Ethereum’s worth has fallen sharply in current buying and selling, shaking investor confidence throughout the market. $ETH It has misplaced important worth in a brief time frame, intensifying fear-based reactions.

Many buyers have now modified their stance and are growing promoting stress on the altcoin king. Such actions may lengthen the decline, however they might additionally create circumstances for a more healthy long-term restoration.

Ethereum holders return to not shopping for

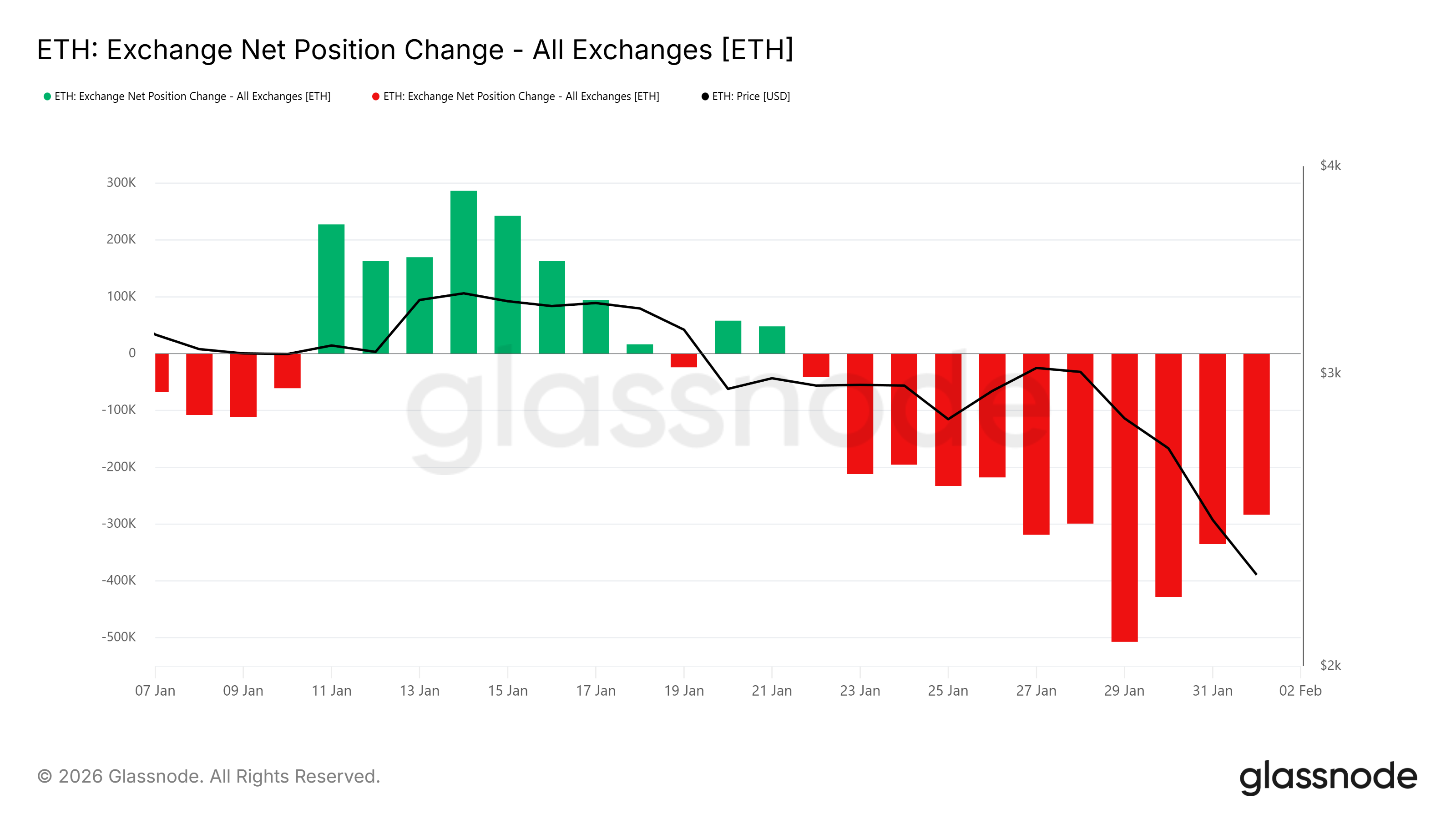

Latest on-chain information highlights a notable shift in market sentiment. Adjustments within the trade’s internet place point out that the shopping for momentum constructed over the previous two weeks is fading. The pink bar monitoring internet inflows has been steadily shrinking. This decline signifies that energetic accumulation is slowing down.

As soon as shopping for stress subsides, promoting momentum typically continues. Buyers who entered earlier could start to shut out their positions to restrict their losses. This transition often impacts worth fluctuations. Within the case of Ethereum, a drop in demand will increase the chance of additional declines earlier than stabilization returns.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Adjustments in internet positions on the Ethereum trade. Supply: Glassnode

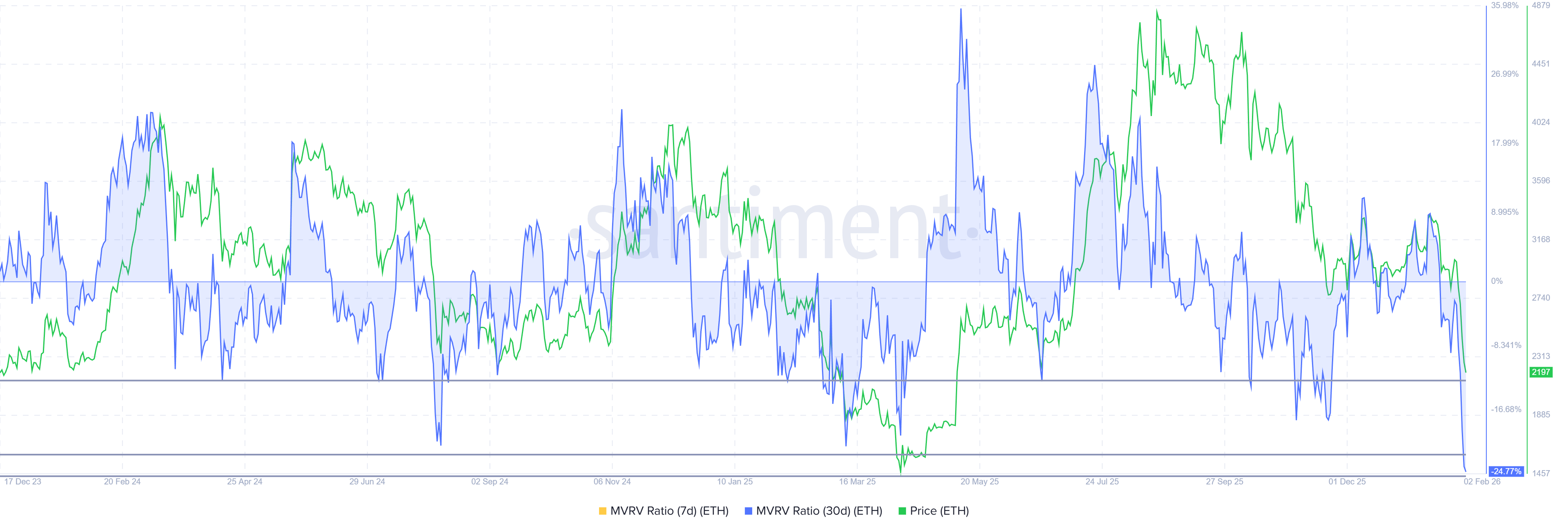

Regardless of short-term weak spot, macro indicators level to a extra constructive outlook. Ethereum’s market worth to realized worth ratio has entered the chance zone. This vary of -12% to -24% traditionally signifies intervals of sell-off.

Within the earlier cycle, $ETH Instantly after MVRV entered this zone, a worth reversal adopted. Saturation of losses prevents additional promoting to keep away from buyers perceiving deeper drawdowns. Accumulation typically resumes throughout these phases. Ethereum may gain advantage from comparable dynamics as a peak in promoting stress.

Ethereum MVRV ratio. Supply: Santiment

$ETH Value more likely to fall to $2,000

Ethereum is buying and selling round $2,211 on the time of writing, simply above the $2,205 help stage. The asset stays beneath stress, having fallen 27% over the previous 5 days. Present momentum suggests additional draw back dangers stay excessive.

$ETH The inventory is 9.2% away from falling beneath $2,000. Given the weakening shopping for momentum and heightened warning, it appears possible that the worth will transfer in direction of this stage. Though bearish within the brief time period, such a decline may appeal to value-conscious buyers. Low costs typically encourage accumulation amongst long-term individuals.

$ETH worth evaluation. “>

$ETH worth evaluation. “>

$ETH Value evaluation. Supply: TradingView

The rebound situation is dependent upon new demand close to main helps. Ethereum may get better to present ranges if buyers benefit from the low cost. This transfer would mark the start of a reversal-driven restoration. Nonetheless, there are dangers if bearish momentum continues. Unstable and could also be despatched $ETH We are going to delay any sustained rebound beneath $1,796.

The article “Ethereum worth is 10% away from dropping beneath $2,000, however there are indicators of hope” appeared first on BeInCrypto.