowded positioning, heavy open curiosity, and an growing obsession with a slender vary of worth ranges just under $100,000.

Bitcoin derivatives knowledge exhibits market bracing for volatility

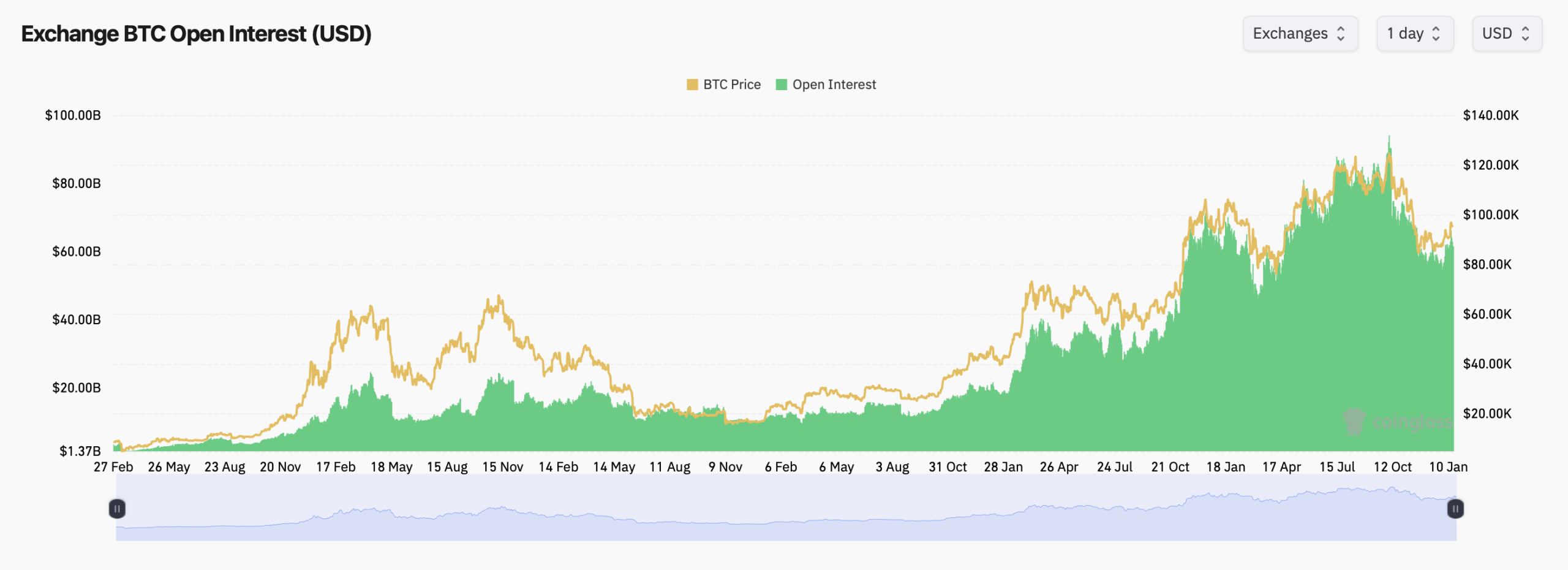

Whole open curiosity in Bitcoin futures at the moment stands at roughly $646,850. BTCBased on statistics from Coinglass.com, the notional quantity is equal to roughly $61.48 billion. Whole open curiosity elevated barely previously 1-hour and 4-hour home windows, however the 24-hour studying was down practically 2%, suggesting selective trimming reasonably than a widespread withdrawal from leverage.

Amongst futures buying and selling venues, Binance leads the pack this weekend with round 129,540. BTC Open curiosity accounts for simply over 20% of the worldwide complete. CME follows intently with 122,640. BTCreinforcing its position as a most popular locus of institutional positioning. OKX, Bybit, Gate, and MEXC spherical out the highest tier, every providing significant publicity regardless of short-term positioning adjustments.

Futures open curiosity as of January 18, 2026, in accordance with coinglass.com statistics.

Market actions throughout a number of exchanges paint a special image. Binance and OKX have seen a slight improve in open curiosity over the previous day, whereas CME and Bybit have recorded a slight contraction. This churn means that merchants are rotating their publicity reasonably than abandoning bets totally, preserving leverage excessive as costs method acquainted territory.

Possibility Information Indicators Bullish Sentiment Ready

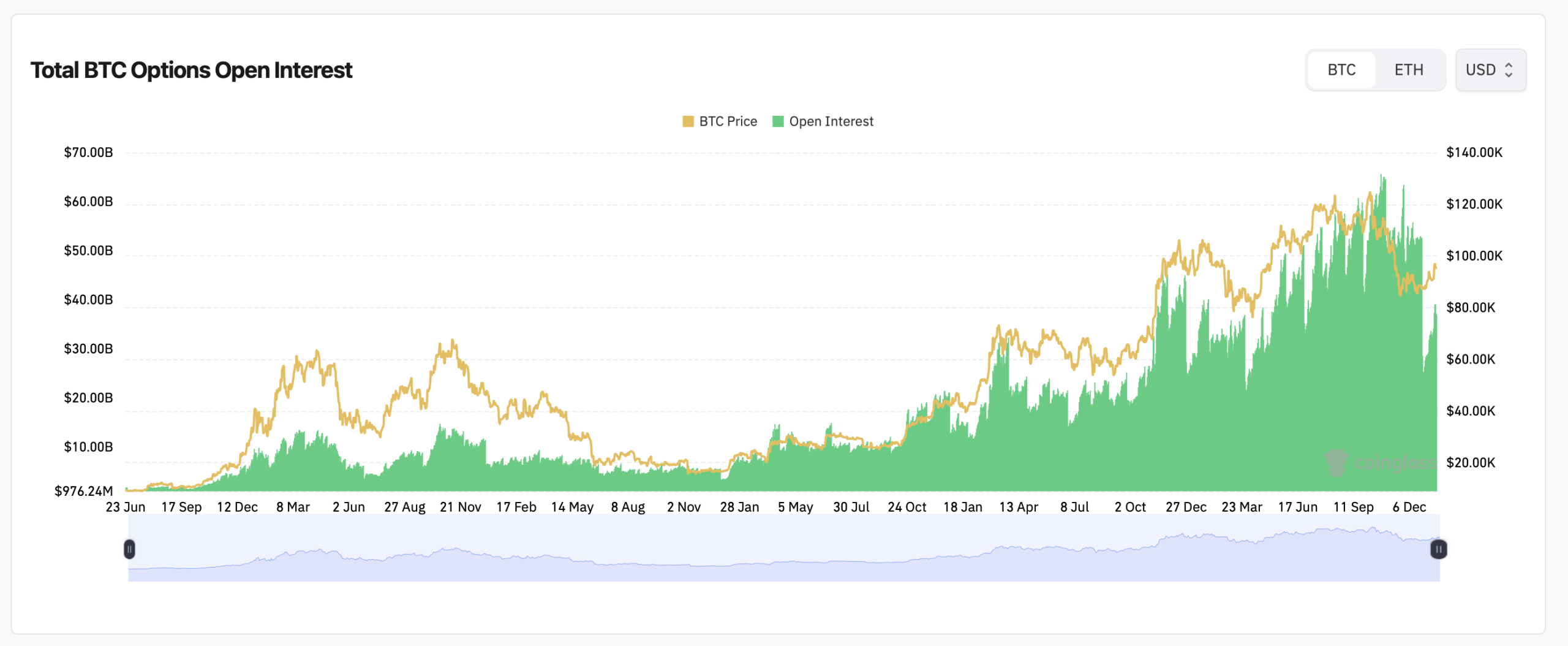

In the meantime, the Bitcoin choices market continues to develop. Whole open curiosity in choices is at the moment approaching $36.88 billion and is intently linked to cost as merchants load contracts throughout a number of expirations. Deribit stays the undisputed powerhouse, internet hosting the biggest share of contracts and probably the most actively traded strikes.

Choices open curiosity on January 18, 2026, through coinglass.com statistics.

Calls nonetheless dominate the choices market. Roughly 57% of the entire choices open curiosity is tied to name contracts, which equates to over 209,000. BTCPlaces, then again, account for about 43%, or about 157,000. BTC. This bias means that merchants stay bullish over the long run, even when short-term warning stays.

Brief-term buying and selling volumes are a special story. Over the previous 24 hours, put choices barely outperformed calls, capturing over 55% of the each day choices quantity. This imbalance suggests tactical hedging and draw back insurance coverage for merchants to organize for potential disruptions round upcoming maturities.

Most ache degree offers additional perception. Deribit has the biggest focus of notional values for late January maturities across the $90,000 to $93,000 vary, with an extra strain zone rising round $95,000. These ranges typically act like a magnet as expiration approaches, irritating overconfident speculators.

Additionally learn: The Battle of $95,000: Can Bitcoin Bulls Maintain the Line?

Binance’s choices market presents a special taste. The most important ache there’s close to $100,000, with important notional worth piled up with strikes between $95,000 and $105,000. This setup means that Binance merchants are bracing for broader worth actions reasonably than tighter worth actions.

The place of max ache in OKX is barely decrease, with max ache drifting in the direction of the low $90,000 area over a number of expirations. Mixed with larger notional values on some train rights, the info suggests cautious optimism wrapped in a thick layer of hedges.

Taken collectively, the Bitcoin derivatives market displays conviction with out complacency. Futures merchants stay engaged, choices merchants actively derisk, and costs proceed to orbit the zone the place leverage, psychology, and persistence collide.

Regularly requested questions ⏱️

- What does the peak of Bitcoin futures open curiosity point out?This means robust dealer participation and elevated leverage throughout derivatives markets.

- Why do calls dominate Bitcoin choices open curiosity?A place with a whole lot of calls means that merchants expect the value to rise over time.

- What’s the most pane in Bitcoin choices?Most ache is the value degree at which most choices expire nugatory and sometimes acts as a short-term gravity zone.

- Which exchanges dominate Bitcoin derivatives buying and selling?Binance, CME, OKX, Bybit, and Deribit account for almost all of futures and choices buying and selling.