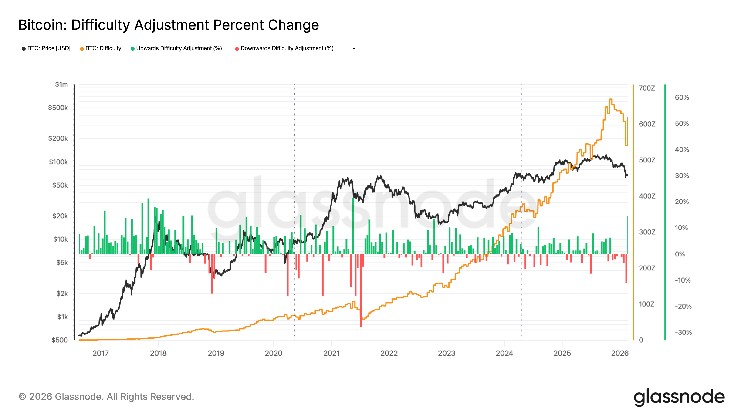

Bitcoin mining issue rose 15% to 144.4 trillion (T), the largest improve since 2021 when China’s mining ban induced large disruption, however was later revised upward by 22% because the community stabilized.

Issue adjustment measures how tough it’s to mine new blocks on the community. It rebalances each 2,016 blocks roughly each two weeks in order that blocks proceed to be generated roughly each 10 minutes, no matter hashrate adjustments.

This adjustment was made in response to a 12% lower in issue resulting from a decline in Bitcoin’s hashrate, the whole computational energy that secures the community. Mining exercise suffered its sharpest setback since late 2021 after extreme winter storms in america pressured a number of main operators to cut back operations.

When Bitcoin reached an all-time excessive of round $126,500 in October, the hashrate additionally reached 1.1 Zettahash/second (ZH/s). As the value fell to $60,000 in February, the hashrate dropped to 826 exahash/second (EH/s). Since then, the hashrate has recovered to 1 ZH/s and the value has recovered to round $67,000.

On the similar time, the hash value, or the estimated each day earnings miners earn per unit of hashrate, stays at a multi-year low (23.9 PH/s), placing strain on profitability.

Regardless of these profitability pressures, large-scale operators with entry to low-cost vitality proceed to mine aggressively. The United Arab Emirates, for instance, has about $344 million in unrealized income from mining operations.

Capital-rich firms that may mine effectively are serving to keep hashrate progress and resilience whilst Bitcoin costs hunch.