Ethereum was buying and selling between $2,014 and $2,028 per coin as of February 10, however a lot louder voices had been being heard behind the scenes within the derivatives market. Futures open curiosity stays excessive, choices positioning is closely biased towards calls, and most ache ranges throughout main exchanges are uncomfortably near the spot.

Flash combined alerts between Ethereum derivatives, Binance, OKX and Deribit

Ethereum futures open curiosity continues to hover close to cycle highs, with combination trade information displaying leveraged publicity is unfold throughout concentrated exchanges. Though costs have fallen from latest highs, merchants haven’t considerably decreased threat, suggesting that confidence stays intact, not less than for now.

Amongst futures exchanges, Binance holds the biggest share of Ethereum open curiosity at roughly $5.32 billion, which equates to greater than $2.63 million. $ETH. Binance’s short-term positioning trended cautiously constructive, with 1-hour and 4-hour open curiosity rising regardless of softening 24-hour numbers, suggesting an aggressive repositioning reasonably than a wholesale exit.

CME ranks subsequent, with roughly $3.48 billion in funds. $ETH Futures Publicity. Not like the offshore market, the CME futures market confirmed regular progress throughout all time frames tracked, reinforcing the presence of institutional flows reasonably than fast capital outflows.

OKX and Bybit observe carefully, with open curiosity starting from $1.7 billion to $2 billion, respectively. OKX rose sharply by greater than 10% in 24 hours, indicating a resurgence of speculative curiosity regardless of modest declines in shorter intervals.

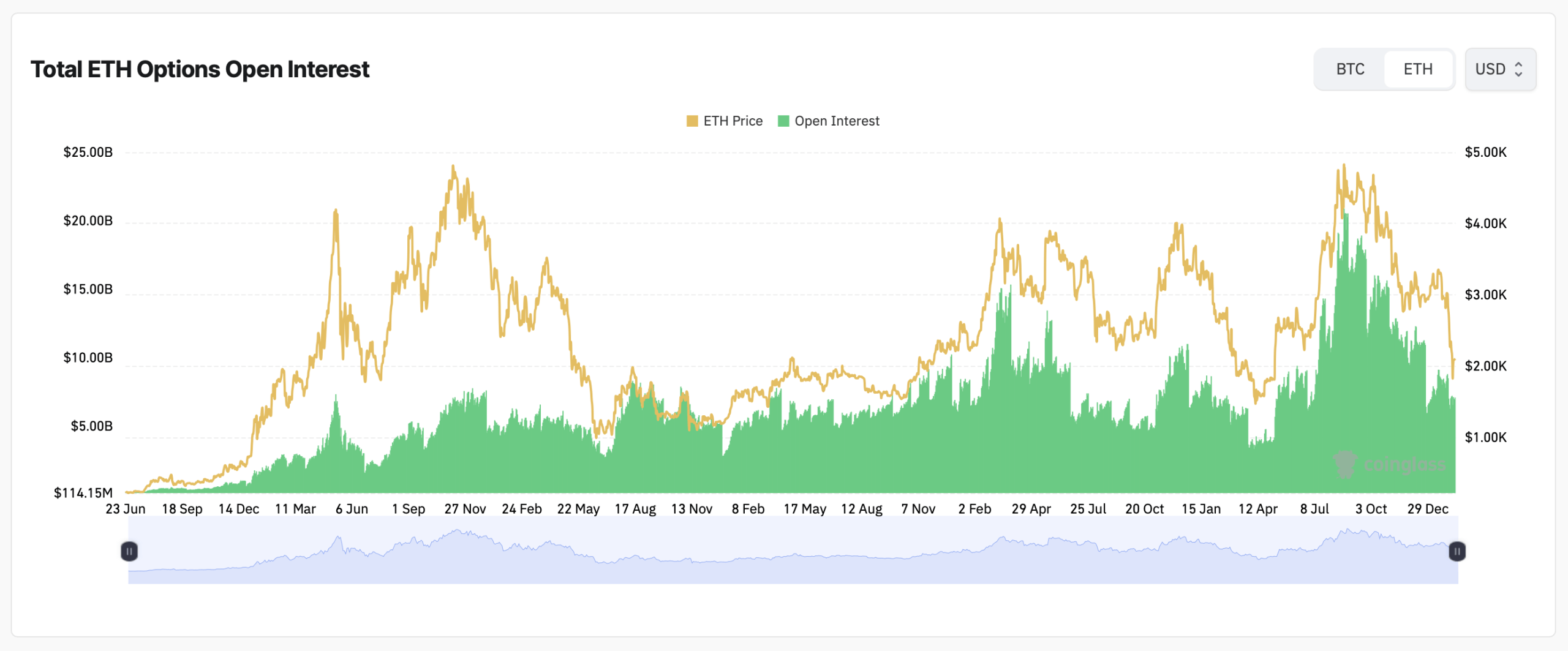

The Ethereum choices market paints a equally busy image. Complete open curiosity in choices has expanded together with value over the previous yr, rising to multi-month highs at the same time as Ethereum retreats towards $2,000. This mix, a draw back spot and sticky derivatives publicity, usually units the stage for sharp directional strikes.

Cole continues to dominate positioning. Open curiosity in choices totaled greater than 1.8 million, with 57.41% allotted to calls and 42.59% allotted to places. $ETH On a name. The amount information additionally displays that bias, with calls accounting for 53.12% of 24-hour choices buying and selling, indicating that merchants are nonetheless trending greater reasonably than bracing for a collapse.

Essentially the most closely traded contracts are concentrated round short-term expirations, particularly in February and March. There’s a giant focus of open curiosity within the $1,800 to $3,500 strike vary, suggesting that merchants are hedging broadly whereas leaving room for volatility.

Most ache information made the image even clearer. On main choices venue Deribit, short-term most ache ranges hovered round $2,000 to $2,200 for February expirations, however skyrocketed to $2,800 in March and almost $3,000 in June, uncomfortably near present ranges.

Ethereum choices open curiosity as of Tuesday, February 10, 2026, based on statistics from Coinglass.com.

Binance’s most ache curve confirmed a flatter construction, with ache ranges concentrated between $2,200 and $2,600 throughout the upcoming expiration dates. This vary means restricted directional mercy for overconfident merchants who’re too biased in both route.

On OKX, most ache ranges remained low within the brief time period, hovering round $2,100 to $2,400, however spiked towards $3,400 on the finish of the yr. This curve means that merchants count on turbulence first, adopted by transparency.

Essentially, the Ethereum derivatives market seems to be very crowded, arbitrary, and hasty. With spot costs pegged close to $2,000 and leverage nonetheless set excessive, this setup leaves little room for complacency.

Ceaselessly requested questions ⏱️

- What’s the present value of Ethereum?Ethereum traded at costs between $2,014 and $2,028 per coin on February tenth.

- Are merchants bullish or bearish within the choices market?Calls are dominating each open curiosity and quantity, indicating a bullish development.

- Which trade has essentially the most Ethereum futures open curiosity?Binance leads with over $5.3 billion $ETH Futures Publicity.

- The place is the utmost ache degree concentrated?Relying on the trade fee, the largest short-term ache might be nearer to $2,000 to $2,400.