Whereas value fluctuations are at all times risky and undoubtedly thrilling, the Bitcoin community itself is inbuilt such a method that it feels boring. A metronome that may be set to tick, rinse, repeat, and clock for 10 minutes per block.

And typically it turns into very human once more.

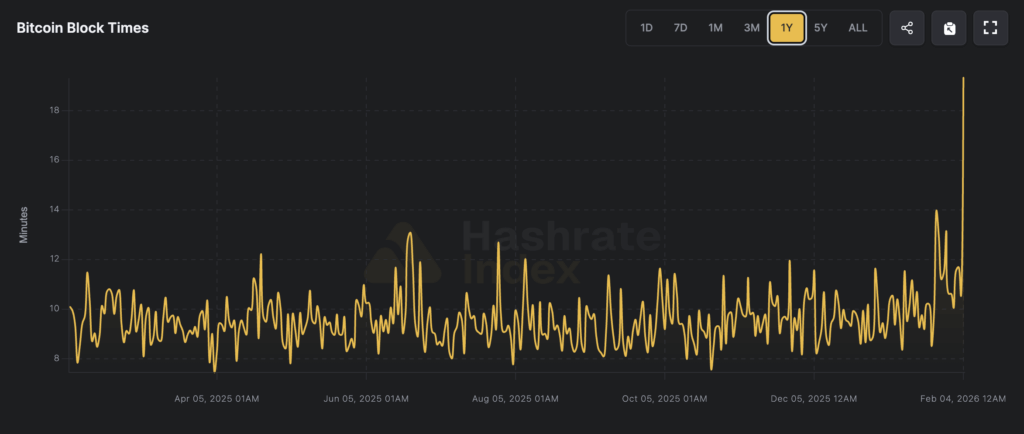

Early this morning, block era slowed down sufficient that the common block time briefly spiked to 19.33 minutes. On the floor it seems to be a technical subject. What follows seems to be a real-time take a look at an business working with skinny margins, loud fan noise, low-cost energy, and plenty of stress.

When a miner shuts down a machine, the community doesn’t regulate instantly. Bitcoin issue solely updates each 2,016 blocks, so if the hashrate drops shortly, blocks will arrive slower till the subsequent retarget. The hole between actuality and the protocol’s response ends in unusual mornings, lengthy wait occasions, anxious posts within the mining chat, and a quiet sense that one thing is fallacious.

In the meanwhile, “off” appears to be like just like the miners are backing away.

Networks say miners are pulling again

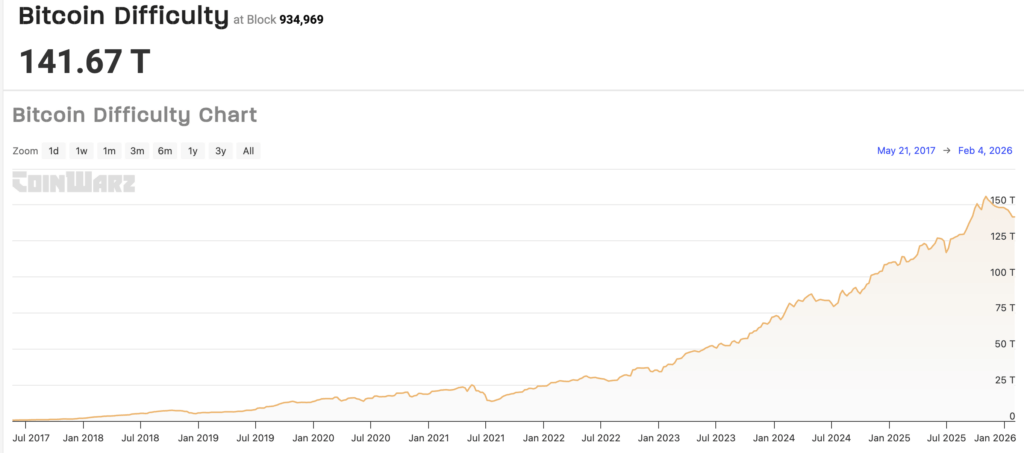

That is necessary as a result of issue is Bitcoin’s method of matching workload to the variety of machines competing to unravel a block, though lots of them had been destructive within the final levels of issue adjustment.

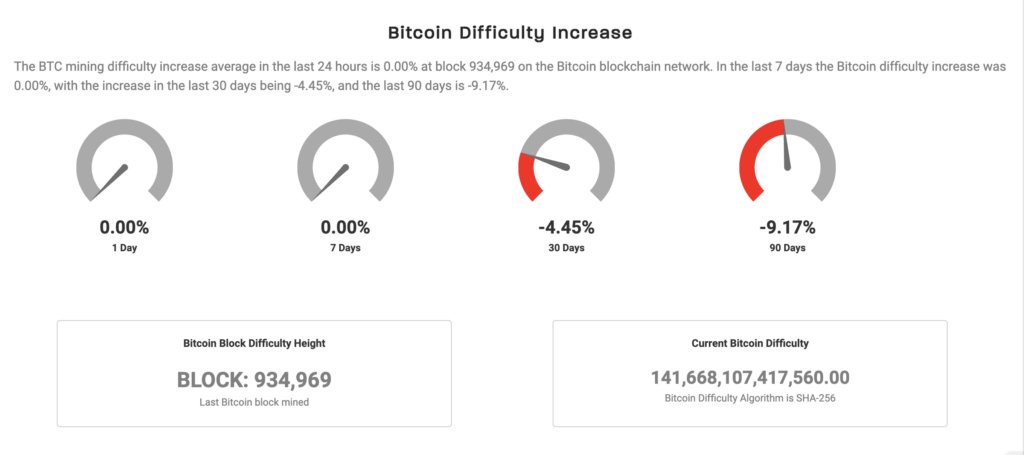

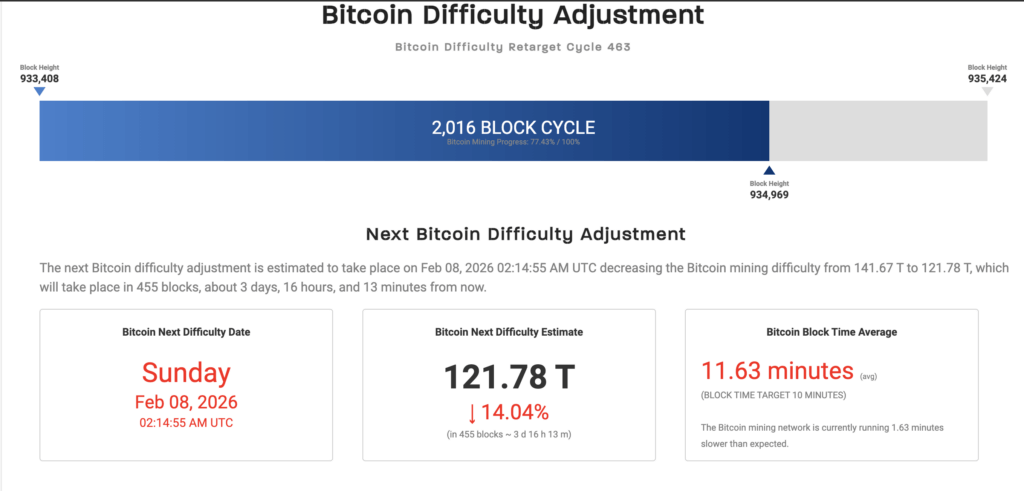

The most recent weekly abstract of the Hashrate Index factors out that the newest issue adjustment on January twenty second was a -3.28% discount, bringing the problem to round 141.67T, and it’s more likely to rise once more within the subsequent cycle, across the February eighth body. It cautioned in opposition to early expectations of a big destructive adjustment, with early epoch forecasts bouncing across the mid-teens vary, however cautioned that these estimates may change because the epoch progresses.

Different trackers have landed in the identical neighborhood. For mempool, the subsequent adjustment is estimated to be a lower of almost 15%, with the common block time on the positioning’s dashboard hovering within the 11-12 minute vary for the present interval.

That is slower than the ten minute goal and is per the story the chart is attempting to inform, the place miners are withdrawing, the community is caught, and the protocol is ready for the subsequent realignment.

CoinWarz estimates the subsequent issue degree to be 121.78T, down roughly 14.04%, with a median block time of roughly 11.63 minutes, and a retarget date of February eighth.

Subsequently, the subsequent correction would be the steepest decline because the China embargo. Block time spikes are a symptom. Performing a destructive issue adjustment is diagnostic.

Why is a 14-18% discount in issue an enormous deal?

A double-digit issue minimize is a protocol that acknowledges that the mining economics have modified so quickly that earlier settings now not match. For these exterior the mine, it is ambient noise. For miners, it is the distinction between a fleet limping alongside and one having to show off the lights.

If the subsequent correction lands round 14-18%, it might be giant sufficient to push the index decrease, particularly after a number of destructive corrections in current months. It additionally serves as a reminder that Bitcoin’s issue algorithm is a shock absorber, not a crystal ball.

Actions of this magnitude have occurred earlier than, and so have larger ones.

The most important single issue downward adjustment in historical past occurred in early July 2021, decreasing issue by roughly 28% after China’s mining crackdown took a lot of the world’s hashrate offline.

So a 14-18% discount was precedent, and the community obtained even worse. Nevertheless, the scenario is totally different. Whereas China’s period was a sudden geopolitical shock, right now’s stress is a extra gradual squeeze, with costs, energy, and profitability seemingly colliding with one another.

Influence on merchants is margin name

Mining is a enterprise the place the product is arithmetic and the enter is electrical energy. In different phrases, the business lives and dies by spreads.

When the value of Bitcoin falls, miners earn fewer {dollars} for a similar quantity of Bitcoin. Enter prices rise when electrical energy prices rise or when a area tightens provide as a consequence of climate occasions. When each happen on the similar time, older machines and better price websites are the primary to be evicted.

That is why the dialog retains coming again to “who can keep on-line?”

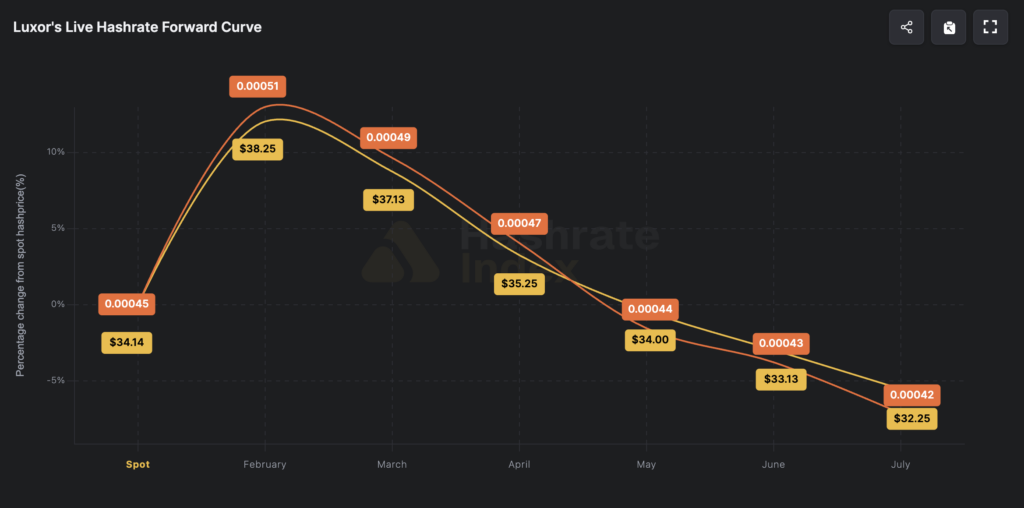

In our Hash Fee Index abstract, we famous that USD hash costs are pegged at round $39.22 per PH per day within the snapshot, one of many clearest concise indicators of miner earnings, and that the futures market is pricing in common hash costs round $39.50 over the subsequent six months.

Nevertheless, final week’s sharp value decline has since introduced the six-month futures market value right down to $32.25.

This small element could be simply skipped and stands out as the most helpful predictive anchor in your entire dataset. The truth that costs have come down so shortly means that the market is settling right into a narrower, weaker space of profitability quite than betting on a speedy restoration.

Should you discuss to miners when hash costs are compressed, the language turns into much less theoretical. It turns into energy contracts, energy discount applications, lenders, equipment loans, and the fixed query of whether or not to maintain tools linked that provides you with extra revenue than electrical energy, or shut down and await hardship to return.

That may be a destructive adjustment and acts as a sort of reduction.

As the problem decreases, each miner who stays on-line earns a little bit extra Bitcoin per unit of hashrate, all else being equal. There’s a chance that among the machines that had been kicked out will come again. Some operators come again to life.

That is considered one of Bitcoin’s unusual balancing acts, the place the protocol is detached however the final result is deeply private to the folks working the {hardware} warehouses.

Three paths to observe for what occurs subsequent

The cleanest story from here’s a moderated bounce of issue.

issue minimize

If the community issue is diminished by round 14-18%, block occasions will return to nearer to 10 minutes and profitability for on-line miners will instantly enhance.

It tends to sluggish the bleeding and will even restore some hashrate, particularly if the underlying drawback was marginal economics quite than an exterior shock. The mempool dashboard for mempool reveals in actual time whether or not blocking occasions are returning to their common values.

Reducing issue and value decline

The harder path is extended compression.

Problem may lower and miners may nonetheless wrestle if Bitcoin costs proceed to fall, power prices stay excessive, or credit score situations for mining firms that depend on funding develop into tougher.

In that world, we’ll see a loop, a drop in hashrate, a downward adjustment in issue, the arrival of income reduction, a resurgence of value stress, and a hunting down of weak operators anyway.

Problem discount, value drop, miner pivot

The third path is quieter and entails structural change.

Mining has been shifting towards versatile, power-aware operations for years, and miners that may scale back costs throughout peak durations and enhance when the grid is reasonable are inclined to survive longer.

The business is more and more leaning into that mannequin because it transitions to AI. As sure areas face repeated cuts and extra energy is directed to AI, the hashrate line might stay decrease for longer durations of time and difficulties adapt to the brand new equilibrium.

Past the upcoming operational adjustments, this shift illustrates how miners are being pressured to adapt to shrinking margins, evolving regulatory pressures, and growing competitors for power sources.

Because the business matures, these changes may reshape the steadiness of energy between mining firms, speed up consolidation, and affect Bitcoin’s long-term community safety and decentralization.

What this implies for others

For peculiar Bitcoin customers, sluggish block cadences nearly at all times lead to latency and might result in greater charges as demand builds up. Often it isn’t catastrophic. It is extra like a visitors jam.

For miners, it is the entire enterprise.

For the broader market, it is one of many few occasions you possibly can see invisible infrastructure teetering in public, base layers displaying their seams. Bitcoin’s safety mannequin is tied to miners’ income in greenback phrases, and when that income is compressed, the dialog in regards to the well being of the community grows.

The necessary factor is that Bitcoin is designed to maintain going by means of this. Modify the problem degree. Blocks are arriving one after one other. The metronome begins beating once more.

The fascinating half is the story inside that coordination, the folks on the opposite aspect of the machine, the operators making calculations at 3 a.m. to determine what lights up and what goes darkish, and the community silently recording these decisions in the one language it is aware of: the time between blocks.

If the subsequent retarget hits close to the mid-teens, it may be learn as a transparent sign that the miners are pulling again in a significant method. It is also a reminder that the protocols are nonetheless working as they at all times have, absorbing shocks, resetting issue, and shifting the system ahead one block at a time.