Ethereum co-founder Vitalik Buterin and different outstanding “whales” have amassed hundreds of thousands of {dollars}. $ETH It added narrative gasoline to a market rout that has seen the world’s second-largest cryptocurrency drop under $2,000 since early February.

Though Mr. Buterin’s high-profile gross sales have been the psychological set off for retail panic, a more in-depth take a look at market information means that the primary stress got here from systematic de-leverage and file gross sales exercise throughout the community.

Nonetheless, these disposals, mixed with important promoting by different trade gamers, have led traders to query whether or not undertaking leaders are dropping confidence or are merely managing runway operations amid excessive volatility.

Why is Buterin promoting his Ethereum holdings?

Within the final 3 days, Buterin has offered 6,183 items $ETH In response to blockchain analytics platform Lookonchain, the common worth is $2,140 ($13.24 million).

However a take a look at the small print of Buterin’s trades reveals a calculated technique quite than a panic-driven one.

Notably, Buterin publicly revealed that he had amassed $16,384. $ETHIt was valued at round $43 million to $45 million on the time and is anticipated to be rolled out over the following few years.

He stated the funds will go in direction of open supply safety, privateness know-how and broader public curiosity infrastructure because the Ethereum Basis enters a interval of what he described as “delicate austerity.”

Seen from this angle, essentially the most defensible rationalization for “why he offered” is an earthly one. It appears to be a conversion of the pre-allocated $ETH As a substitute of taking pictures for the highest of the market immediately, put your funds into out there runway (stablecoins) for a multi-year monetary plan.

Nevertheless, the channels via which these gross sales affect the market are narrative-driven quite than liquidity-based. When traders see founder wallets lively on the promote aspect throughout a downturn, sentiment tilts and deepens the bearish resolve of an already risky market.

Nonetheless, buterin stays $ETH Whales, holding 224,105 $ETHwhich equates to roughly $430 million.

Buterin’s $ETH Will gross sales trigger a market crash?

The central query for traders is whether or not Mr. Buterin’s promoting was pushed mechanically. $ETH Lower than $2,000.

From a structural perspective, it is arduous to argue that Buterin’s $13.24 million gross sales program itself has damaged via main market ranges. $ETHThe day by day buying and selling quantity reaches billions of {dollars}.

Subsequently, a promote order of this dimension is small in comparison with regular quantity and doesn’t have sufficient quantity to eat order e-book depth and drive the value considerably decrease.

However Buterin wasn’t simply promoting. He was a part of a broader exodus of huge holders that weighed in the marketplace as an entire.

On-chain trackers have flagged important exercise by Stani Kulechov, founding father of DeFi protocol Aave. Just a few hours earlier, Kulechov offered 4,503 Ethereum (value about $8.36 million) at a worth of about $1,857. $ETHThe slide accelerated.

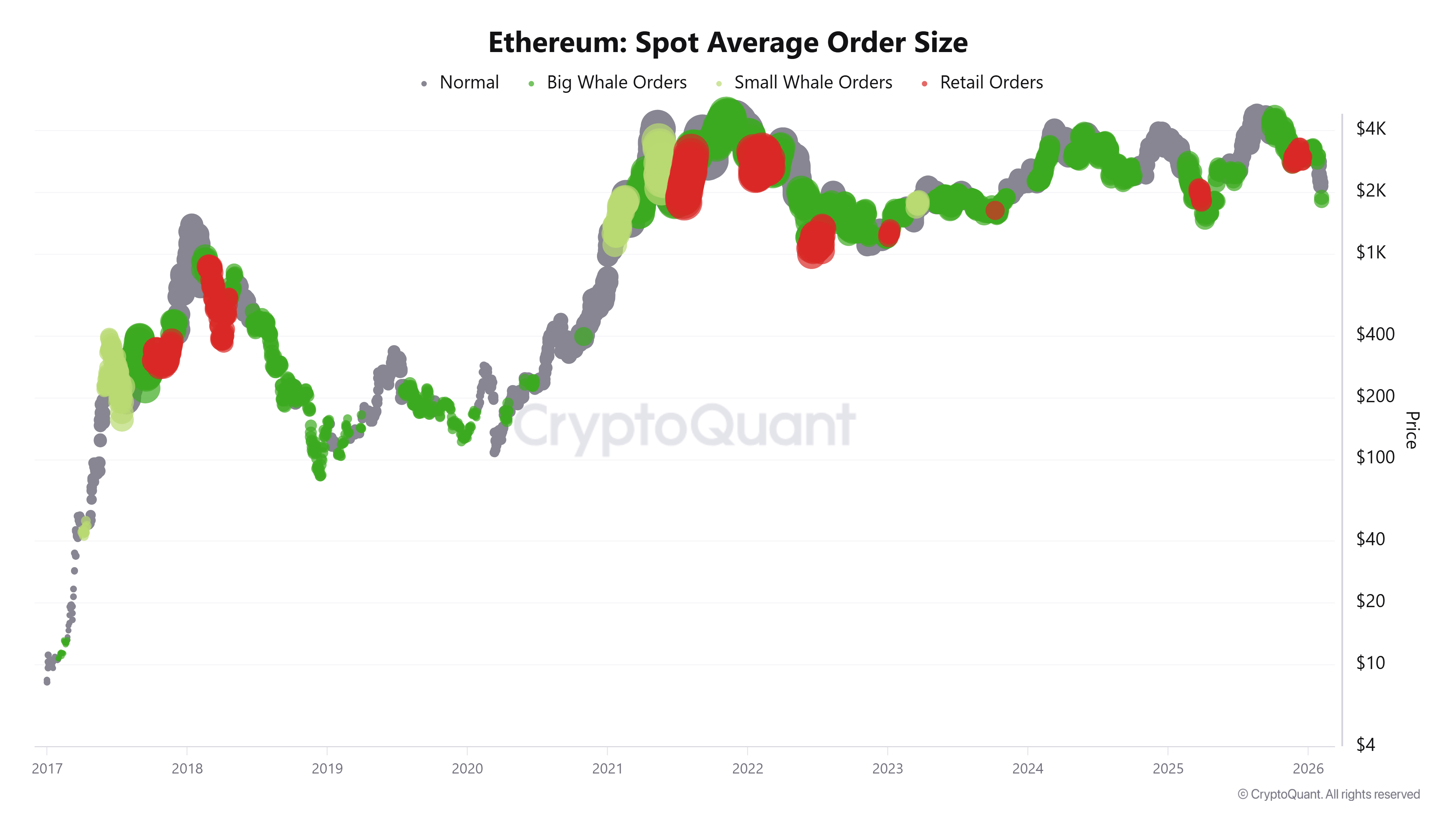

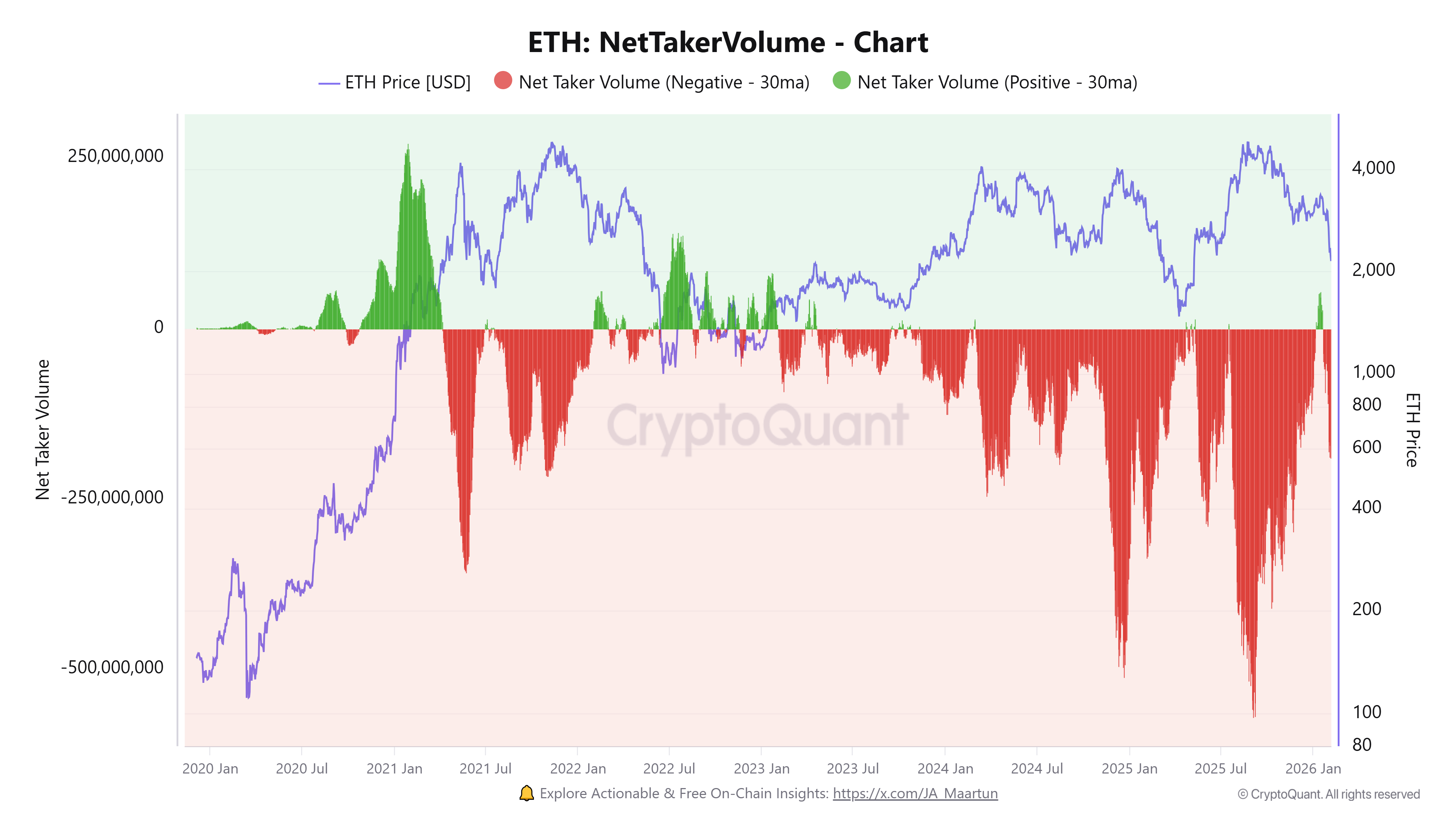

This exercise is a symptom of a broader development. In response to CryptoQuant information, the community is dealing with file gross sales exercise this month.

The analytics agency famous that the community noticed a rise in massive whale order values through the downturn, suggesting that high-net-worth people and entities have been actively risk-averse to the liquidity created by the decline.

Whereas no single whale can collapse a market, the mass exit of trade leaders may create a self-fulfilling prophecy.

When liquidity is skinny and leverage is excessive, these “headline flows” sign “good cash” threat mitigation all through the market, encouraging smaller merchants to observe swimsuit to protect capital.

the actual driver behind $ETHcrash of

Though the story centered on the founders’ wallets, the crash was largely pushed by three completely different market forces: unwinding leverage, ETF outflows, and macroeconomic headwinds.

Coinglass information exhibits it is value lots of of hundreds of thousands of {dollars}. $ETH Within the worst case, liquidation took greater than 24 hours, and long-term liquidations have been predominant.

This created a basic cascade state of affairs the place worth declines precipitated pressured gross sales from overleveraged positions, which in flip precipitated additional declines and extra pressured gross sales.

On the identical time, institutional assist evaporated. usa spot $ETH The ETF has recorded internet outflows of about $2.5 billion over the previous 4 months, in accordance with Soso Worth information.

This occurred alongside bigger outflows from Bitcoin ETFs. This represents extra essential institutional threat aversion than any pockets at a time when markets are already falling.

Additional complicating these crypto-specific points is the macroeconomic context.

Reuters linked the widespread decline in cryptocurrencies to considerations about declines amongst property and a liquidity squeeze. The crypto market has misplaced about $2 trillion since its peak in October 2025, with about $800 billion worn out within the final month alone, as traders lowered threat and leveraged unwinding of positions.

Metrics to observe

When markets are looking for a backside, three indicators matter greater than any whale alarm.

First is liquidation power. If pressured liquidations proceed to extend; $ETH Even with out further discretionary promoting, the “hole” can nonetheless be lowered.

In response to Phemex analysts, a decline in whole clearings resulting from stabilization is commonly the primary signal {that a} cascade is burning out.

The second is the ETF circulation regime. A single day’s outflow is noise, but when it continues for a number of weeks, the marginal patrons change. $ETHThe near-term path of the disaster will largely rely on whether or not institutional capital flows stabilize or proceed to spill over into broader risk-off conduct.

Lastly, traders have to control forex inflows and the actions of huge shareholders.

Founders’ wallets are seen, however a extra apparent indicator is whether or not giant holders enhance their deposits on the change (distribution) or whether or not their cash transfer to chilly storage and staking (accumulation). When these indicators reverse, the market normally follows.

The underside line is that Vitalik Buterin’s gross sales are finest understood not as a sudden lack of credibility however because the execution of pre-announced funding plans tied to public items and open supply spending.

However in collapses brought on by leverage liquidations, ETF outflows, and macro risk-offs, even “small” founder gross sales can have a disproportionate affect.

They do not obtain it by supplying sufficient $ETH Breaking above $2,000 is by including narrative gasoline to a market already on the lookout for causes to promote first and ask questions later.