Ethereum value has fallen over 5% over the previous few days and is presently under key short-term buildings. February tenth, $ETH The worth didn’t maintain the slender rebound channel and fell under $1,980. The transfer adopted a pointy decline in DeFi exercise and weakening institutional capital flows. However regardless of the stress, giant holders began including once more.

The query is straightforward. I ponder if that is an preliminary buildup or only a short-term pause earlier than one other leg comes down.

Sample Break Confirms Weak Help for “Massive Cash”

Ethereum’s current rally from early February shaped contained in the bear flag. This construction acted extra like a short-term restoration try than a development reversal. On February tenth, as predicted in a earlier Ethereum evaluation, the worth fell under the decrease certain of the flag, triggering a sample break with a possible crash of over 50%.

The transfer was important as a result of it occurred amid weak capital flows.

Chaikin Cash Movement (CMF) makes use of value and quantity to measure whether or not capital is flowing into and out of an asset. When the CMF is above zero, we regularly see large-scale shopping for by institutional buyers. If it stays under that, it signifies weak participation.

From February sixth to February ninth, $ETH Though it bounced again, the CMF by no means went above zero. It additionally failed to interrupt out of the downtrend line. This meant that the rebound lacked robust assist from giant buyers.

Activated breakdown construction: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Merely put, costs rose, however critical funds didn’t observe strongly sufficient. When rebound happens with out the robust assist of CMF, it tends to fail. That is precisely what occurred right here. As soon as the shopping for momentum stalled, sellers regained management and pushed up. $ETH decrease.

This confirms that the breaks within the sample usually are not random. Maybe it was helped by giant flows of cash disappearing. Nevertheless, technical weaknesses alone don’t clarify the entire image.

DeFi TVL and trade flows reveal structural points

A deeper downside lurks in Ethereum’s DeFi actions.

Whole Worth Locked (TVL) measures how a lot cash is held inside a decentralized finance platform. This displays precise utilization, capital dedication, and long-term confidence. When TVL rises, customers lock up their funds. When it falls, capital flows out.

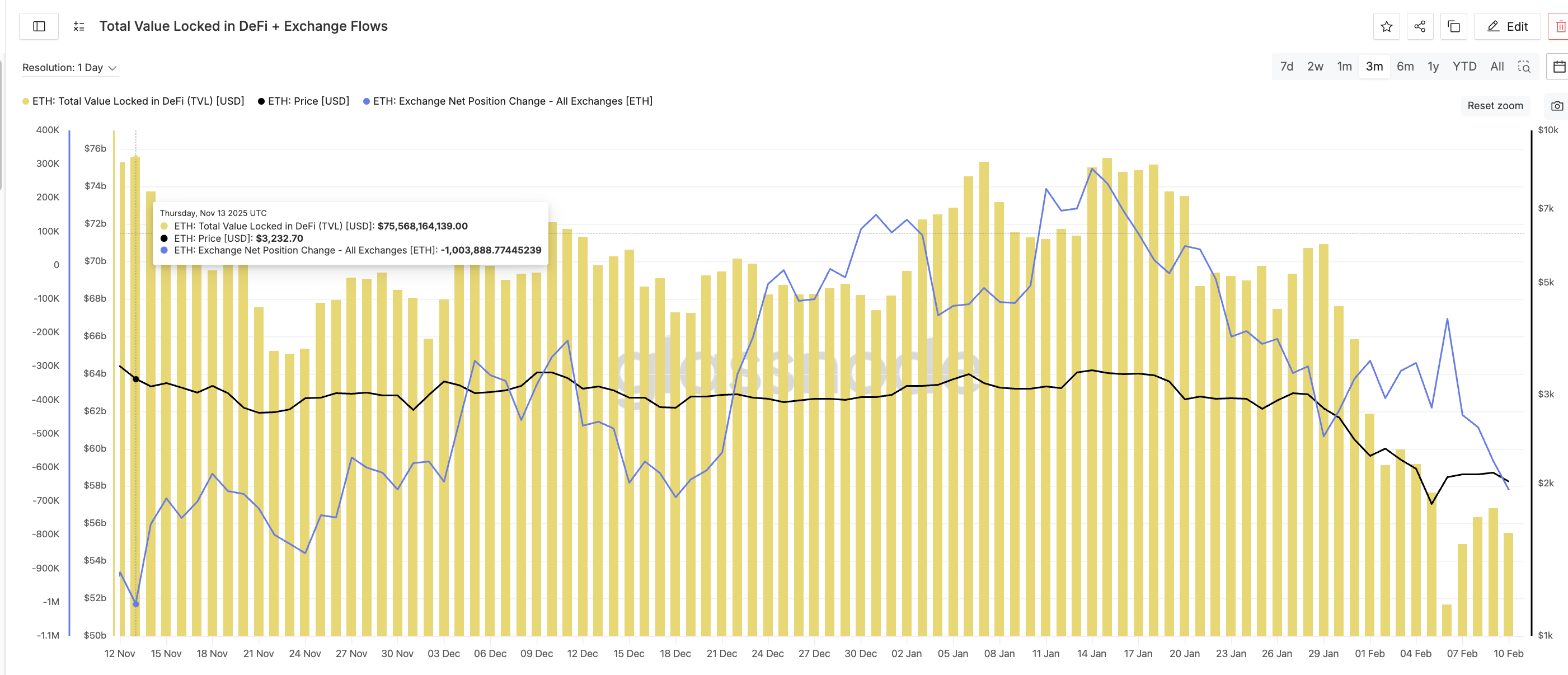

Analysts at BeInCrypto mixed TVL and trade move dashboards to indicate a transparent sample.

As of November thirteenth, DeFi TVL was $75.6 billion. on the similar time, $ETH It traded for about $3,232. The trade’s internet place change is considerably damaging, indicating that extra cash are leaving the trade than getting into it. Buyers might have moved $ETH To self-detention.

TVL impacts trade flows and costs: Glassnode

It was a wholesome setting.

By December 31, TVL had fallen to roughly $67.4 billion. $ETH It fell to $2,968. Overseas trade flows turned optimistic. About 1.5 million $ETH Moved to the trade. Promoting stress elevated. Now, let’s take a look at February.

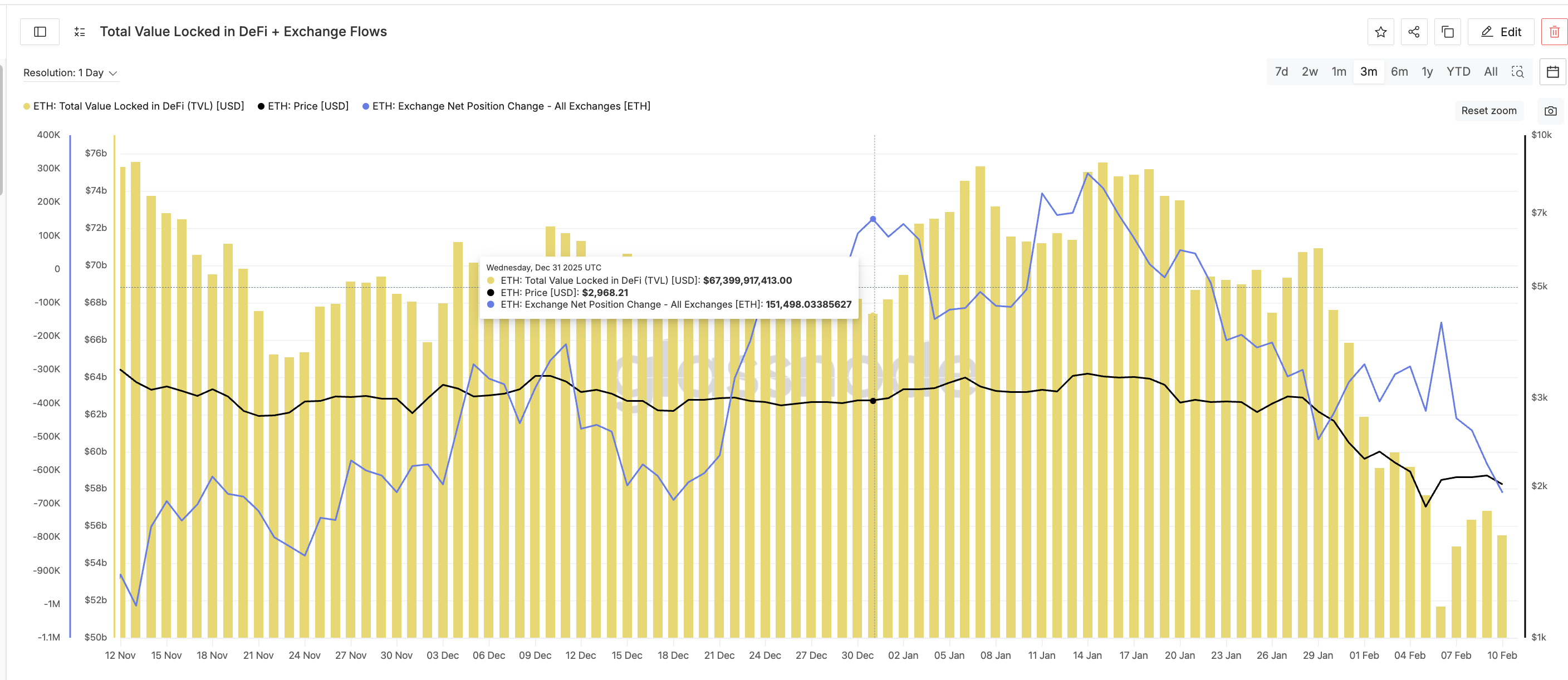

TVL historical past and rising deal move: Glassnode

On February sixth, DeFi TVL hit a three-month low of $51.7 billion. $ETH It was almost $2,060. Overseas trade outflows weakened sharply (the web place line reached a neighborhood peak). Though internet flows remained barely damaging, shopping for stress collapsed, as defined by the height on February sixth. This reveals a repeating relationship.

A fall in TVL both will increase overseas trade inflows or decreases outflows. This implies capital is shifting from long-term use to potential sale.

As of February 10, TVL had solely recovered to about $55.5 billion, down about $20 billion from its mid-November degree. This stays close to a three-month low. Barring a stronger restoration, exchange-side stress is more likely to return. In different phrases, a sample break is happening whereas Ethereum’s core utilization stays depressed.

It is not only a chart subject, it is a structural subject.

Explaining Ethereum value assist on a whale accumulation and value foundation

Regardless of weak technicals and a drop in TVL, the whales haven’t utterly retreated.

Observe whale provide $ETH It’s held in giant wallets excluding exchanges. Since February 6, the whale inventory has decreased from about 113.91 million people. $ETH That is almost 113.56 million folks. This confirmed the distribution throughout breakdown. Nevertheless, up to now 24 hours, this development has stopped.

Ethereum Whale: Santiment

Holdings barely recovered from 113.56 million $ETH There was a small enhance within the variety of folks, from 113.62 million to 113.62 million. This means that the whale is testing assist somewhat than absolutely committing.

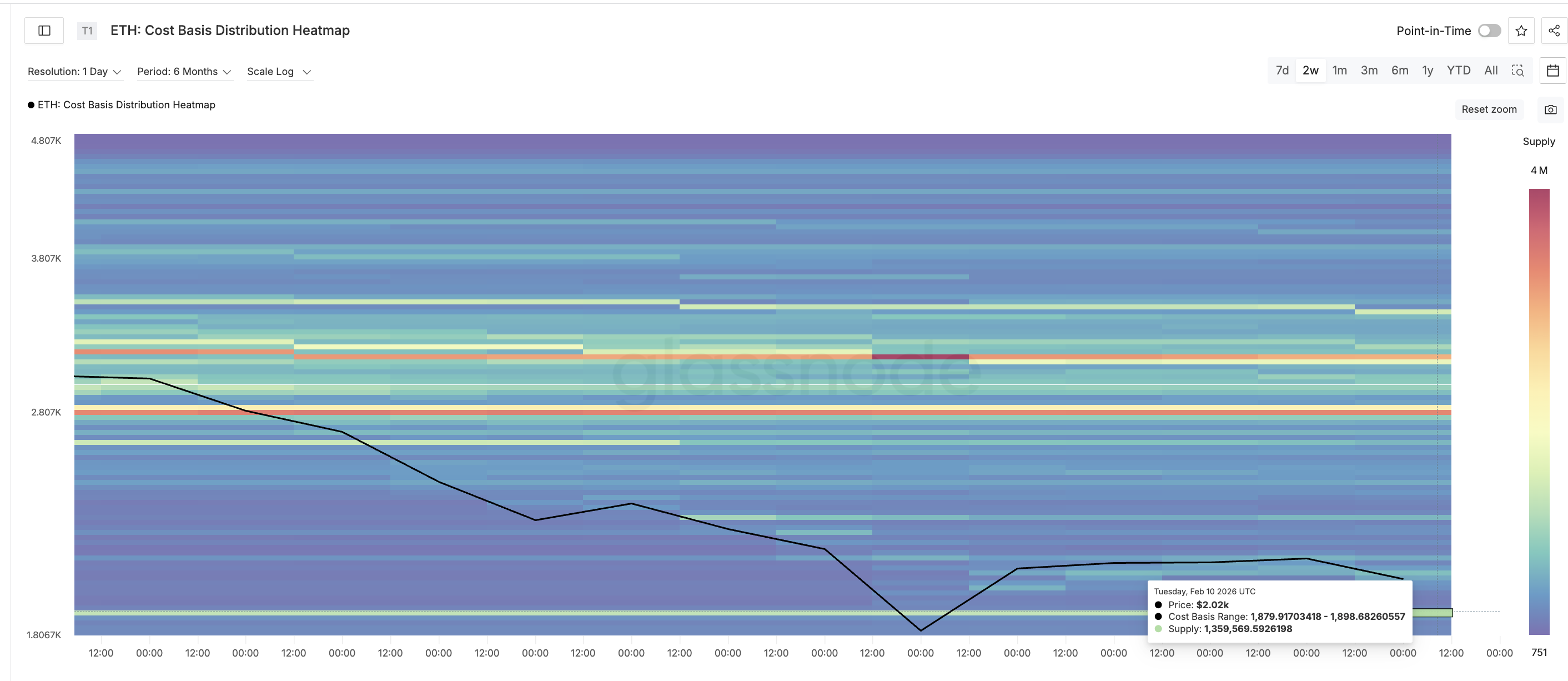

The rationale for this turns into clear if you take a look at cost-based information.

The fee-based heatmap reveals the place a big group of buyers have bought their cash. These zones typically act as assist as holders shield their entry value. For Ethereum, the principle cluster is between $1,879 and $1,898. Roughly 1.36 million $ETH amassed inside this vary. Subsequently, it’s a excessive demand space.

Value-based heatmap: Glassnode

Present costs are hovering simply above this space.

just for $ETH If it stays above this band, whales have an incentive to guard it. If the worth falls under this, many holders will undergo losses and there’s a excessive chance that promoting will develop into stronger. This makes for a prudent purchase.

Whales aren’t betting on a rally. Maybe you might be defending an vital price zone.

From right here, the worth construction of Ethereum turns into clear.

Help is situated close to $1,960 after which $1,845. If the worth closes under $1,845 for the day, a serious price cluster will break down, confirming extra critical draw back dangers. If this occurs, the subsequent main draw back zones can be round $1,650 and $1,500.

Ethereum Value Evaluation: TradingView

On the optimistic aspect, $ETH You could get again $2,150 to stabilize. A transfer above $2,780 will weaken the broader bearish construction. Till then, rebounding stays weak.

Put up Ethereum ($ETH) Breaking the Sample Amid the $20 Billion DeFi Slide — Why Are Whales Nonetheless Shopping for? The submit appeared first on BeInCrypto.