Publicity to HPC/AI drove minor valuations in 2025. The following stage is the separation of execution and narrative, which is the place re-evaluation diverges. $IREN $APLD $CIFR $WULF $HUT.

The next visitor publish is from bitcoinminingstock.io, A public market intelligence platform that gives knowledge on firms uncovered to Bitcoin mining and crypto treasury methods. First printed by Cindy Feng on January 30, 2026.

Over the previous few weeks, now we have famous a transparent shift in the way in which capital markets worth public Bitcoin miners in 2025. Because the second half of this 12 months, buyers have more and more favored firms with dependable HPC/AI publicity.

This was not a sentiment-based commerce. It coincided with a pointy acceleration of execution. Core Scientific, a public miner, was the one one to signal a hyperscaler contract in 2024. In 2025, that quantity will improve to 5. What was as soon as framed as an experimental diversification is now shaping the stability sheet, improvement pipeline and long-term technique of the complete sector.

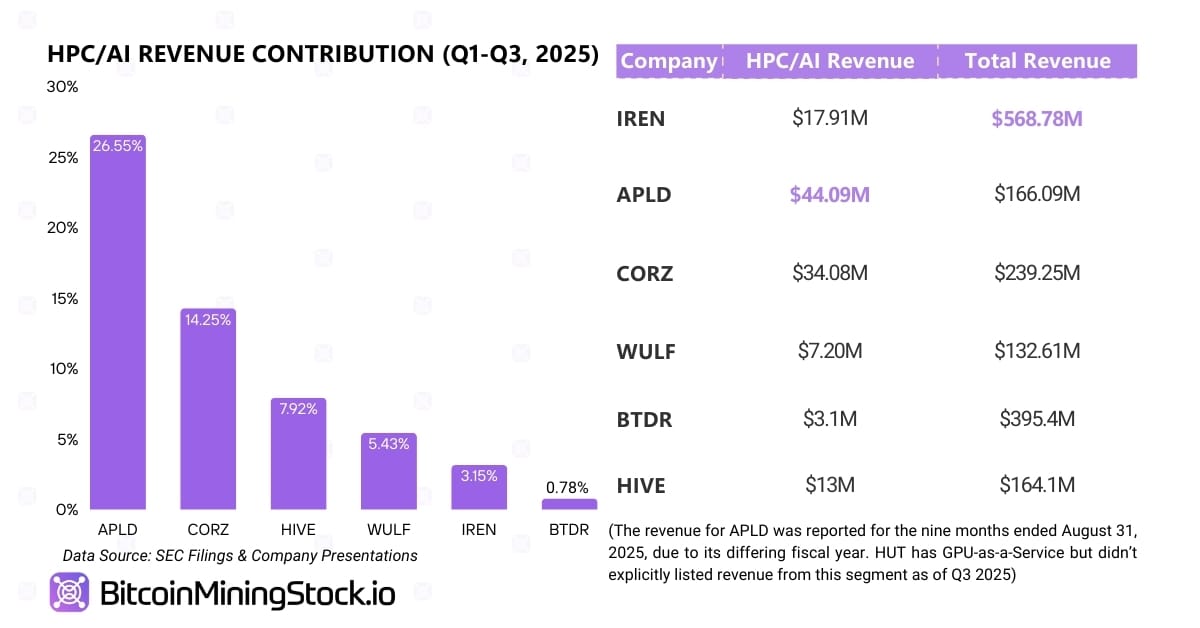

Revenues are nonetheless small, however income visibility is bettering

Regardless of the proliferation of bulletins, HPC/AI’s contribution to income stays restricted till the anticipated 2025. Most hyperscaler offers are structured as long-term contracts with phased infrastructure deployments. Capability is constructed and activated in phases, leading to important returns anticipated to extend from 2026 And past that.

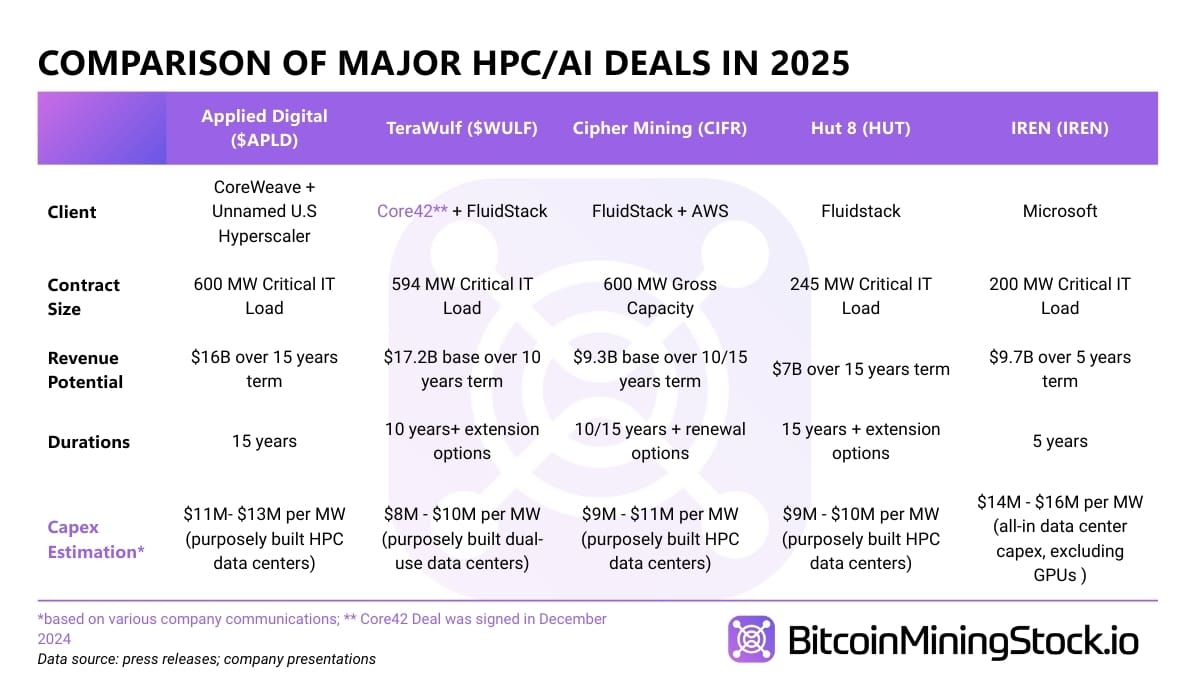

Not all hyperscaler offers are the identical

All the introduced offers have hyperscaler publicity, however the underlying enterprise fashions are very totally different. Most frequently, miners place themselves as: HPC infrastructure supplier, not an AI cloud operator. Their position is primarily colocation, offering energy, cooling, and bodily infrastructure, circuitously promoting AI clouds.

The excellence is essential as a result of capital expenditures, margins, and execution necessities are totally different. Two contracts with related headline values can yield very totally different financial outcomes relying on whether or not the miner is working GPUs or just internet hosting them.

※reference unique report Get full particulars about particular person firm transaction breakdowns, knowledge heart areas, and extra.

For some miners, that is now not diversification

Extra fascinating modifications are taking place underneath the heading. For some firms, HPC is now not a aspect hustle. That is the place future capital will go.

Some miners will proceed to function Bitcoin fleets so long as they proceed to make cash. Nonetheless, their improvement pipeline is now virtually solely HPC-focused, together with IREN and TeraWulf. Firms like Bitfarm have gone additional and prompt that Bitcoin mining itself might finish over time.

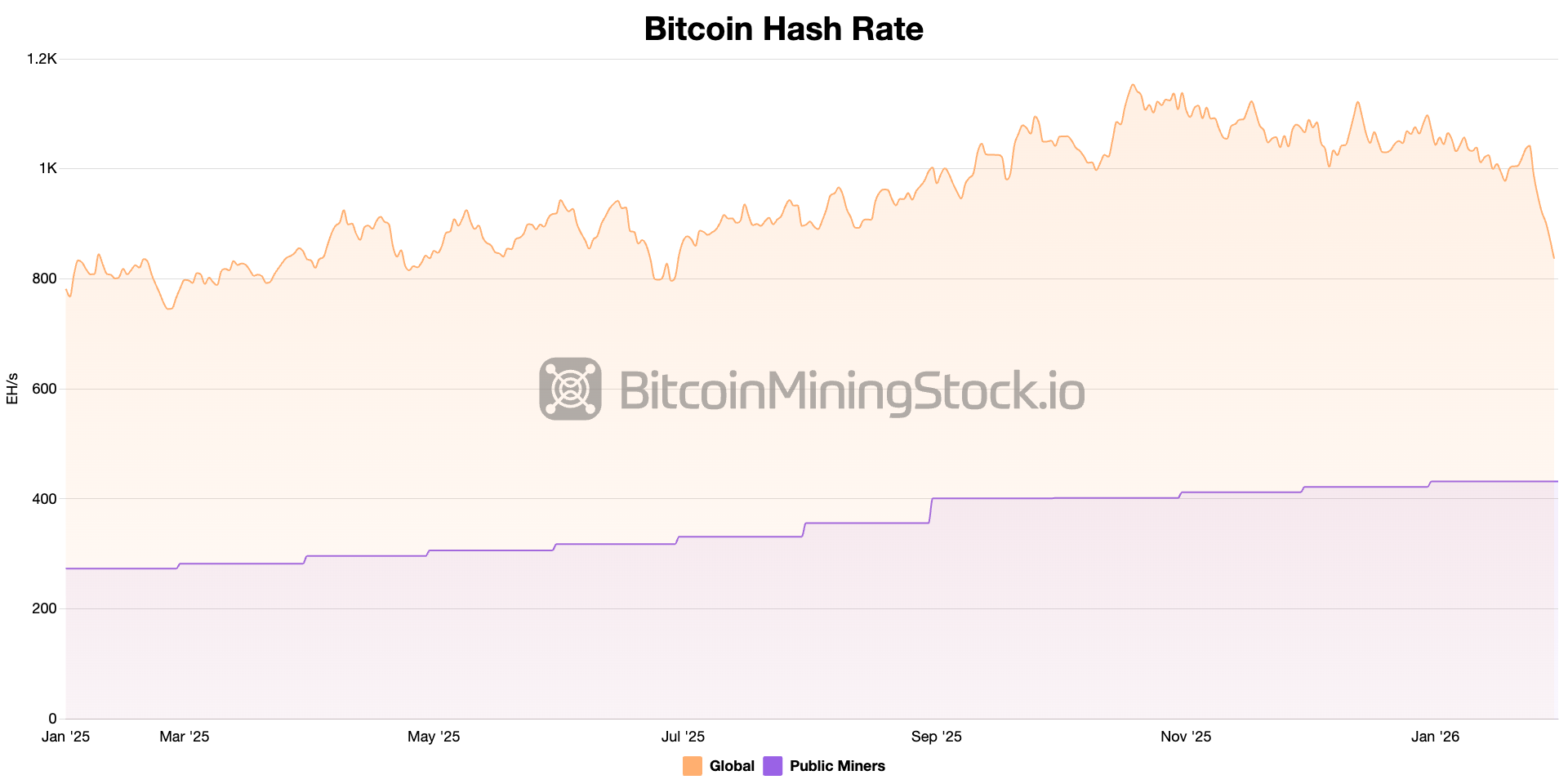

With this shift, secondary impact. As public miners more and more allocate capital and energy capability to AI/HPC workloads, combination hash price development from publicly traded firms might gradual, plateau, and even decline.

Pivoting just isn’t doable for everybody

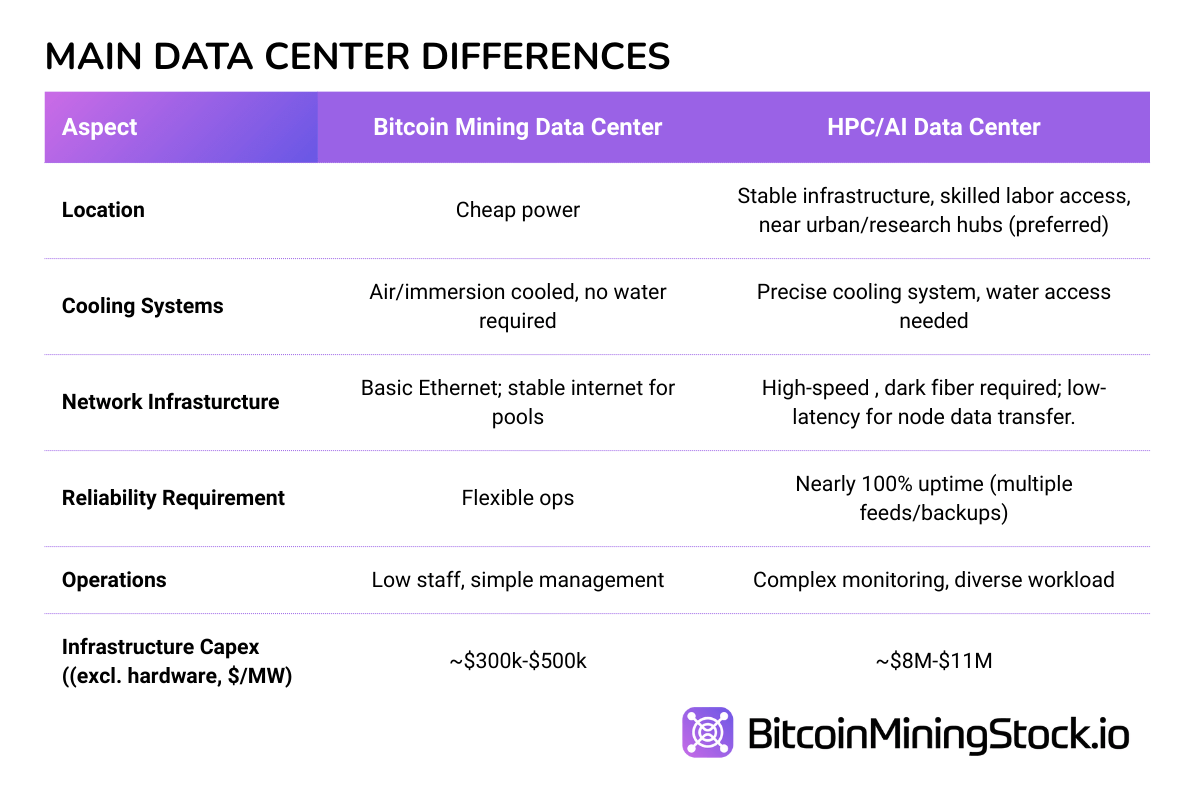

Whereas an HPC/AI pivot could also be debated, it will be a mistake to suppose that anybody with energy and land could make the transition. trulymost mining websites are designed for velocity and suppleness (mining containers are extensively used) moderately than the density, redundancy, and operational self-discipline required for hyperscale workloads. Some websites are adaptable. For instance, Core Scientific is making modifications. (roughly $1.5 million to $3 million per MW) An present Bitcoin mining knowledge heart to meet our contract with CoreWeave. Many merely cannot do this, or the prices simply make pivoting much less economical.

Capital and execution are the actual constraints. HPC buildout requires: Massive upfront funding ($8 million to $11 million per MW vs. $300,000 to $500,000 per MW) Numerous operational experience. Even with the precise infrastructure and technical capabilities, monetizing HPC operations takes time, and in contrast to Bitcoin mining, there aren’t any assured block rewards to fall again on.

One prediction: Extra transactions, much less storytelling.

Hyperscaler bulletins are more likely to proceed into 2026, provided that miners already management what AI consumers want most, reminiscent of permitted land, energy entry, and improvement capability.

Nonetheless, the market response is altering. Megawatts and prime contract quantities are now not sufficient. What buyers are in search of tougher questions: Who financed its development? When earnings truly begin. What occurs if a buyer walks? Is the danger actually on the venture stage, or is it quietly flowing again to the dad or mum firm?

Primarily, Not all HPC trades revalue shares the identical approach. That premium will more and more be paid to operators with buildings that de-risk their enterprise fashions and might accomplish that with out including costly capital to already circulating mine money flows.

After the HPC pivot: What’s subsequent for Bitcoin mining?

(The next perspective was not included within the unique report, however many readers have raised the identical query, so it is price sharing right here.)

For some, the rising shift of public miners to AI and HPC infrastructure is seen as a risk to Bitcoin mining. The truth is, this might be the start of the evolution of mining. The Bitcoin mining panorama is beginning to look totally different as capital, experience, and power capability flows into high-value AI workloads. If large-scale miners cut back or withdraw from Bitcoin miningearlier capability, {hardware}, and sources are redistributed to new geographies and enterprise fashions.

One of many seen results is that shift in the place mining occurs. AI knowledge facilities will compete for one of the best energy websites in mature markets, particularly North America, whereas Bitcoin miners will probably be relegated to areas with stranded power, flare fuel, and small-scale or off-grid energy sources. In these environments, flexibility is prioritized over scale. A mining load that when resided on a hyperscale campus in Texas might reemerge as a set of modular containers in Paraguay, Ethiopia, or Scandinavia, the place fleets nonetheless contribute to community safety however with vastly totally different economics and threat profiles.

on the similar time, Mining operation strategies will evolve. Not like AI workloads, Bitcoin mining doesn’t require steady uptime or redundancy. This makes them perfect for hybrid configurations the place mining acts as a buffer to soak up extra energy, take part in demand response applications, and scale back total power prices. In such an atmosphere, mining just isn’t the first product, however a invaluable device in an built-in power infrastructure.

This evolution additionally Increase the bar for miners They proceed to deal with Bitcoin. Older fashions: purchase an ASIC, join it to an inexpensive energy provide, and wait. – tougher to keep up. In an more and more aggressive atmosphere, operators may have to offer grid companies, reuse warmth, or develop nearer relationships with electrical energy suppliers in order that they’ll generate a number of income streams.

None of those assure outcomes. However one factor is for positive: Bitcoin mining will proceed to evolve.

📙 Word: This text deliberately omits particulars. If you need to be taught extra about particular person firms and their contract buildings, supply schedules, capital depth, and so forth., please seek advice from the unique report.