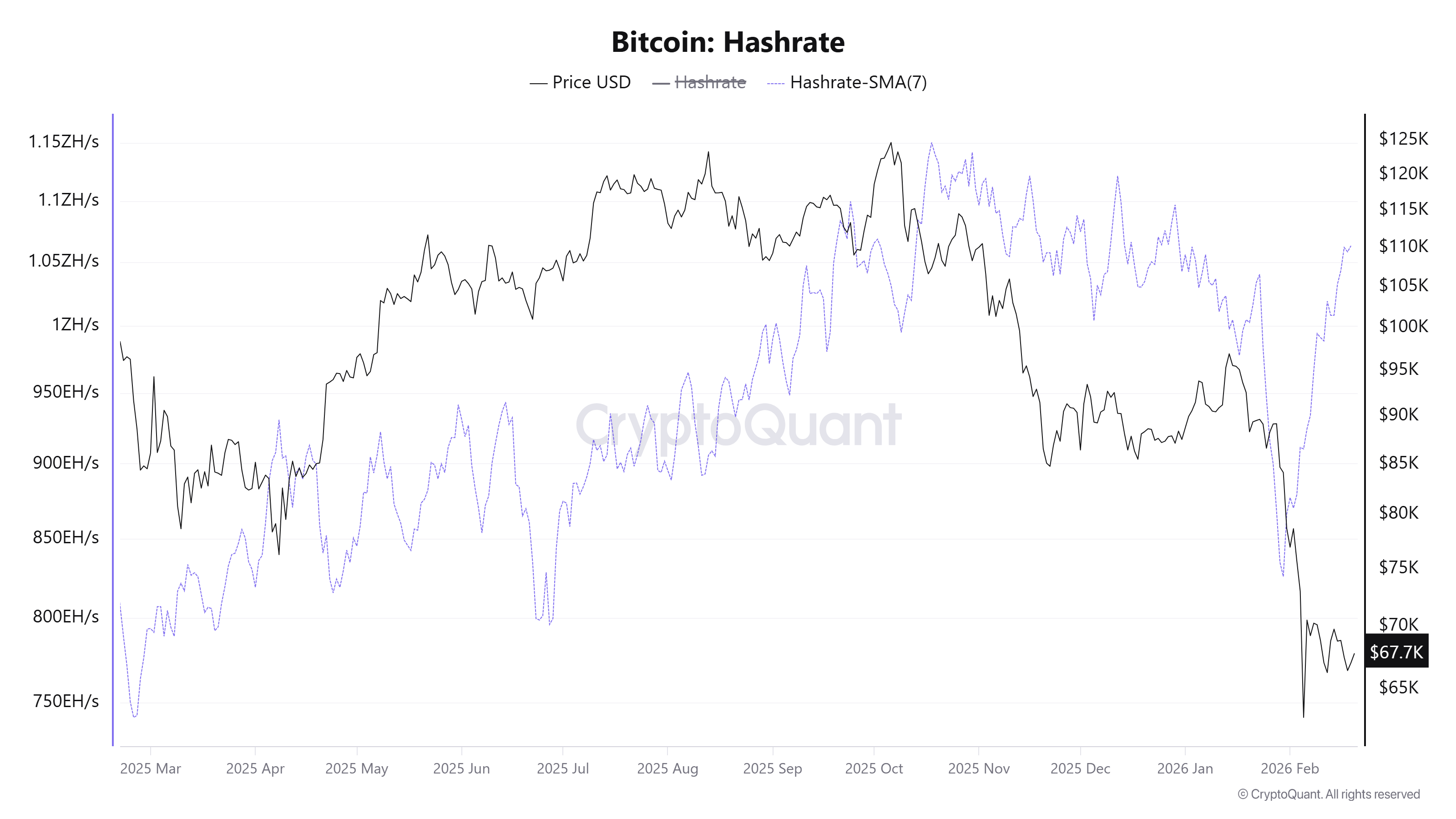

Bitcoin’s hash fee, an vital indicator of the community’s complete computational energy, recorded a pointy V-shaped restoration in February.

This sudden turnaround raised hopes that Bitcoin might finish its five-month shedding streak and make a powerful restoration.

Hashrate and value correlation signifies a possible upside state of affairs

A earlier report by BeInCrypto famous that Bitcoin’s hashrate suffered a significant shock in early 2026. An excessive arctic chilly wave has hit america.

Subzero temperatures, heavy snowfall and a surge in heating demand strained the nation’s energy grid. Authorities issued a request to preserve power, inflicting localized energy outages in a number of areas.

Consequently, the community’s hashrate dropped by about 30%. Roughly 1.3 million mining machines had been taken offline, delaying block manufacturing.

However by February, the information confirmed a speedy turnaround. Hashrate has recovered from under 850 EH/s to over 1 ZH/s, recovering virtually all the earlier vital downward correction.

Bitcoin hash fee. Supply: CryptoQuant.

“Bitcoin mining has develop into roughly 15% tougher, the biggest improve in absolute problem ever, utterly erasing the numerous downward revisions of the earlier period,” Menpool developer Mononaut commented.

Regardless of the hashrate restoration, Bitcoin value continues to fluctuate under $70,000 and doesn’t replicate the identical energy. In keeping with market evaluation platform Hedgeye, it prices about $84,000 to mine one Bitcoin in February. This implies that many miners are nonetheless working at a loss.

The rise in hashrate displays the return of computing energy. Miners are powering their machines again on and look like turning into extra optimistic about Bitcoin’s long-term profitability.

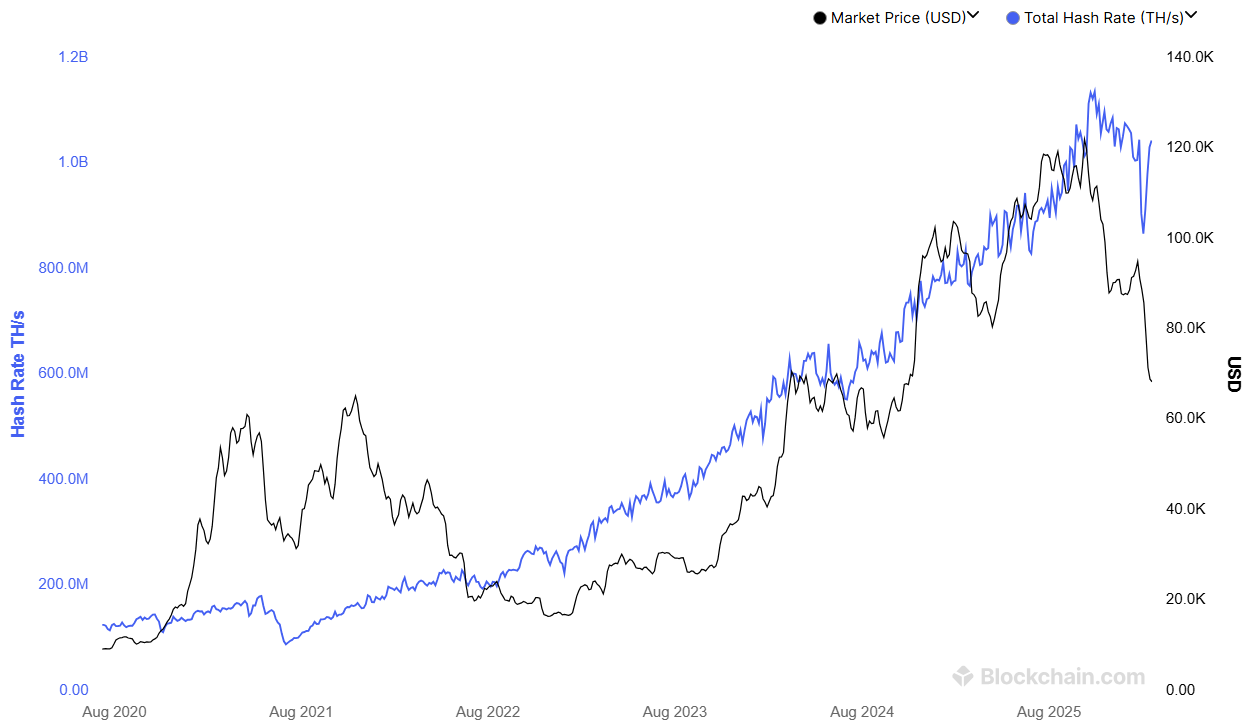

Historic knowledge reveals that V-shaped recoveries in hashrate usually coincide with sturdy rebounds in value.

Bitcoin hash fee and value. Supply: Blockchain.com

A notable instance occurred in mid-2021. After China imposed a complete ban on Bitcoin mining, the hashrate plummeted by greater than 50%, dropping from 166 EH/s to 95 EH/s in July. A couple of months later, a V-shaped restoration in hashrate was paralleled by a powerful rebound in value. Bitcoin rose from about $30,000 to greater than $60,000 by the tip of the 12 months.

“Bitcoin community hashrate has rebounded sharply after its latest plunge. This can be a sturdy sign that miner confidence is unbroken and is coming again on-line. Traditionally, hashrate is a number one indicator of restoration. Worth tends to observe hashrate,” mentioned Bitcoin OG Satoxis.

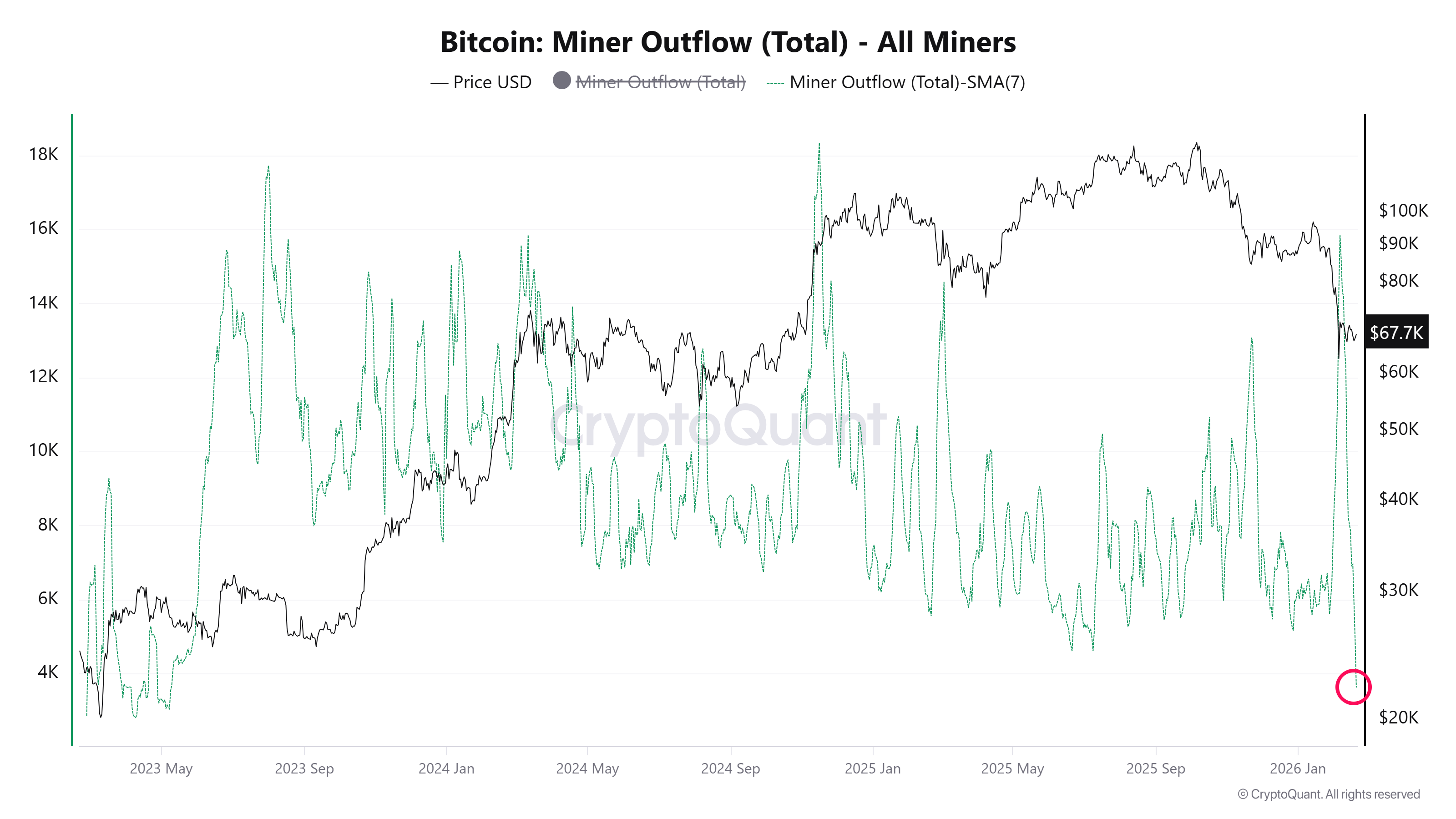

CryptoQuant knowledge on Bitcoin miner outflows additional helps the view that miners expect a value restoration. The seven-day common outflow from minor wallets has fallen to its lowest degree since Might 2023.

Bitcoin miner leak. Supply: CryptoQuant

This development signifies that miners are now not actively promoting their holdings. Moderately, they appear to be holding on to the potential of a rebound.

Extra evaluation on BeInCrypto highlights {that a} sustained restoration at this stage would must be confirmed by way of a breakout above $71,693.

The article “Bitcoin’s hashrate reveals a V-shaped restoration – will Bitcoin value observe go well with?” The publish appeared first on BeInCrypto.