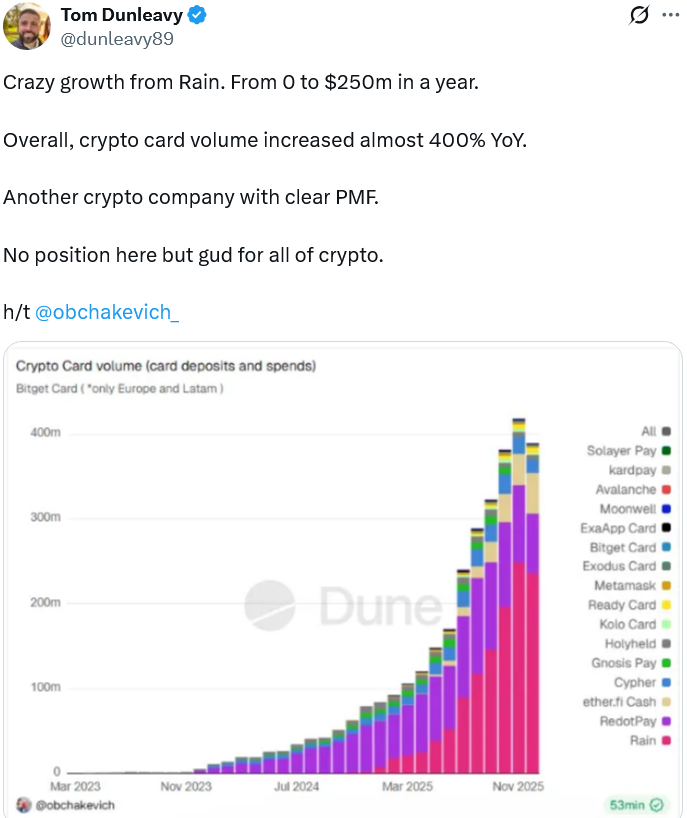

Trade leaders mentioned stablecoin-powered playing cards are shaping as much as be one of many greatest crypto themes of 2026, searching for to supply the advantages of blockchain whereas sustaining a well-recognized fee expertise for customers.

“This is without doubt one of the huge themes for 2026: Cryptocurrencies will change into extra deeply concerned in fee flows within the international economic system,” Haseeb Qureshi, managing accomplice at Dragonfly, a enterprise capital agency specializing in cryptocurrencies, posted on X Friday.

“Stablecoin playing cards are rising like loopy around the globe,” the VC added, after stablecoin startup Rain raised $250 million in a funding spherical, growing its valuation to almost $2 billion.

This huge funding spherical comes as Rain grew its lively card base 30x in 2025 and annual fee quantity almost 40x, making it one of many world’s fastest-growing fintech firms.

The platform helps main stablecoins comparable to Tether (USDT) and USDC (USDC) throughout a number of blockchain networks comparable to Ethereum, Solana, Tron, and Stellar.

Rain is a part of a brand new wave of stablecoin startups integrating blockchain into fee methods to allow sooner funds, decrease prices, and larger international attain, whereas sustaining a seamless expertise for customers, Qureshi mentioned.

“They do not even know that it is a cryptocurrency underneath the hood. All they know is that hastily, anytime, wherever, they will pay folks, purchase issues with {dollars}, and all the pieces is ‘simply high quality.'”

This comes after Bloomberg Intelligence predicted on Thursday that stablecoin fee flows will develop to $56.6 trillion by 2030 at a compound annual progress charge of 81%.

sauce: tom dunleavy

Stablecoin playing cards could have restricted use in developed markets

Nonetheless, not everyone seems to be satisfied that stablecoin funds will compete with conventional playing cards in developed international locations, with Sheel Mohnot of Higher Tomorrow Ventures GP saying that stablecoin service provider acceptance lacks a captive viewers, exclusivity and killer incentives to make significant change.

Mason Nystrom, an investor at Pantera Capital, disagreed with Mohnot, stressing that stablecoin funds supply retailers prompt payouts, prompt settlement, and chargeback safety.

“Stablecoin rails are going to be deployed throughout the fintech stack. Some incumbents will undertake them, whereas others might be utterly changed. Stablecoin checkouts are going to be huge.”

Stablecoin regulation progresses

Regulatory momentum seems to have elevated with the passage of the GENIUS Act within the US late final 12 months, and Canada and the UK have renewed efforts to introduce stablecoin frameworks in 2026 or the close to future.

Adoption by institutional traders can be growing, with cash switch platform Western Union planning to introduce a stablecoin fee system on the Solana blockchain within the first half of 2026, alongside a stablecoin card to allow shopper spending in rising markets.