Yesterday, Ethereum (Ethereum) fell beneath the usual amid widespread market volatility.

Analysts are at present assessing the place Ethereum may discover a backside. By leveraging technical evaluation, on-chain information, and market cycle idea, the next situations have emerged: EthereumThe following massive transfer could possibly be unfolding.

Analyst outlines Ethereum backside situation

Ethereum’s current value actions replicate the uncertainty gripping the broader crypto market, with the escalation and de-escalation of geopolitical tensions leading to important volatility.

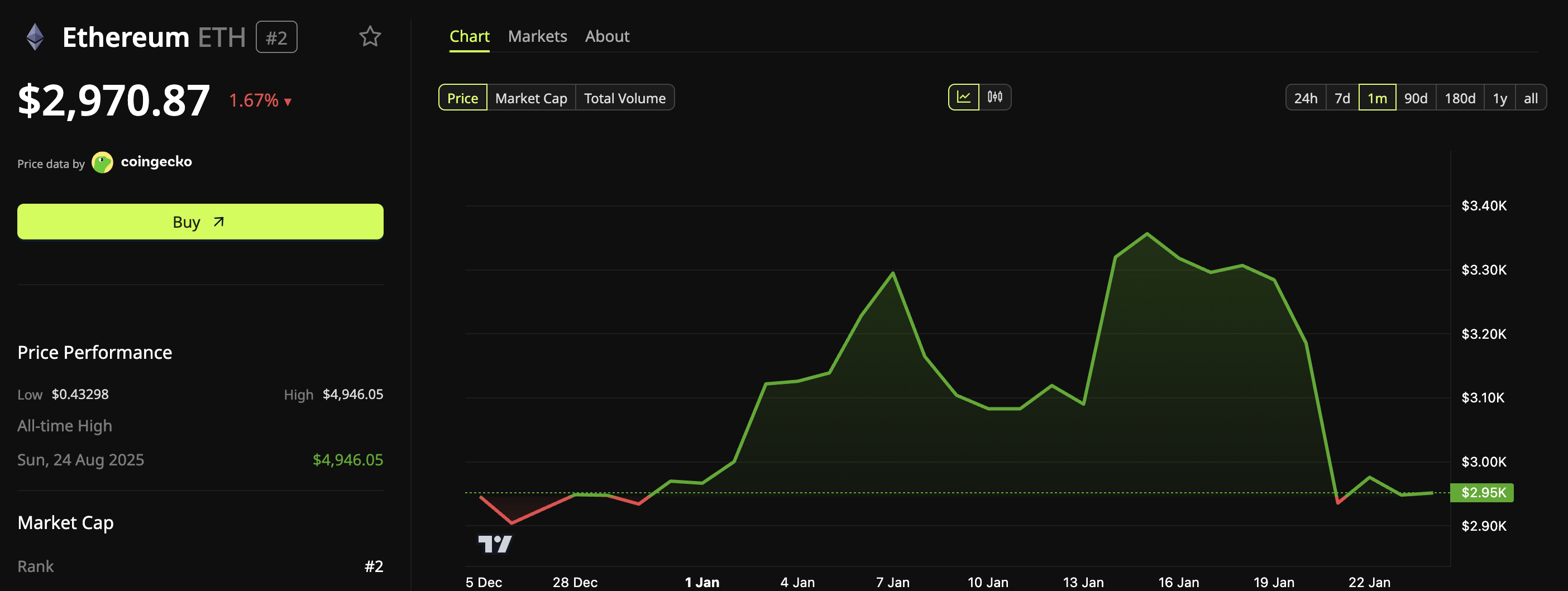

The second-largest cryptocurrency has fallen by 1.67% previously 24 hours, based on information from BeInCrypto Markets. On the time of writing, Ethereum was buying and selling at $2,970.87.

ETH) value efficiency. Supply: BeInCrypto Markets”>

ETH) value efficiency. Supply: BeInCrypto Markets”>

Ethereum (Ethereum) Worth efficiency. Supply: BeInCrypto Markets

Analyst Ted Pillows steered {that a} profitable rally above the $3,000 to $3,050 vary may pave the way in which for the $3,200 zone. Nonetheless, if this house can’t be reclaimed, Ethereum could possibly be uncovered to new annual lows.

Towards this backdrop, different analysts have additionally outlined elementary assumptions about Ethereum. CryptoQuant analyst CW8900 noticed that the realized value of an Ethereum accumulation deal with is an indicator that displays the typical value for long-term holders to accumulate the deal with. Ethereumhas continued to rise and is now approaching the spot market value.

This development suggests that enormous buyers, sometimes called whales, are nonetheless including to their positions slightly than exiting them.

“Moreover, realized costs are a robust assist stage for accumulation whales,” the evaluation states.

The analyst added that Ethereum shouldn’t be buying and selling beneath this value threshold, suggesting that whales are likely to defend this value vary by rising their shopping for exercise. Based mostly on this information, CW estimates that even when Ethereum falls additional, the potential backside could possibly be round $2,720.

“In different phrases, even when additional declines happen, the underside is prone to be round 27,200, which corresponds to a couple of 7% distinction from present costs,” CW writes.

From a technical perspective, dealer Kamran Asghar argued: Ethereum The third “big weekly spherical backside” was fashioned. The earlier two formations have been adopted by a value enhance that would trace at additional upside.

On greater time frames, different analysts have additionally famous an analogous reversal construction. In accordance with analyst Bit Bull, Ethereum On the month-to-month chart, it seems to be forming a double backside construction alongside an inverted head and shoulders sample. Each of those are usually thought-about bullish reversal alerts in technical evaluation.

“I believe Ethereum 2026 will shock everybody,” Bitbull stated.

Ethereum

Ethereum You are doing what it’s a must to do after a brutal cycle. That’s, the bottom.

The story of “generational backside” shouldn’t be a couple of V-shaped restoration, however about construction.

Increased lows + restoration of earlier worth = sluggish transition from laggard to chief.

The true factor is that it’s accepted past this vary… pic.twitter.com/76AsVKX8PR

— CyrilXBT (@cyrilXBT) January 21, 2026

Lastly, analyst Matthew Hyland pointed to historic cyclical patterns. He steered that Ethereum could also be shifting into a brand new section of market construction.

This method argues that in contrast to Bitcoin’s 4-year halving cycle, Ethereum follows a 3.5-year sample. The analyst stated the cyclical backside will kind within the fourth quarter of 2025.

“The three.5-year cycle, just like the earlier two cycles, will see a brand new all-time excessive after which decline till months 40-42. Ethereum “It is began,” he stated.

Total, analysts’ views stay blended, however a number of indicators counsel that Ethereum could also be approaching an vital tipping level. Though short-term volatility persists, on-chain information, technical construction, and historic cycle patterns level to areas the place draw back costs can entice new demand, probably setting the stage for Ethereum’s subsequent transfer.

The publish The place is the underside for Ethereum? How analysts consider on-chain and technical alerts appeared first on BeInCrypto.