- Ethereum ($ETH) has remained near $3,000 as monetary establishments are accumulating, regardless of combined short-term sentiment.

- Robust staking, pockets development, and ETF inflows are supporting Ethereum’s worth flooring.

- ERC-8004 has the potential to unlock AI-driven on-chain demand and long-term demand. $ETH worth.

Ethereum is getting into a pivotal section as worth volatility, institutional flows, and protocol-level innovation start to converge.

After an unstable begin to the 12 months, $ETH has regained the $3,000 stage, indicating renewed confidence amongst each merchants and long-term holders.

On the time of writing, Ethereum is buying and selling round $3,010, with a market cap of roughly $364 billion and a 24-hour buying and selling vary of $2,899 to $3,028.

This restoration regardless of $ETH The inventory continues to be buying and selling almost 40% under its all-time excessive of round $4,946 in August 2025.

The broader context means that Ethereum’s present consolidation might not be about weak point, however preparation.

Market construction exhibits resilience regardless of combined sentiment

Ethereum’s current drop under $3,000 was short-lived as consumers actively intervened to guard psychological assist ranges.

On-chain information exhibits that $ETH are traded in dense cost-based clusters, usually reflecting accumulation fairly than dispersion.

The variety of non-empty Ethereum wallets has reached an all-time excessive, highlighting continued adoption of the community even throughout instances of worth uncertainty.

Demand for staking stays sturdy, with withdrawal exercise remaining comparatively calm, whereas validator entry queues are rising.

This imbalance means that extra individuals are dedicated. $ETH Securing your community is healthier than giving up your place.

Organized actions are additional reinforcing this development, with firms and funds reportedly including greater than 1 million funds. $ETH This has affected its stability sheet in current months.

The Spot Ethereum ETF additionally returned to internet inflows after a number of days of outflows, pushed primarily by sturdy demand from Constancy. $ETH product.

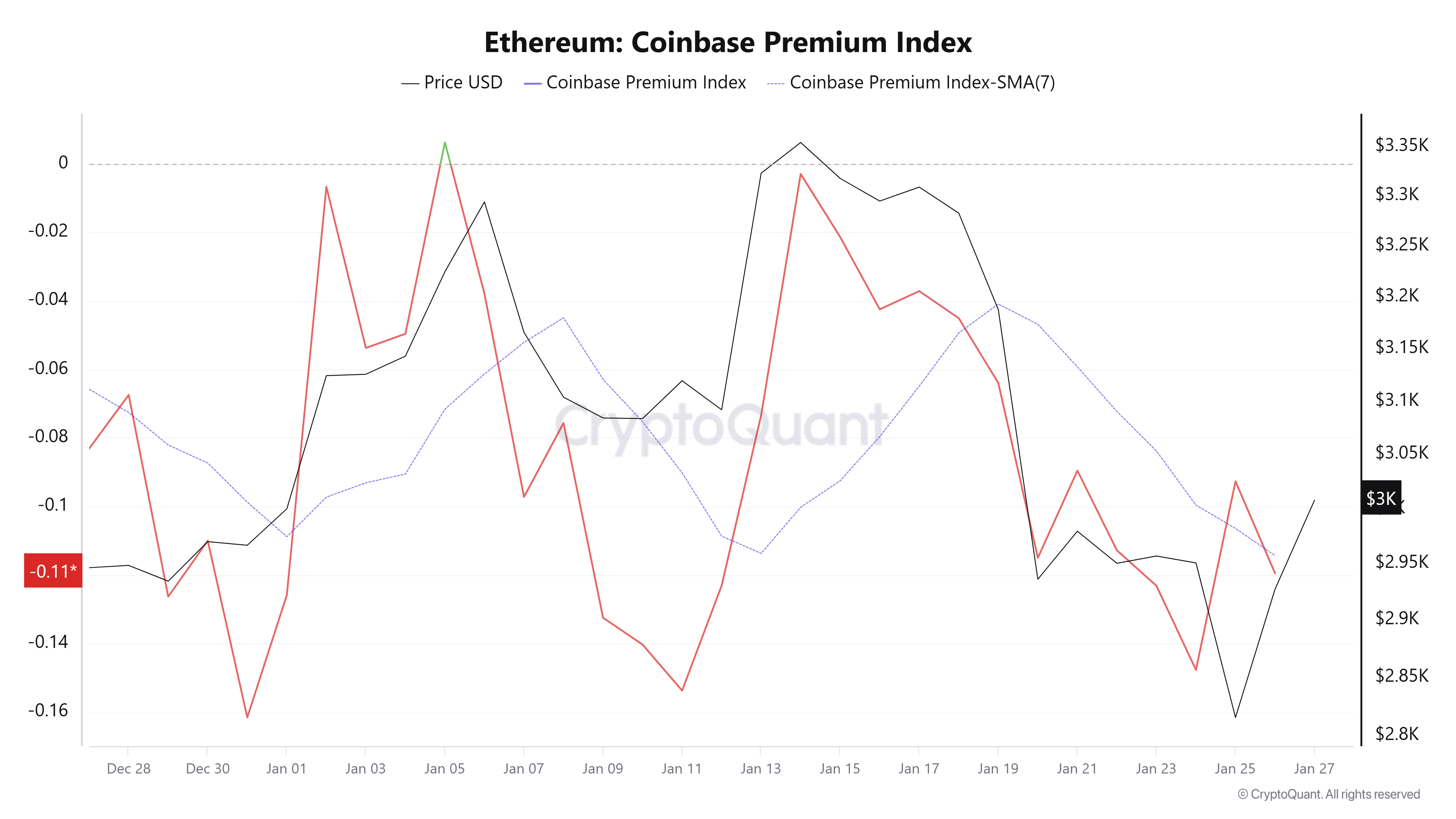

Nonetheless, promoting stress from US traders stays important because the Coinbase Premium Index continues to point cautious home sentiment.

Ethereum Coinbase Premium Index |Supply: CryptoQuant

This disconnect between inflows from institutional traders and reluctance from retailers persists. $ETH Fairly than inflicting a direct breakout, it will likely be confined to a slender vary.

From a technical perspective, Ethereum faces short-term resistance close to the $3,050 to $3,100 zone, which coincides with the 20-day exponential transferring common.

A decisive pullout above this area might open the door for a transfer in the direction of $3,260, however a lack of assist at $2,880 would shift the main target to the low demand zone round $2,775.

Ethereum worth chart |Supply: TradingView

Lengthy-term bullish narrative stays intact

Regardless of the short-term consolidation, many merchants argue that Ethereum’s broader market construction nonetheless helps a considerably larger valuation.

Analysts level to Wyckoff-style cumulative fashions that proceed to foretell historic cycle patterns and upside situations.

In these frameworks, $ETHThe present vary of is taken into account a re-accumulation section fairly than a high formation.

Some merchants like Annie and Bitcoin Census declare {that a} sustained breakout might ultimately take it to $10,000. $ETH Return to the desk later within the cycle.

This outlook is strengthened by the regular enhance in day by day transactions, energetic addresses, and good contract deployments throughout the community.

Remarkably, Ethereum has achieved development on this exercise whereas transaction charges have fallen to multi-year lows, rising ease of use with out sacrificing demand.

Decrease charges are sometimes interpreted as a long-term adoption catalyst, particularly for purposes that depend on excessive transaction throughput.

These structural enhancements strengthen our long-term Ethereum worth forecast into 2026.

ERC-8004 rollout provides new primary catalysts

In opposition to this backdrop, Ethereum is getting ready for the mainnet deployment of ERC-8004, a brand new normal designed to assist decentralized AI brokers.

ERC-8004 can be dwell on mainnet quickly.

By enabling discovery and transportable fame, ERC-8004 permits AI brokers to work together throughout organizations, guaranteeing belief is transmitted all over the place.

This opens up a worldwide market the place AI providers can interoperate with out gatekeepers. https://t.co/Yrl0rvnSxj

— Ethereum (@ethereum) January 27, 2026

ERC-8004 introduces an on-chain identification, fame, and validation framework that permits autonomous AI packages to work together trustlessly.

This normal goals to get rid of reliance on centralized intermediaries in AI coordination by enabling transportable and verifiable agent analysis.

This growth positions Ethereum as a elementary funds and belief layer for the rising AI-native financial system.

The timing of this growth is notable because it coincides with a rising curiosity in autonomous brokers in each cryptocurrencies and conventional expertise.

If applied, ERC-8004 might energy new classes of on-chain exercise, from automated providers to agent-to-agent commerce.

For such use circumstances, blockspace, staking, and $ETH As such, it’s the core financial asset of the community.