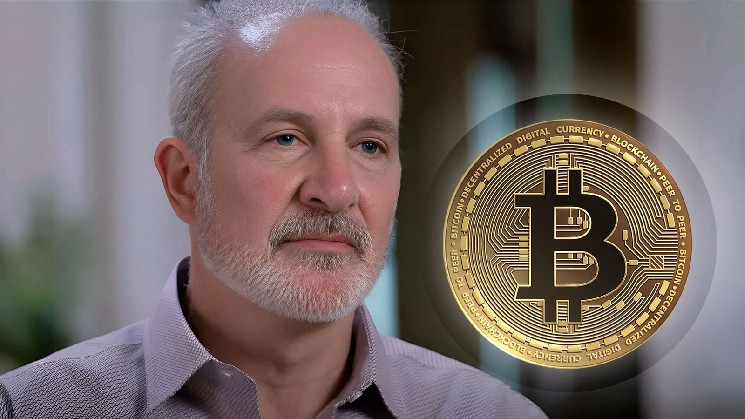

Peter Schiff is new concept The explanation Bitcoin (BTC) is struggling to keep up its momentum in early 2026 is as a result of Wall Avenue killed it.

In a current social media change, the Abominable Goldbug claimed that the “institutionalization” of cryptocurrencies has successfully killed its worth proposition.

Schiff mentioned the asset was at its greatest when it was a distinct segment contrarian guess.

Now packaged into ETFs and bought to the general public, he claims they’ve turn out to be one of many “worst performing property.”

116% income in comparison with “late-comer” entrants

The remark was sparked by an change on X (previously Twitter), the place one person pointed to the scoreboard and objected to Schiff’s bearish stance.

“For the reason that ETF’s launch in January 2024, it is actually up over 116%,” Kavardjian famous.

SchiffNevertheless, the 116% determine was dismissed as a “rearview mirror” indicator that obscures actuality for almost all of present holders.

“Principally simply within the first few months,” Schiff retorted. “Most individuals who personal it now have since purchased it. However gold and silver have outperformed effectively over 116%.”

Bitcoin vs. treasured metals

Bitcoin is at present buying and selling round $92,000 (up about 116% from its January 2024 stage of about $42,000), but it surely faces stiff competitors from child boomers.

Silver has been on a parabolic trajectory, not too long ago hitting one more all-time excessive.

“Silver is over $98 and buying and selling at $98.35. It is superb to see it lower than $2 away from $100. It is up over 35% year-to-date and there is nonetheless over per week left in January!” Schiff mentioned.

Gold has been persistently making new highs and is at present inching in the direction of the $5,000 stage.

“Bitcoin is at present down over 50% with gold costs since its peak in November 2020. Let’s let that sink in,” Goldbug famous.