Ethereum trades close to $2,000 After a pointy decline, the long-term chart motion signifies a ultimate leg up in a multi-year construction. Brief-term value motion is at the moment tense within the triangle, making ready for the subsequent decisive transfer as momentum cools.

Ethereum counts “diagonal growth” as $9,000-1,8,000, zone marks subsequent goal

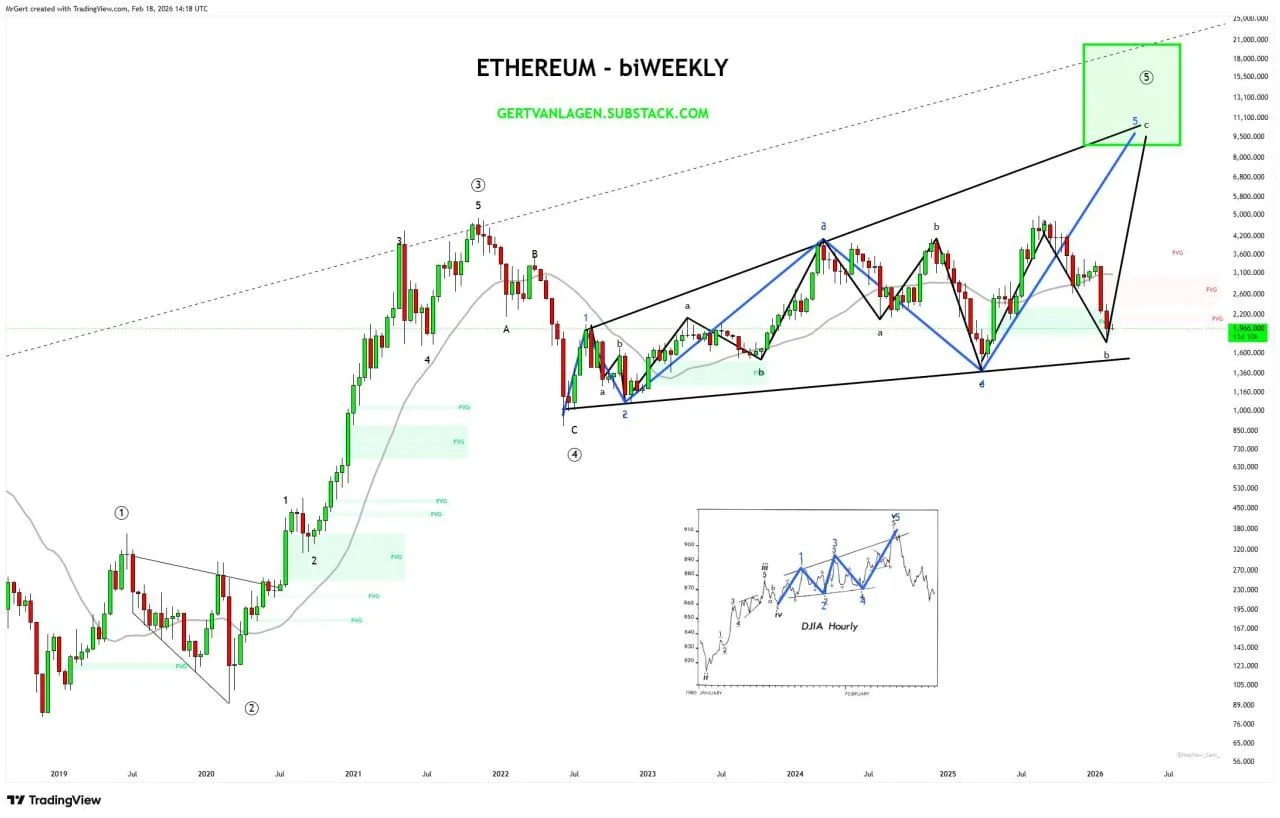

Ethereum continues to trace what analyst Gerd van Lagen described as a “textbook prolonged diagonal” on its biweekly chart. In a publish to

Ethereum biweekly chart. sauce: Gerd van Lagen of X

Van Lagen mentioned that the subsequent leg ⑤-5-b fell after Ethereum misplaced the easy shifting common of the upper time-frame. He added that the most recent decline closed the honest worth hole marked between roughly $1,800 and $2,300, a zone highlighted as a earlier imbalance on the chart.

The analyst framed ⑤-5-c as a remaining upside push inside the construction and set the anticipated goal zone between $9,000 and $18,000. He set an invalidation on the break under the extent labeled ⑤-4 on the chart. This might invalidate the rely in his framework.

$ETH On the every day chart, the bottom is maintained under $2,000 as a consequence of short-term triangle formation.

Ethereum was buying and selling round $1,972 on the every day ETHUSD chart as the worth compressed right into a slim triangle under the $2,100 space. This sample adopted a pointy decline from the low $3,000s, adopted by a push all the way down to the lows whereas the lows slowly rose from the mid-$1,800s. This construction signifies short-term indecision as the worth stays under earlier assist round $2,000 and is at the moment appearing as resistance.

Ethereum USD 1D chart. sauce: Rendoshi on X

On the identical chart, a earlier swing confirmed an analogous compression section in early 2025, with costs resuming close to resistance earlier than resolving larger. Present settings are under a broad vary that ranges from round $1,150 on the draw back to $4,950 on the upside, ranges marked as historic assist and resistance every day. Costs stay effectively under the ceiling that has restricted their rise since late 2024.

RSI momentum remained within the decrease band, displaying a slight rebound from readings under 30 as costs stabilized. Whereas this indicator displays the cooling of downward strain after the latest decline, value motion continued to report a good candlestick close to the highest of the triangle. The chart highlights that it’s repeatedly testing the identical assist zone and not using a clear break, leaving short-term route unresolved whereas the market waits for a definitive transfer.