The crypto IPO market is again, however the firms main the cost are usually not those most uncovered to token volatility.

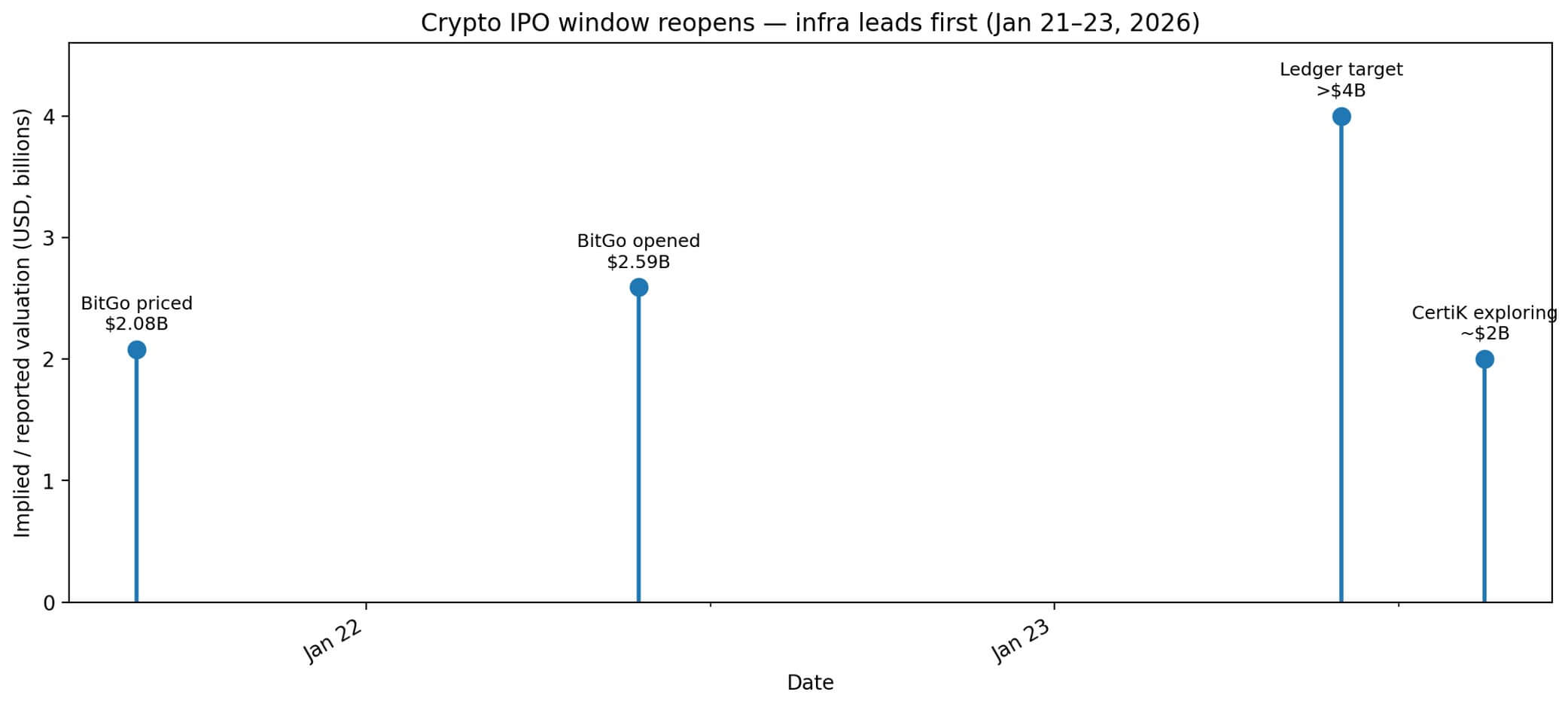

BitGo priced its preliminary public providing on January twenty first at $18 per share, elevating $212.8 million and valuing the custody platform at $2.08 billion. The inventory opened the next day at $22.43, a rise of 24.6%, pushing the implied valuation to $2.59 billion.

Inside 24 hours, two extra security-focused firms signaled public market ambitions.

{Hardware} pockets maker Ledger is reportedly making ready to checklist in New York at a valuation of greater than $4 billion, with Goldman Sachs, Jefferies and Barclays main the method, in keeping with the Monetary Occasions.

CertiK, a blockchain safety audit agency, confirmed to The Block that it’s contemplating an IPO of roughly $2 billion.

The sample is evident. Public markets reward regulated infrastructure narratives greater than token-exposed hypothesis.

BitGo clearly positions itself as a worthwhile regulated digital asset infrastructure, highlighting its nationwide constitution approval and web revenue of $35.3 million within the first 9 months of 2025.

Ledger and CertiK are touting the belief layer’s position as pockets safety and protocol auditing at a time when institutional demand for safety infrastructure is rising quicker than demand for round buying and selling platforms.

This isn’t only a reflexive bounce; a filtering mechanism is in place.

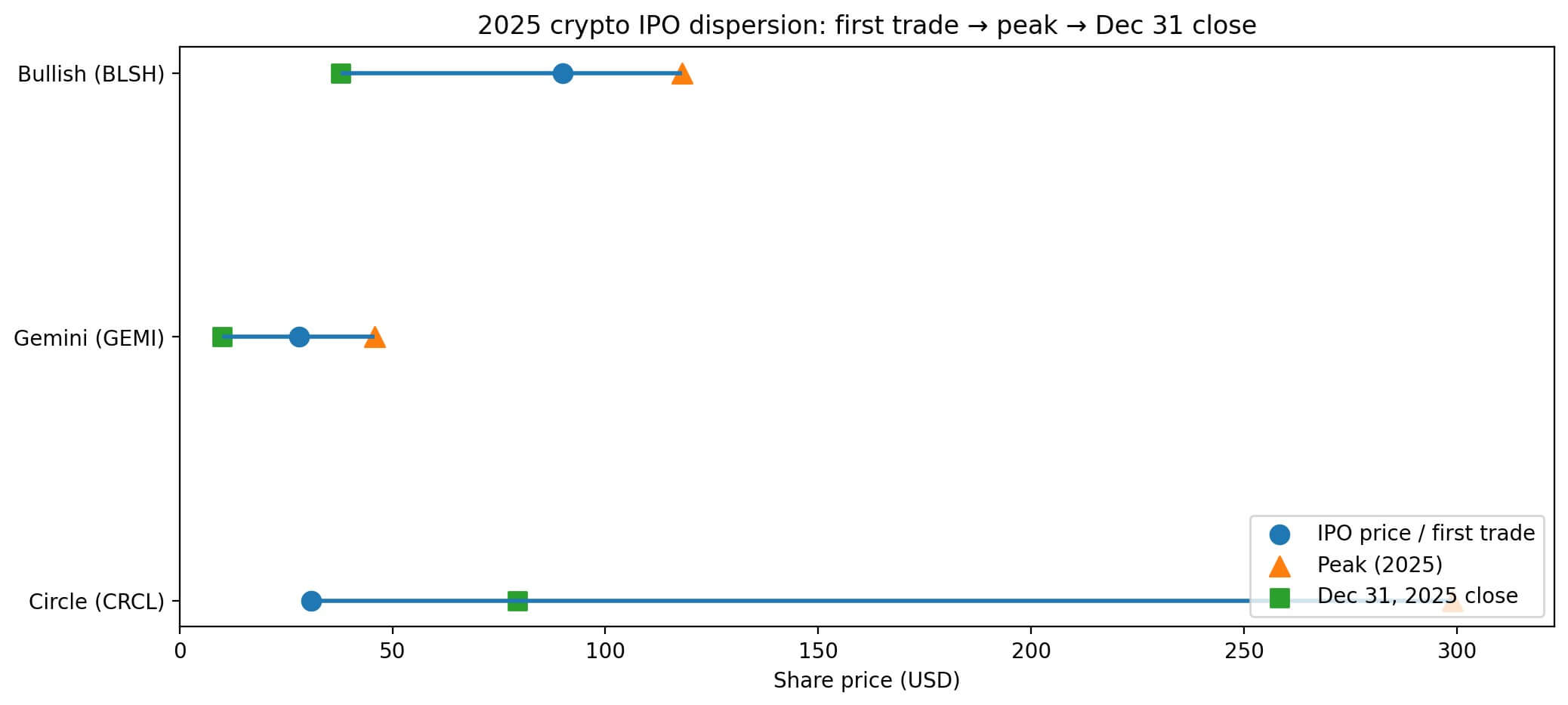

The IPO window opened in 2025, and Circle, Gemini, and Bullish have been listed, however their efficiency diverged tremendously.

Circle was priced at $31 and scaled to lift $1.05 billion. The bullish inventory value has greater than doubled since its debut, giving the trade a worth of about $13.16 billion. Gemini raised $425 million at a valuation of $3.33 billion.

Nevertheless, by December thirty first, Gemini had fallen about 64.5% from its all-time excessive, and Circle had rebounded sharply from its excessive close to $300.

The market rewarded momentum first, then fundamentals. Firms now making ready to go public are betting that traders have realized their lesson.

Regulated Infrastructure Seems to be Not in Beta

BitGo’s debut checks the speculation that custody and compliance infrastructure has decrease perceived threat than platforms whose returns transfer in tandem with token costs.

BitGo reported web revenue of $35.3 million for the primary 9 months of 2025 and obtained approval to transition to nationwide constitution standing, a regulatory milestone that indicators sturdiness for institutional traders.

This nationwide constitution is essential as a result of it brings BitGo underneath federal banking supervision, reduces counterparty threat for patrons, and creates a clearer path to serving regulated monetary establishments.

It isn’t a beauty. It is a structural moat that opponents working underneath state-level belief charters or offshore jurisdictions can not reproduce with out years of regulatory engagement.

Ledger’s reported $4 billion valuation goal leans towards the identical logic. The FT factors out that Ledger has generated triple-digit multi-million greenback revenues, and its undisclosed 2023 valuation was beforehand at $1.5 billion.

The corporate’s pitch focuses on safe storage infrastructure and institutional custody calls for, positioning its {hardware} wallets as enterprise-grade safety instruments fairly than shopper devices.

Safety is turning into an investable space

CertiK’s IPO consideration reveals that safety is shifting from a value heart to an investable class.

Chainalysis estimates that $17 billion can be stolen in cryptocurrency scams and scams in 2025. This quantity reveals why safety spending is structural fairly than discretionary.

CertiK positions itself because the infrastructure for auditing sensible contracts and blockchain protocols to scale back systemic threat for builders, exchanges, and DeFi platforms.

The corporate’s securities agency has reached a non-public valuation of $2 billion in 2022 and is contemplating going public at an analogous valuation.

The gross sales pitch is straightforward and clear. As on-chain capital flows improve and regulatory oversight will increase, safety audits will grow to be non-negotiable.

However CertiK additionally has reputational points that traders will scrutinize.

The corporate’s audit additionally coated the protocols wherein the exploit later occurred, elevating questions on its rigor and accountability.

Public market oversight will pressure clearer disclosures about CertiK’s methodology, buyer focus, and the way it will deal with reputational dangers ought to its audited protocols fail.

Ledger and CertiK symbolize totally different slices of the belief layer: pockets safety and protocol safety. Nonetheless, the businesses imagine that investor demand is concentrated on firms that scale back their assault floor, fairly than those who maximize token publicity.

The FT straight linked rising safety calls for to knowledge theft and hacking, noting that institutional traders view safe storage and auditing as non-negotiable infrastructure.

What’s going to an IPO utility reveal?

Over the subsequent three to 6 months, as firms file S-1 paperwork and roadshow supplies, we are going to get clearer solutions about income high quality, regulatory posture, and buyer focus.

Whereas profitability and regulatory approval are already clear with BitGo’s debut, Ledger and CertiK will face much more tough questions.

For Ledger, traders can be scrutinizing the distribution of shopper {hardware} gross sales and institutional custodial income. Shopper {hardware} is cyclical and margins are compressed. Institutional custody is repeated and has excessive revenue margins.

This mix will decide whether or not Ledger is a {hardware} firm with custody advantages or a custody platform that occurs to promote gadgets. The distinction in valuation between these two tales is billions of {dollars}.

Within the case of CertiK, our investigation will give attention to audit legal responsibility, buyer retention, and the way the corporate manages conflicts when audited protocols concern tokens or increase capital. Safety auditors face distinctive tensions. The extra protocols you audit, the extra seemingly they’re to be exploited, creating reputational threat.

CertiK should show that its audit course of is rigorous sufficient to justify a premium value and that its buyer base is various sufficient to resist particular person protocol failures.

Each firms are additionally more likely to face questions on consumer losses and publicity to hacking by exploiting audited protocols.

Retail traders wish to perceive tail dangers, not simply common outcomes. S-1 filings require disclosures about loss historical past, insurance coverage protection, and the way firms are making ready for potential liabilities.

Eventualities vary from 3 to six months

The essential case is a selective window to make sure a worthwhile and controlled infrastructure.

The disparity in efficiency past 2025 will strengthen a fundamentals-driven market the place firms with clear unit economics and regulatory readability obtain funding, whereas platforms with token publicity will face skepticism. BitGo’s debut confirms that speculation.

The bullish case is that risk-on sentiment returns and the pipeline expands past storage and security. The debut of Circle, Bull, and Gemini in 2025 confirmed that IPO demand may shortly return as soon as crypto market sentiment improves.

Exchanges, DeFi platforms, and token publicity companies may comply with the infrastructure leaders into the market if Bitcoin beneficial properties and macro circumstances ease.

The bearish case is macro tightening and risk-off sentiment, forcing postponements or downward revisions to expectations. That window narrows shortly if BitGo’s inventory value falls or if Ledger’s roadshow reveals weaker-than-expected institutional demand.

what to see

Key metrics are submitting date, income disclosure, profitability timeline, and regulatory standing.

BitGo’s S-1 has already revealed $35.3 million in web earnings and state constitution approval.

Ledger’s submitting will present whether or not triple-digit, multi-million greenback revenues lead to profitability, and the way a lot of that income comes from recurring enterprise and one-time {hardware} gross sales to institutional traders.

CertiK’s filings reveal buyer focus, audit failure charges and the way the corporate is making ready for reputational threat.

Public markets are pricing regulated infrastructure as low-beta publicity to cryptocurrency progress. It is a guess that custody, safety, and compliance instruments can seize worth no matter token value fluctuations. As a result of institutional adoption will depend on mitigating operational and safety dangers earlier than allocating capital.

BitGo’s debut justifies that guess. Ledger and CertiK take a look at whether or not safety infrastructure carries the identical premium as custody.

The IPO window is open, however fundamentals are being filtered. Firms that may show profitability, regulatory readability, and recurring income from institutional clients are main the way in which.

A token-exposed platform that will depend on buying and selling quantity and speculative demand awaits. The subsequent three to 6 months will decide whether or not that window expands or whether or not 2026 turns into the 12 months that solely pick-and-shovel firms go public.