The Financial institution of Japan’s rate of interest hike to 1% might trigger giant fluctuations in Bitcoin costs globally.

Japan holds $1.2 trillion in U.S. debt, and any coverage change would have a worldwide impression on Bitcoin costs.

Bitcoin has fallen 3% to date after the Financial institution of Japan raised rates of interest to 0.75% in January.

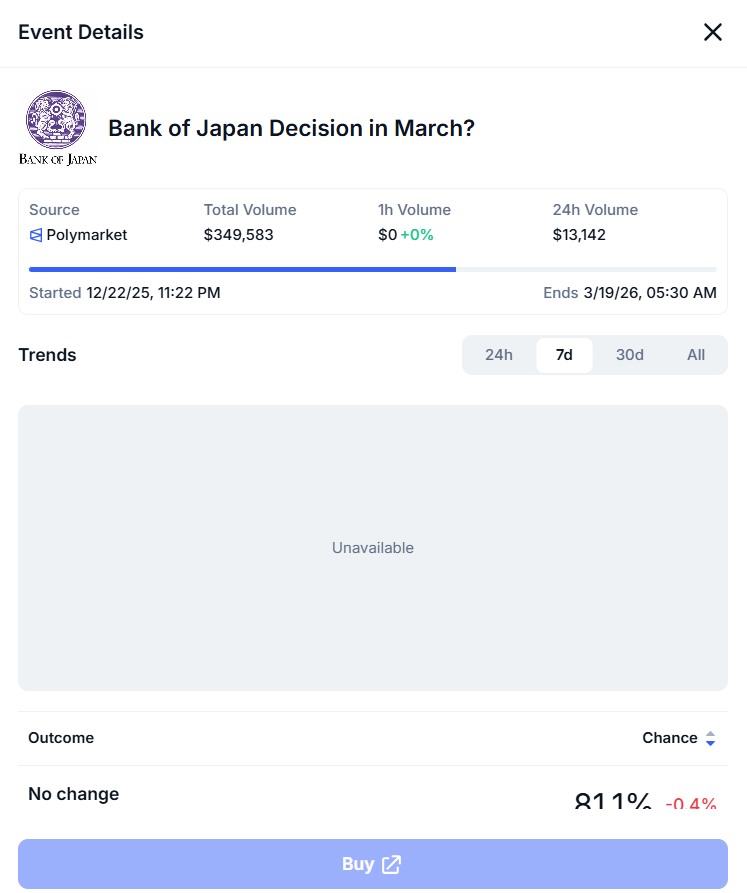

World crypto markets are below strain once more as expectations develop that the Financial institution of Japan might elevate rates of interest to 1% in April 2026. Financial institution of America has warned that Japan’s coverage tightening might cut back world liquidity and trigger one other sharp decline in Bitcoin, just like the three% drop seen after January’s rate of interest hike.

Financial institution of Japan raises rate of interest to 1% in April 2026

The Financial institution of Japan (BOJ) is predicted to lift rates of interest by 25 foundation factors, probably rising to 1% in April 2026, in line with Financial institution of America World Analysis.

The Financial institution of Japan is predicted to lift rates of interest by 25 foundation factors, bringing rates of interest to 1% in April 2026, in line with Financial institution of America World Analysis.

Which means that rates of interest in Japan will attain their highest stage because the Nineties, as Japan has maintained near-zero rates of interest for an prolonged time frame.

Bitcoin value after Financial institution of Japan rate of interest hike

Wanting on the information on the Financial institution of Japan’s rate of interest hikes to date, we are able to see that it is rather delicate to modifications in Japan’s rates of interest. The worth of Bitcoin after the Financial institution of Japan price hike in January 2026 clearly displays this, with Bitcoin falling almost 3% instantly after the Financial institution of Japan raised rates of interest to 0.75%. This reveals how rapidly the cryptocurrency market reacts when the worldwide liquidity scenario modifications.

Rising rates of interest enhance borrowing prices and cut back the stream of cash into dangerous belongings resembling Bitcoin.

Analysts have warned that Bitcoin might face additional downward strain if the Financial institution of Japan raises rates of interest once more in the direction of 1%. Some estimates recommend a decline of 4% to five%, which might push Bitcoin costs nearer to the $60,000 stage.