Ethereum is exhibiting early indicators of restoration after a protracted interval of stagnation that despatched its value plummeting. $ETH has sought to stabilize round key help ranges, however additional upside will depend upon sustained help from buyers and broader market circumstances.

For the time being, Ethereum seems to have no less than one in every of these components working in its favor, retaining the outlook for restoration intact.

Ethereum buyers change stance

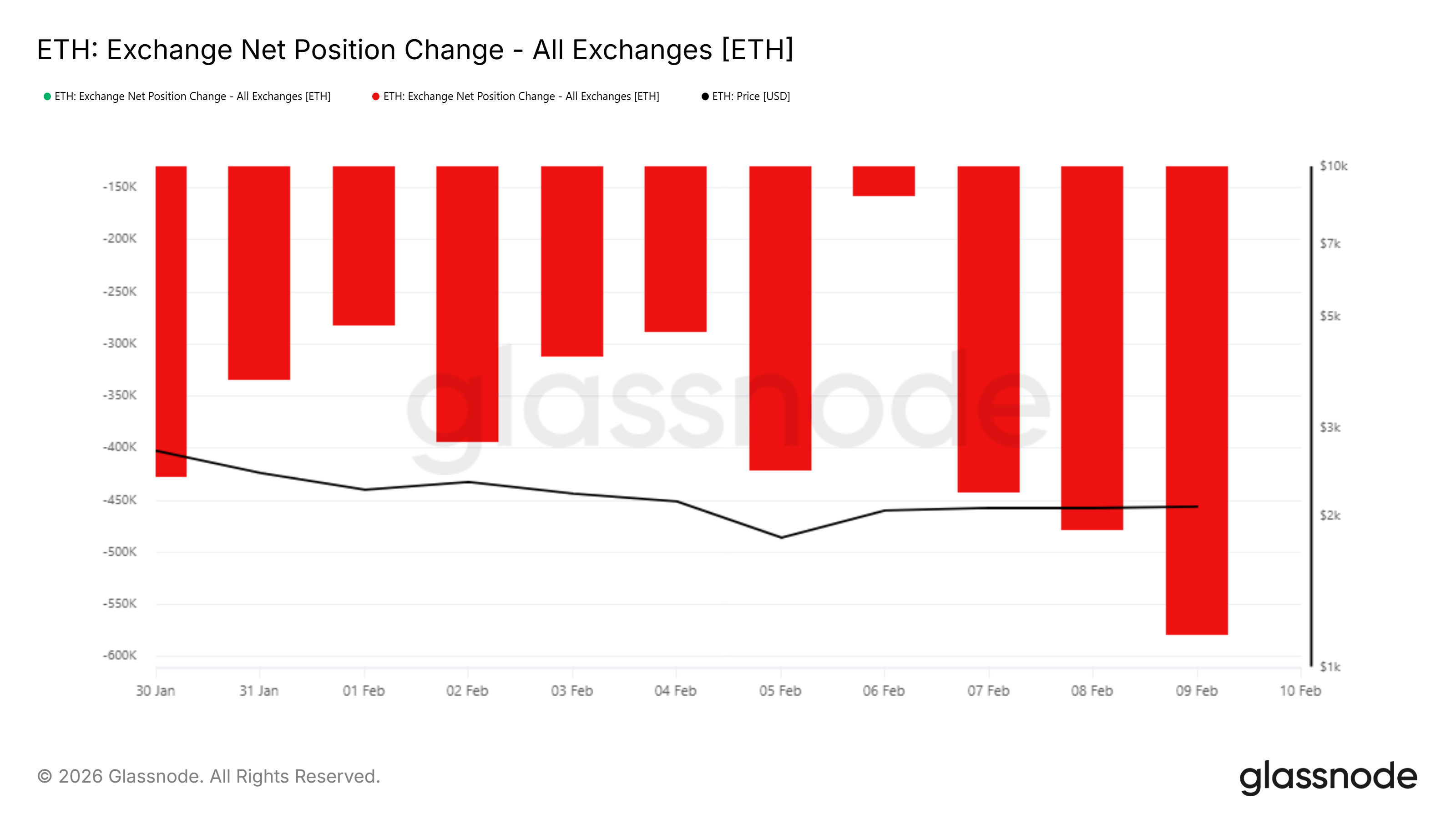

On-chain knowledge suggests a notable shift in investor conduct. The trade’s web place change indicator, which tracks the circulation of capital into and out of exchanges, turned damaging for Ethereum. This exhibits much more $ETH Leaving an trade quite than becoming a member of it. That is often a sample related to accumulation quite than distribution.

Such outflows counsel that holders are opting to purchase and switch $ETH As a substitute of making ready it on the market, put it in your private pockets. This conduct is usually inspired by falling costs as buyers brace for a possible rebound. This variation in stance displays improved confidence, despite the fact that costs haven’t but totally mirrored elevated demand.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Modifications in web positions on the Ethereum trade. Supply: Glassnode

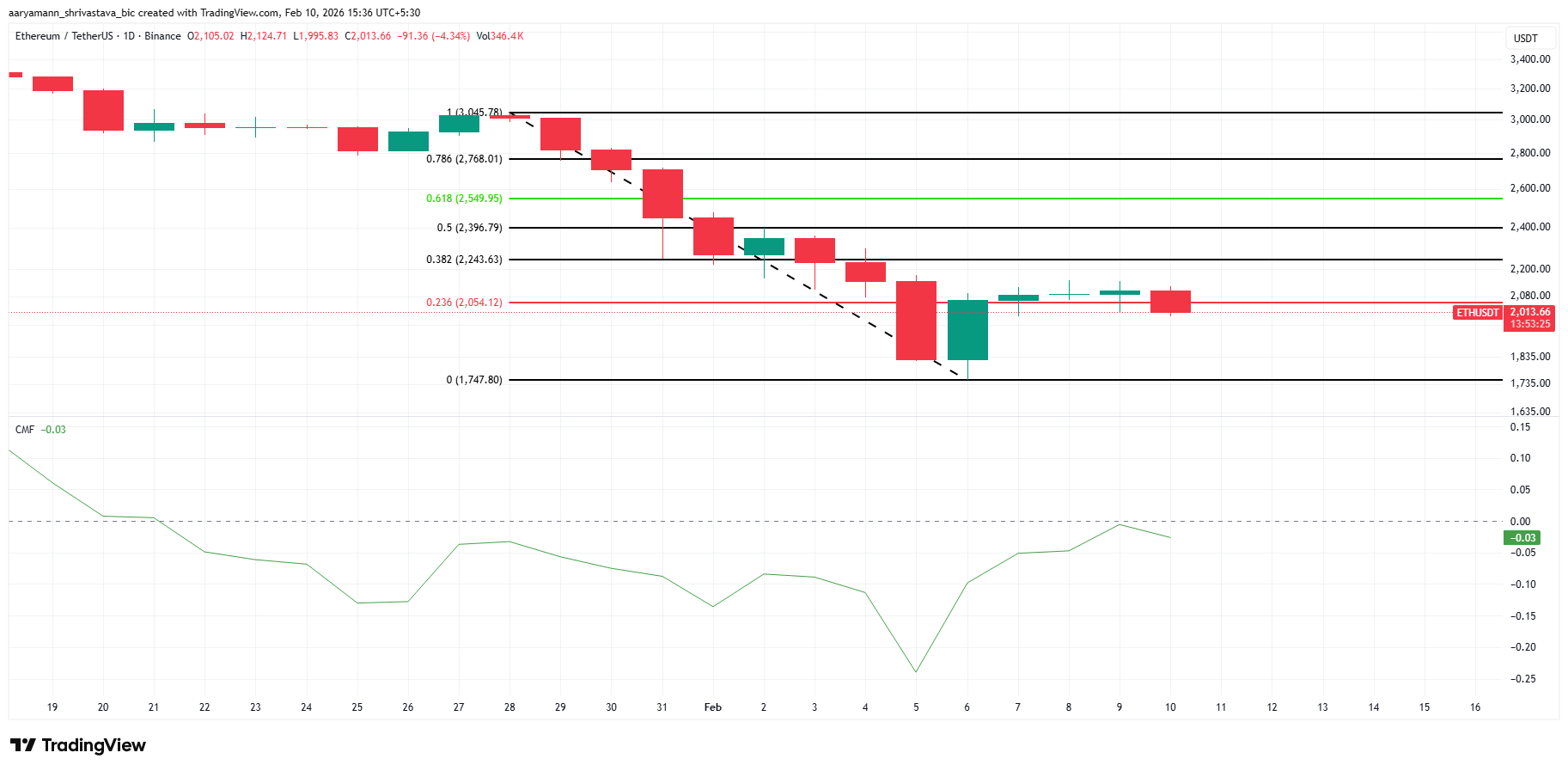

Broader momentum indicators help this story. Chaikin cash flows have proven a gentle improve over the previous week, reinforcing the developments noticed in forex knowledge. The rise in CMF values signifies that outflows are reducing and the dynamics of capital flows throughout the Ethereum market are enhancing.

A transfer above the zero line can be a bullish growth as inflows will exceed outflows. $ETH. On the similar time, Ethereum has managed to carry above the 23.6% Fibonacci retracement close to $2,054. Sustaining this degree typically acts as a set off for brand new participation and encourages buyers to deploy capital as draw back dangers look like extra contained.

Ethereum CMF. Supply: TradingView

What’s $ETH What’s Value’s subsequent goal?

On the time of writing, Ethereum is buying and selling round $2,018, indicating that there’s nonetheless demand under the present value. The problem lies in changing that demand right into a sustained upward pattern. A profitable rebound from the $2,000 degree may result in an upside transfer. $ETH To the important thing short-term resistance degree at $2,205. Moreover, the psychological aim of $2,500 comes into focus.

Ethereum value evaluation. Supply: TradingView

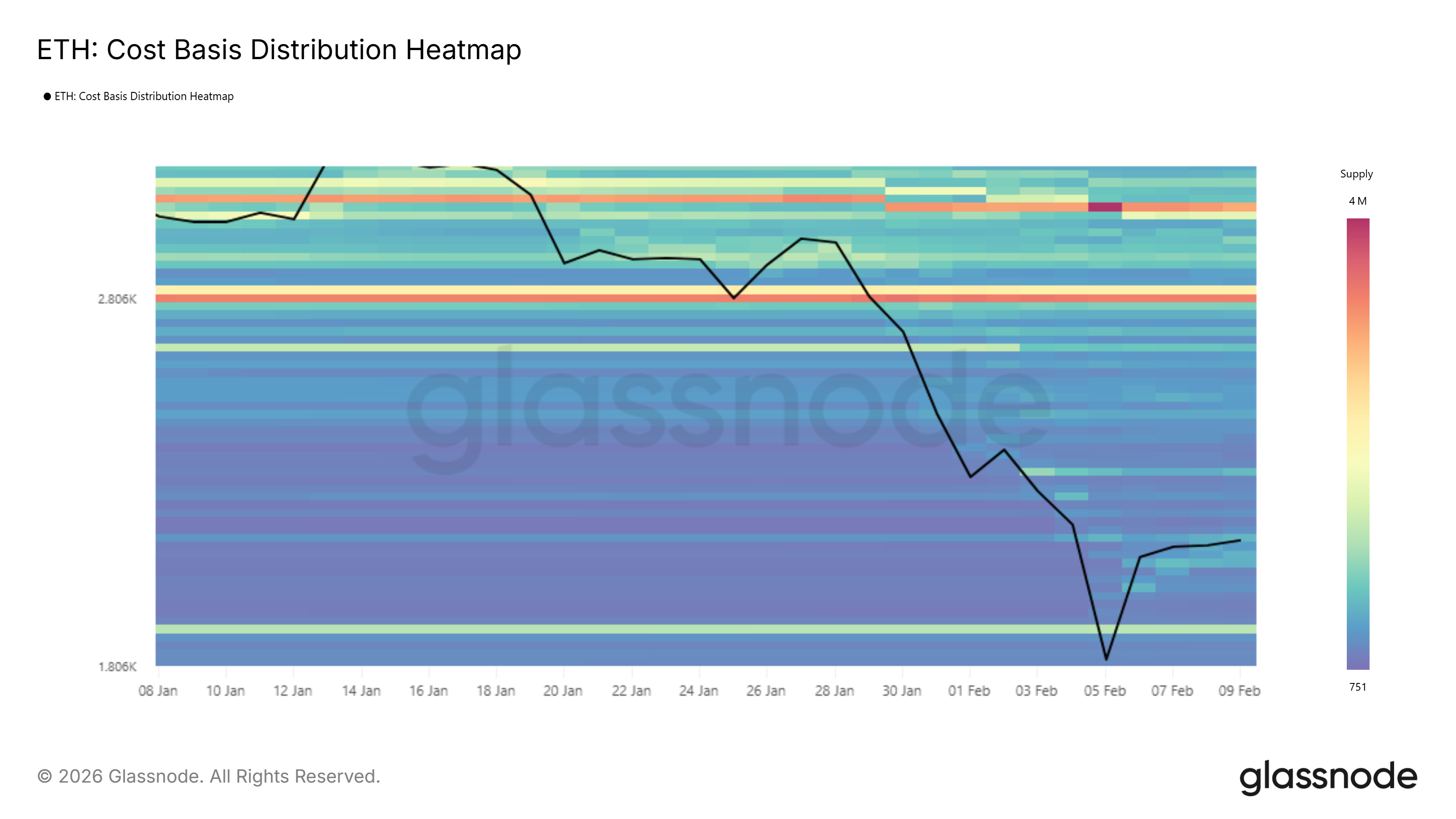

From a structural perspective, reaching $2,500 will not be troublesome. Value-based distribution knowledge exhibits comparatively gentle accumulation round this zone, suggesting restricted overhead provide. Consequently, $ETH As you achieve momentum, it is possible for you to to maneuver by way of this vary with much less resistance. A stronger accumulation cluster seems to be approaching $2,800, which may act as a extra significant barrier.

Ethereum CBD heatmap. Supply: Glassnode

Earlier than that situation performs out, Ethereum must clear intermediate hurdles. A decisive transfer above $2,344 would verify the power of the resilience and validate the trail in the direction of $2,500 and probably increased ranges. Nevertheless, failure to take care of present help will undermine our bullish setting. A loss on the $2,000 degree is $ETH There’s recent draw back threat, with $1,796 rising as the following main help space.

The article Ethereum Holds $2,000 Help — Accumulation Retains Restoration Hopes Alive appeared first on BeInCrypto.