Bitcoin has prolonged its current decline, inflicting concern throughout the cryptocurrency market. Though the correction seems to be orderly, the underlying knowledge factors to deeper structural stress.

Traditionally, related patterns have marked early bear market transitions. Present on-chain indicators recommend that capital turnover stays weak. Nonetheless, some indicators recommend that the state of affairs has not utterly worsened, creating an advanced image for buyers.

Bitcoin might be in a chronic bear market

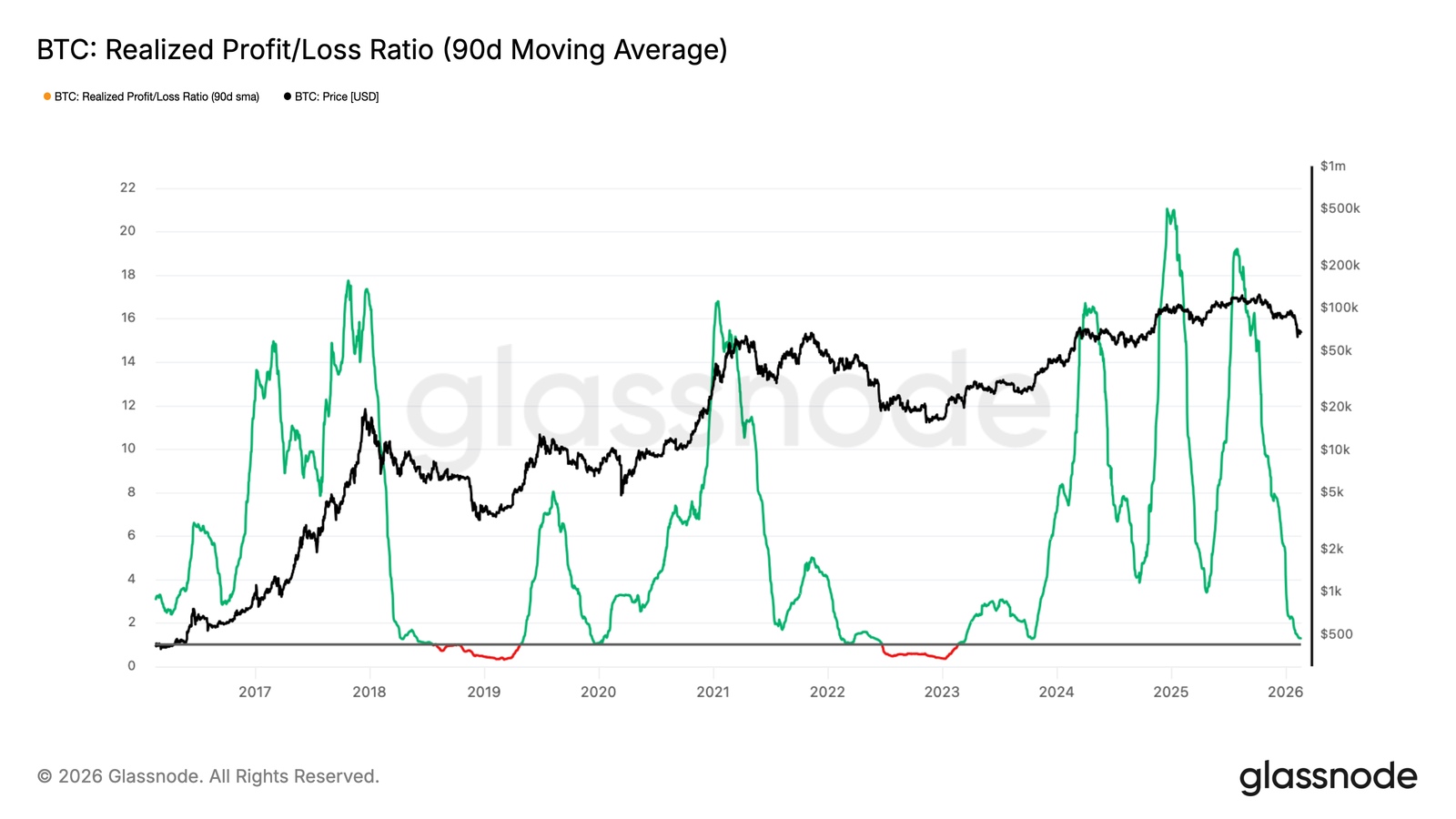

Realized P&L offers necessary perception into the dynamics of Bitcoin capital flows. This metric measures the ratio of realized positive factors to realized losses. The 90-day transferring common has fallen to the 1-2 vary.

Traditionally, this zone has marked the transition from the early bear stage to a extra traumatic setting. As this ratio approaches 1, realized losses start to dominate market exercise. This compression displays restrained profit-taking and restricted liquidity rotation.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Bitcoin realized revenue/loss ratio. Supply: Glassnode

Structural weaknesses are more likely to persist till the realized P&L returns decisively above 2. A continued rise would point out a return to profitability and stronger capital inflows. With out this modification, the general market bias will stay tilted towards warning.

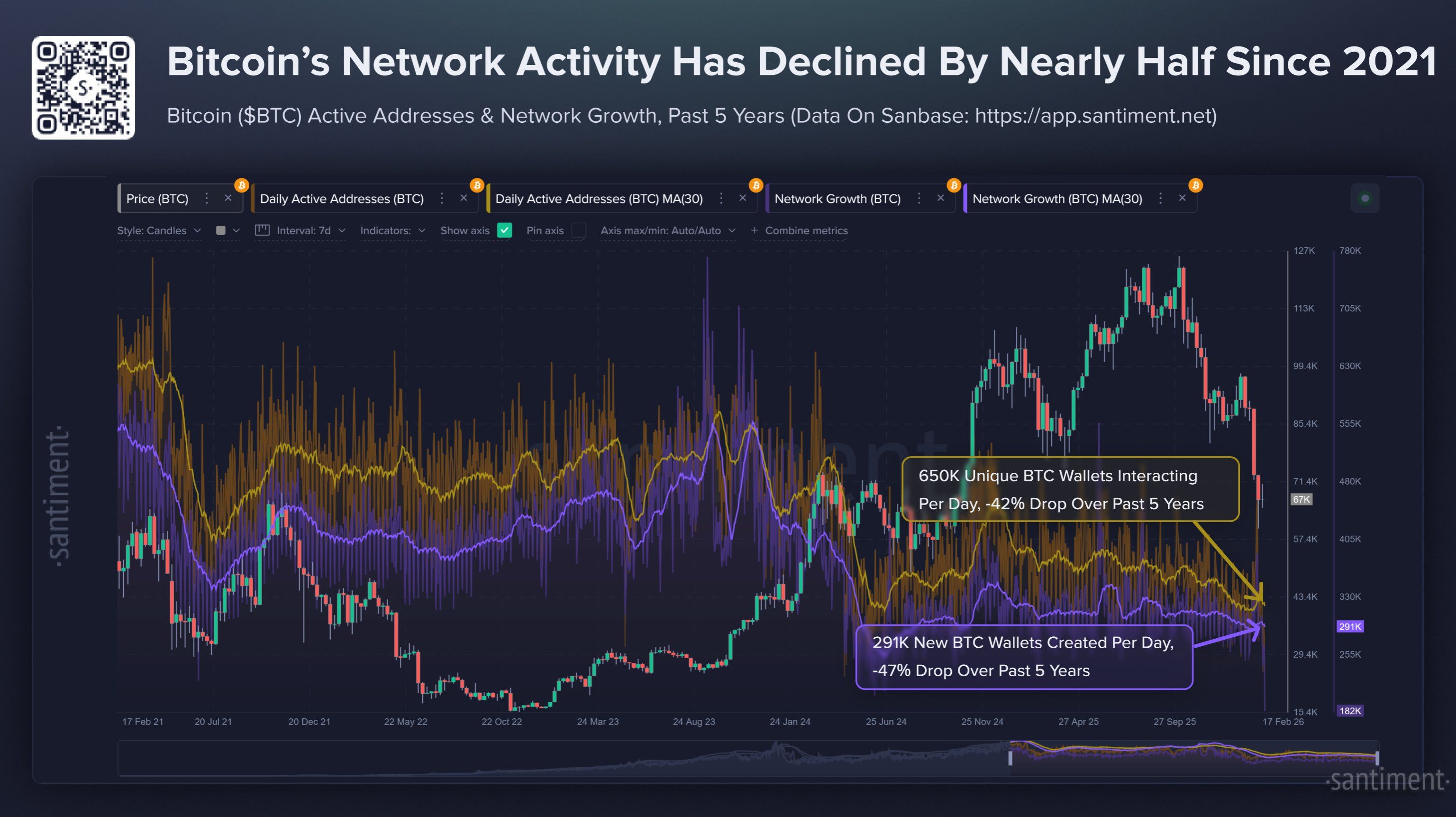

Community exercise knowledge exhibits one other warning sign. In comparison with 5 years in the past, the variety of distinctive Bitcoin registrations has decreased by 42% $BTC Deal with to conduct the transaction. Moreover, new $BTC Addresses decreased by 47%.

This divergence highlights the slowing development of the community regardless of the resilience of costs. A wholesome bullish cycle often coincides with elevated consumer participation. A sustained restoration will seemingly require a rise in energetic addresses and an acceleration of pockets creation, suggesting new substantive demand.

Bitcoin community exercise. Supply: Santiment

$BTC Value should keep away from dropping this help

On the time of writing, the value of Bitcoin is buying and selling at $66,721. The value stays simply above the important thing help stage at $66,550. This zone prevented a sudden breakdown in a number of classes. however, $BTC It continues the downward development that started in late January.

If the bearish momentum continues, Bitcoin could battle to interrupt out of the descending resistance. If the downtrend can’t be damaged, the value may head in direction of the $60,000 help space. A loss at this stage may set off an acceleration of the selloff and expose the subsequent main help close to $52,775.

$BTC value evaluation.”>

$BTC value evaluation.”>

$BTC Value evaluation. Supply: TradingView

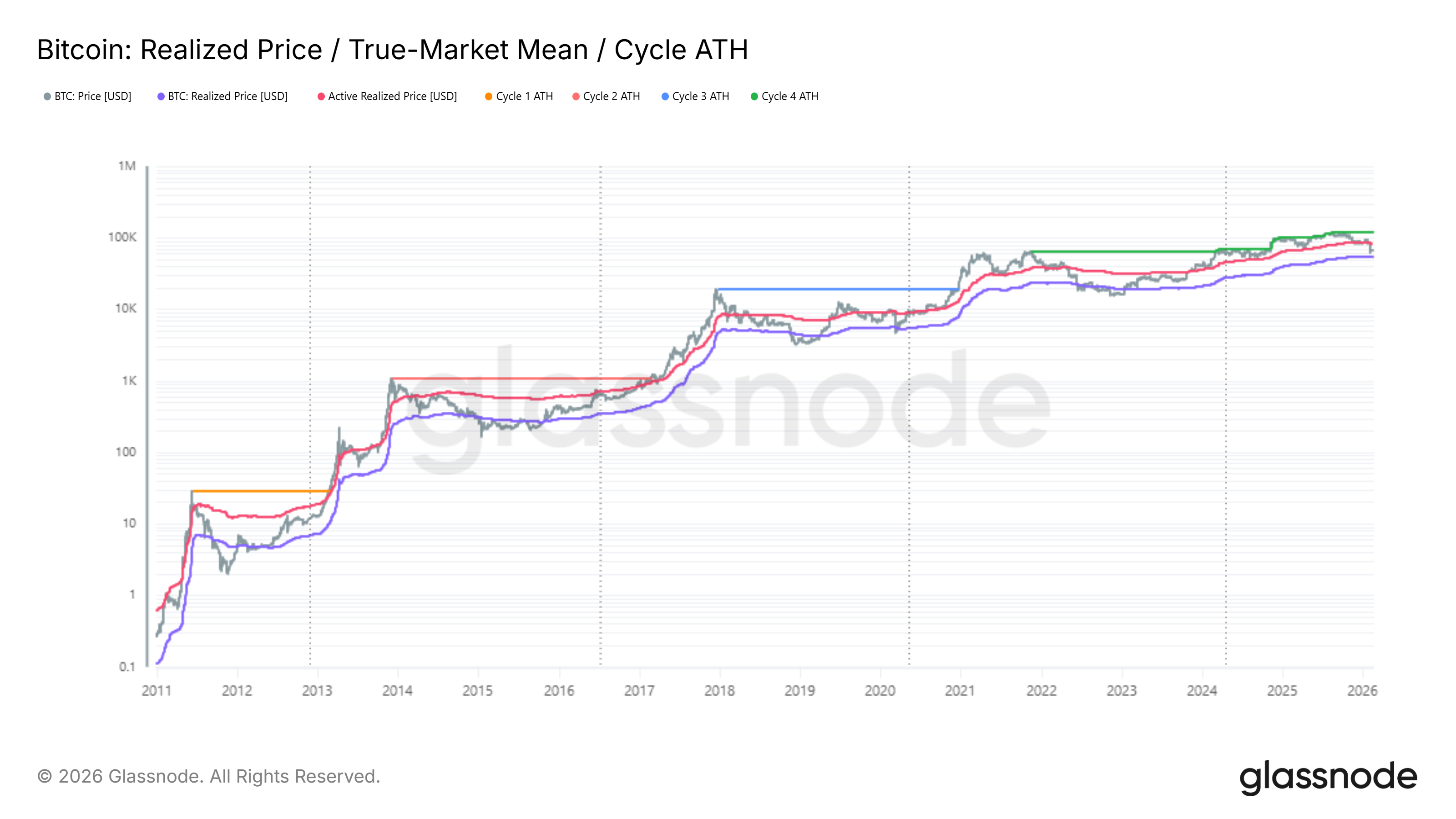

The present realized value is $54,920. Traditionally, lengthy bear markets have been adopted by sustained breaks beneath this benchmark. A fall in direction of the 1.23 Fibonacci stage will improve that threat. Such a transfer may mark the official begin of a protracted bearish cycle.

Bitcoin realized value. Supply: Glassnode

Bitcoin would wish to rebound decisively from $66,550 to invalidate the bearish thesis. A breakout of $71,693 would point out strengthening momentum. A restoration from the near-term 20-day EMA would strengthen restoration prospects. A confirmed transfer above $80,000 can be robust proof of renewed long-term confidence.

The put up Is Bitcoin Value Getting into a New Bear Market? This is Why Metrics Say Sure appeared first on BeInCrypto.