Ethereum funding car Development Analysis continued to cut back its publicity to Ether because the current market crash compelled monetary corporations to promote belongings to repay loans.

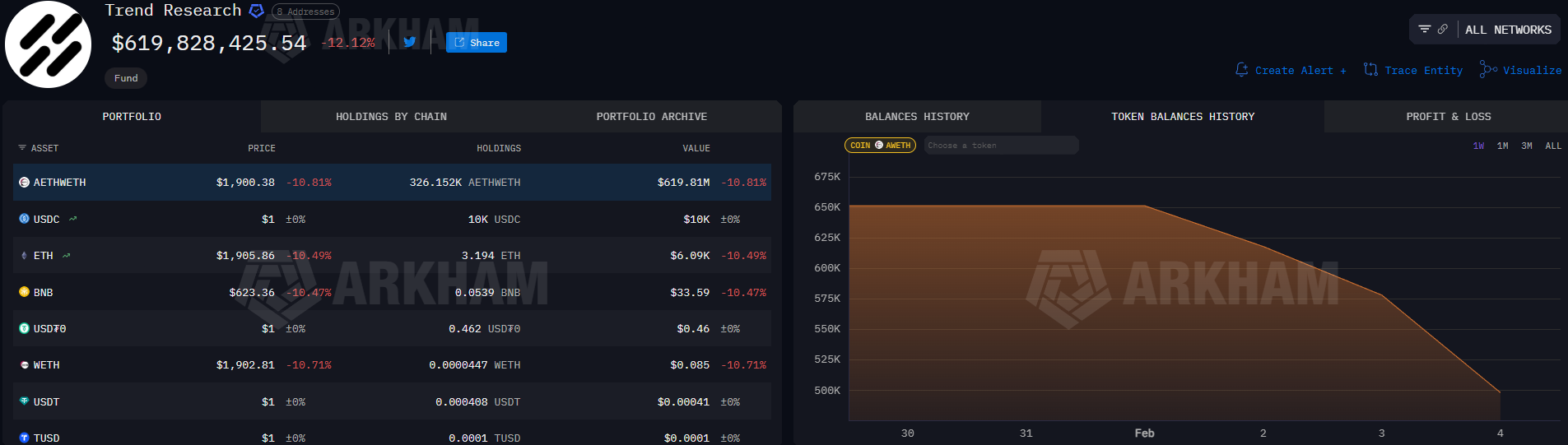

Roughly 651,170 Ether ($ETH) within the type of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. This quantity decreased by 404,090 on Friday, to roughly 247,080 on the time of writing.

Development analysis transfers 411,075 $ETH In keeping with blockchain knowledge platform Arcam, it joined the cryptocurrency change Binance earlier this month.

The switch occurred as follows $ETH The worth has fallen about 30% over the previous week, dropping to $1,748 on Friday, in accordance with CoinMarketCap. On the time of writing, it was buying and selling at $1,967.

Development analysis, WETH token steadiness historical past, 1 week chart. Supply: Arkham

Associated: Sharplink earns $33 million from Ether staking and deploys one other $170 million $ETH

Development Analysis continues to handle threat. $ETH approaching liquidation degree

Development Analysis has ties to Jack Yee, founding father of Hong Kong-based cryptocurrency enterprise agency Liquid Capital. Mr. Yee purchased and gathered shares in an Ethereum funding firm. $ETH On the change, you borrow a stablecoin in Aave utilizing it as collateral and use the funds to amass extra cash. $ETH.

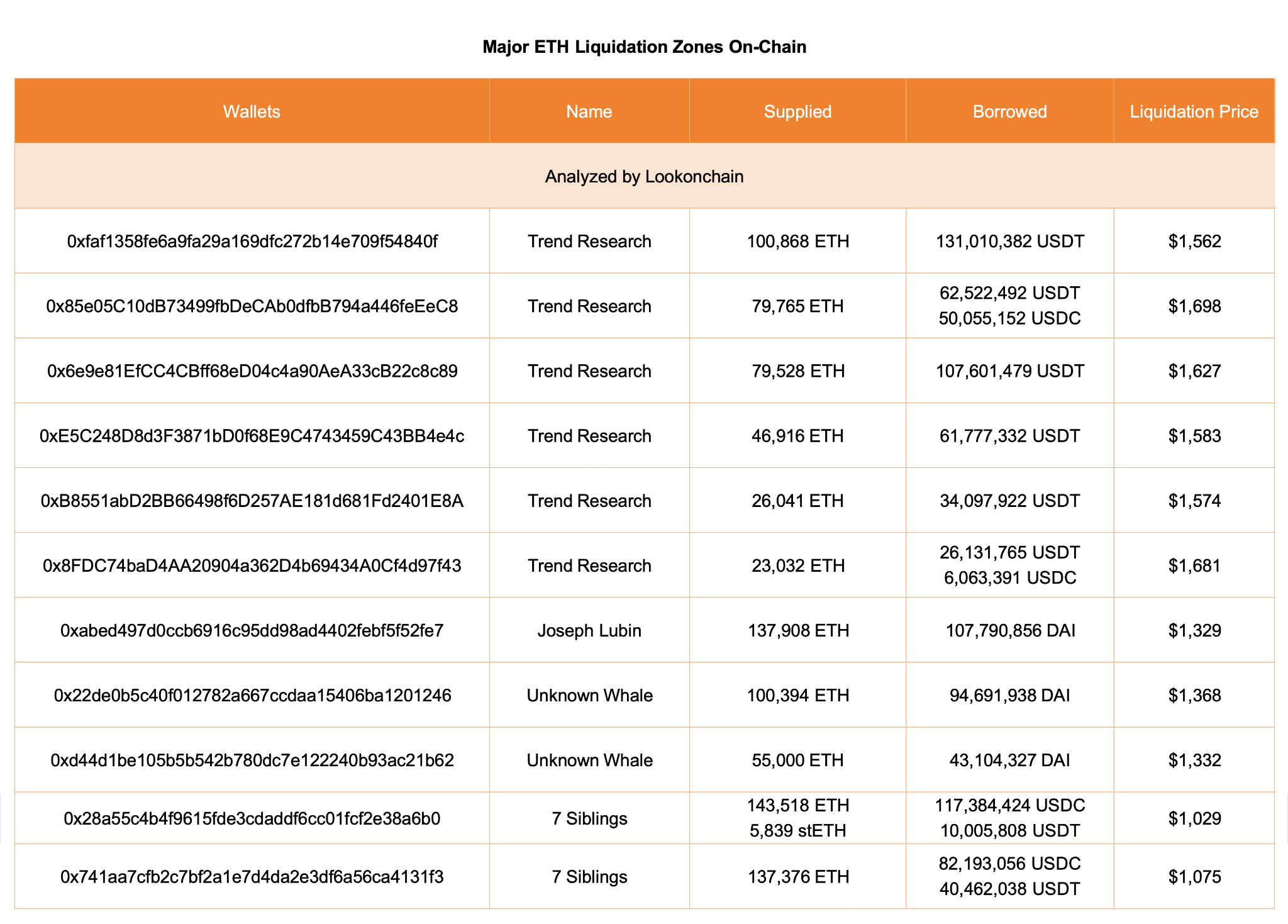

Development analysis faces a number of challenges $ETH The liquidation degree is between $1,698 and $1,562, blockchain knowledge platform Lookonchain wrote in a Friday X submit.

Development analysis liquidation degree. sauce: look on chain

In a submit on X on Thursday, Yi acknowledged that he was too fast to name for a backside in crypto valuations, however remained bullish and stated he would proceed to “handle dangers” and watch for the market to get well.

Associated: BitMine buys $105 million in ether to start out 2026, nonetheless has $915 million in money

Development Analysis gained consideration days after the $19 billion liquidation occasion in October 2025, when funding corporations started aggressively accumulating Ether.

Development Analysis would have ranked because the third largest ether holder as of December, however as a non-public firm it’s not listed on most monitoring web sites.

Bitmine, the most important public firm holder of Ether, had about $8 billion in unrealized features as of Friday.

journal: DAT panic dump 73,000 $ETHIndia’s digital foreign money tax deferred: Asia Specific