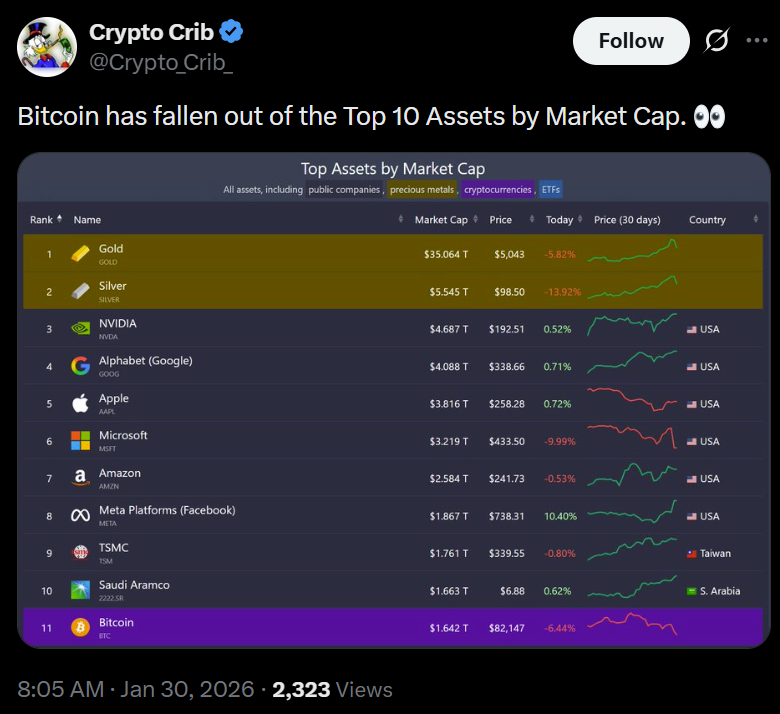

Bitcoin’s sharp reversal this week has pushed it out of the world’s high 10 property by market capitalization and underscored how troublesome its value actions have been in current months because the market continues to digest the biggest compelled liquidation within the crypto business’s historical past.

Bitcoin, which is hovering round $83,000 per coin ($BTC) Market capitalization fell to roughly $1.65 trillion, rating eleventh on the earth. It ranks simply behind state-run oil large Saudi Aramco and under Taiwan Semiconductor Manufacturing Co. (TSMC), in keeping with market information trackers.

In distinction, gold rose to the highest spot by a large margin following its report rally, solidifying its place because the world’s largest asset. This achieve has been accompanied by explosive progress in gold futures buying and selling, a pattern highlighted by current information from crypto trade MEXC.

sauce: crypto crib

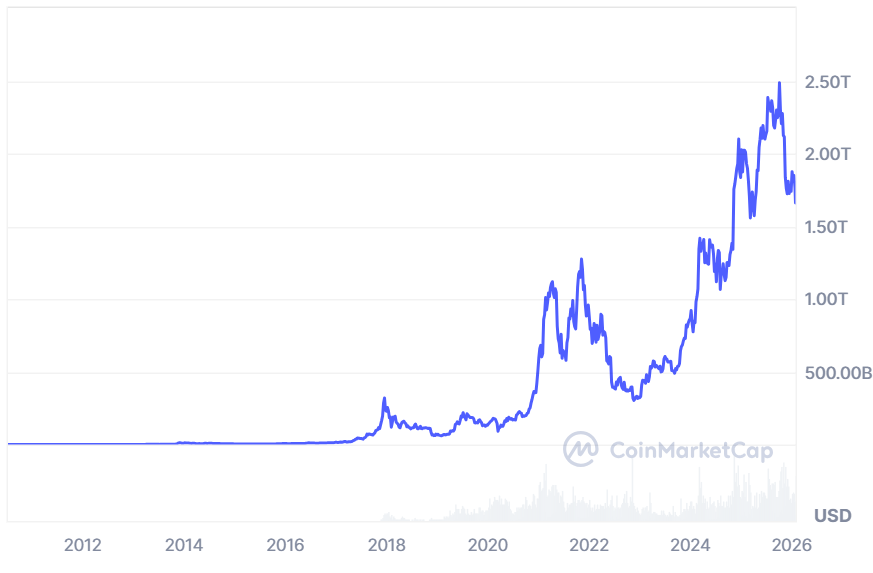

Bitcoin’s market capitalization reached almost $2.5 trillion in October, with the worth at one level exceeding $126,000. The current decline brought on about $1.6 billion in long-term liquidations as the worth fell quickly from almost $90,000 to lower than $82,000.

The transfer reignited issues that the world’s largest cryptocurrency is within the early phases of a chronic bear market.

Bitcoin market capitalization peaked in early October. sauce: coin market cap

Associated: Behind the “Bitcoin Lottery” delusion: NiceHash makes it clear it’s not tagged $BTC block

Macro background checks Bitcoin’s resilience

Bitcoin’s sharp decline has added additional uncertainty to digital asset markets and comes amid hypothesis that US President Donald Trump is contemplating crypto-friendly Kevin Warsh to switch Federal Reserve Chairman Jerome Powell.

Mr. Trump subsequently authorized Mr. Warsh’s nomination, formalizing what had beforehand been market hypothesis. Mr. Warsh should be confirmed by the Senate earlier than taking over the Fed management function in Might, when Mr. Powell’s time period ends in Might.

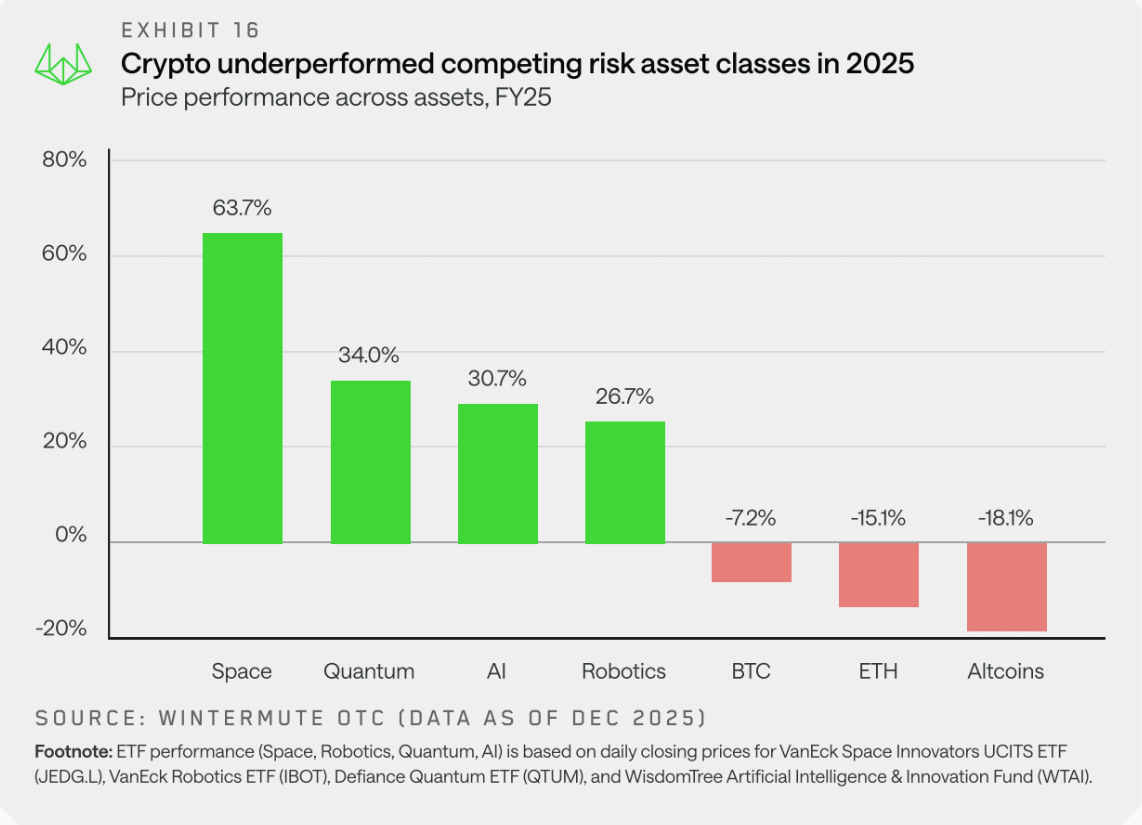

Nonetheless, Bitcoin has considerably underperformed different property, lagging each risk-related markets resembling equities and conventional property resembling gold, regardless of probably supportive circumstances such because the sharp decline within the US greenback.

A current evaluation by market maker Wintermute argued that 2025 may mark a decisive break from Bitcoin’s conventional four-year value cycle, difficult one of many market’s most enduring narratives. Nonetheless, the corporate stated its prospects for a broad restoration in 2026 remained extremely conditional.

In 2025, cryptocurrencies considerably underperformed different danger property. supply: winter mute

In response to our evaluation, a sustained restoration throughout the market is more likely to rely on a number of components, together with elevated mandates from exchange-traded funds and digital asset treasury firms, and a sustained return to Bitcoin and Ether (ETH) inflows.

Wintermute stated such inflows, in addition to short-term value fluctuations, could be wanted to create a wealth impact that might unfold to the broader crypto market.

Associated: 2026 Funding Technique for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Belongings