Rewards for holding Bitcoin BTC$89,477.17 It isn’t definitely worth the wild experience anymore.

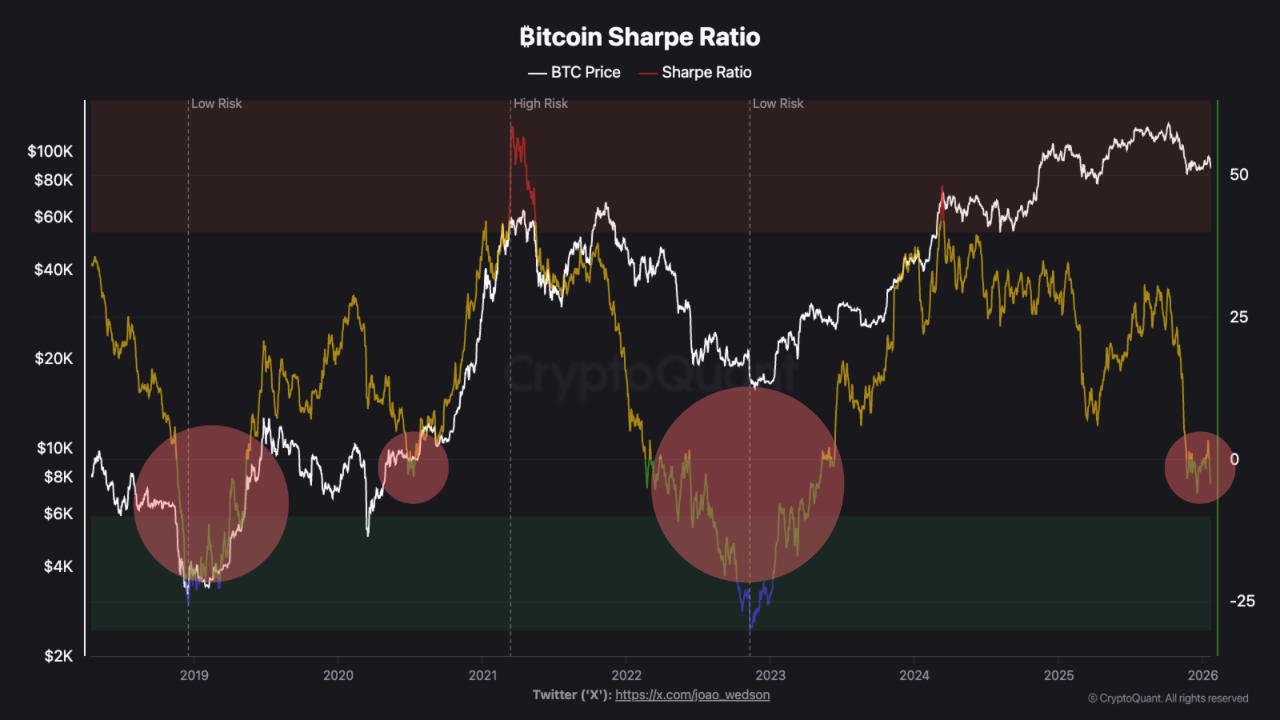

This can be a sign from Bitcoin’s Sharpe ratio. This can be a device utilized by fund managers to test whether or not an funding’s extra returns (over safer choices resembling Treasury payments) compensate for the volatility danger.

Based on knowledge supply CryptoQuant, Bitcoin’s ratio has turned damaging, indicating that returns are not definitely worth the curler coaster. This displays an atmosphere the place sharp intraday fluctuations and uneven rebounds will not be delivering returns. Costs could also be nicely off current highs, however volatility stays excessive, compressing risk-adjusted returns.

This can appear like this BTC Since hitting a report excessive of over $120,000 in early October, it has fallen to $90,000.

Comparable damaging Sharpe ratio measurements have been seen on the backside of the final bear market. In consequence, some on social media are seeing the most recent damaging prints as an indication of a downturn within the economic system. BTC Costs are over and a brand new bull market might start quickly.

Nonetheless, damaging numbers don’t essentially imply a brand new uptrend. It’s because the Sharpe ratio, which measures risk-adjusted returns, reveals the present state of the market, not its future efficiency.

“The Sharpe ratio does not precisely point out the underside, but it surely does point out when the risk-reward has reset to ranges that traditionally precede massive strikes. It is oversold. The type that creates alternatives. The long-term positioning is much less dangerous, not as a result of the value will not go decrease, however as a result of the risk-adjusted setup is favorable,” CryptoQuant analysts stated in a weblog submit.

Within the second half of 2018, this ratio remained damaging for a number of months as a result of continued low costs. The same sample emerged in 2022, with the index remaining depressed by way of a chronic bear market brought on by leverage failures and compelled promoting.

Principally, a damaging Sharpe ratio can persist for a very long time even after the speedy decline in costs has stopped.

What merchants are often taking a look at is how an indicator performs after an prolonged interval of weak spot. A sustained return to constructive territory typically signifies that risk-reward dynamics are enhancing, with returns starting to outweigh volatility, a sample traditionally per new bull markets.

In the intervening time, there aren’t any indicators that Bitcoin will flip bullish once more. The cryptocurrency was buying and selling close to $90,000, nearing the tip of every week marred by uncommon see-saw volatility and underperformance towards gold, bonds and world tech shares.