Bitcoin (BTC) is witnessing a sustained outbreak of volatility consistent with broader market sentiment, with synthetic intelligence (AI) fashions predicting that the asset is prone to commerce under $110,000 by November 1st.

Certainly, the market is weighed down by ongoing commerce tensions, dampening hopes for a fast restoration for Bitcoin.

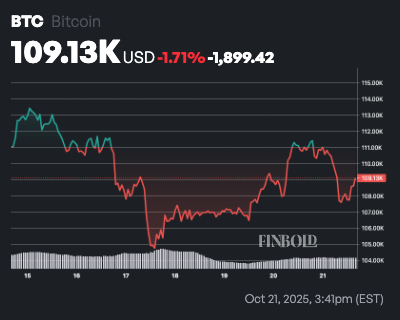

On the time of writing, BTC is buying and selling at $109,066, having corrected virtually 2% up to now 24 hours, whereas the asset is down 1.7% on the weekly timeline.

Bitcoin worth prediction

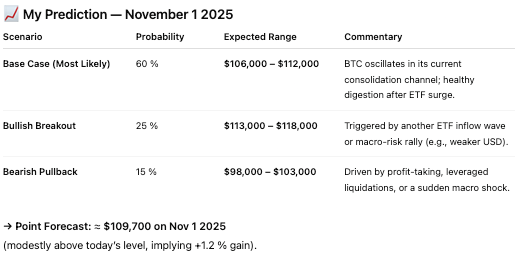

To foretell the November 1 worth, Finvold turned to OpenAI’s ChatGPT and famous that Bitcoin will doubtless commerce at $109,700 on November 1, 2025, suggesting a section of safety moderately than a brand new rally.

ChatGPT evaluation highlights that whereas institutional demand stays sturdy, the tempo of inflows into Bitcoin exchange-traded funds (ETFs), which have reached almost $6 billion for the reason that begin of the 12 months, is prone to gradual, doubtlessly slowing the upward momentum. The mannequin identified that this easing may result in delicate consolidation strain because the market digests earlier beneficial properties.

Technically talking, Bitcoin’s Relative Energy Index of round 65 signifies that the asset stays bullish, however not overbought. The shifting averages (MA) assist this view, with the 20-day common close to $106,000 and the 50-day common close to $99,000, reflecting a stable upward development.

Nevertheless, ChatGPT predicts that within the absence of a brand new catalyst, Bitcoin might briefly retest its 20-day common earlier than returning to the subsequent rally.

On the macroeconomic entrance, we anticipate a weaker greenback and secure inflation expectations to proceed to assist Bitcoin’s optimistic correlation with gold and shares. A sudden change in tone from the Fed, particularly its hawkish stance in late October, may briefly push Bitcoin towards the $100,000 stage.

Bitcoin worth ranges to look at

The mannequin additionally notes that by-product funding charges are excessive, suggesting that extreme leverage may trigger a short-term correction of three% to six% earlier than restoration.

Relating to particular worth ranges, ChatGPT outlined a base state of affairs by which Bitcoin trades between $106,000 and $112,000 with a 60% chance. The chance of a bullish breakout from $113,000 to $118,000 is 25%, whereas the chance of a bearish decline from $98,000 to $103,000 is 15%.

If these ranges are achieved, it will point out that Bitcoin is prone to stay in a wholesome consolidation interval and keep its broader uptrend whereas pausing earlier than the subsequent vital transfer.

Featured picture by way of Shutterstock