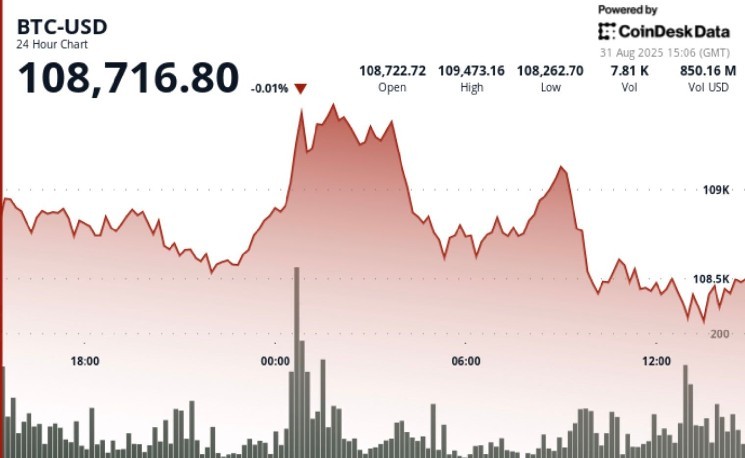

In line with Coindesk information, Bitcoin has stabilized round $108,716, however behind the flat charge motion there are indicators of a possible breakout as each retail and establishments enhance their accumulation.

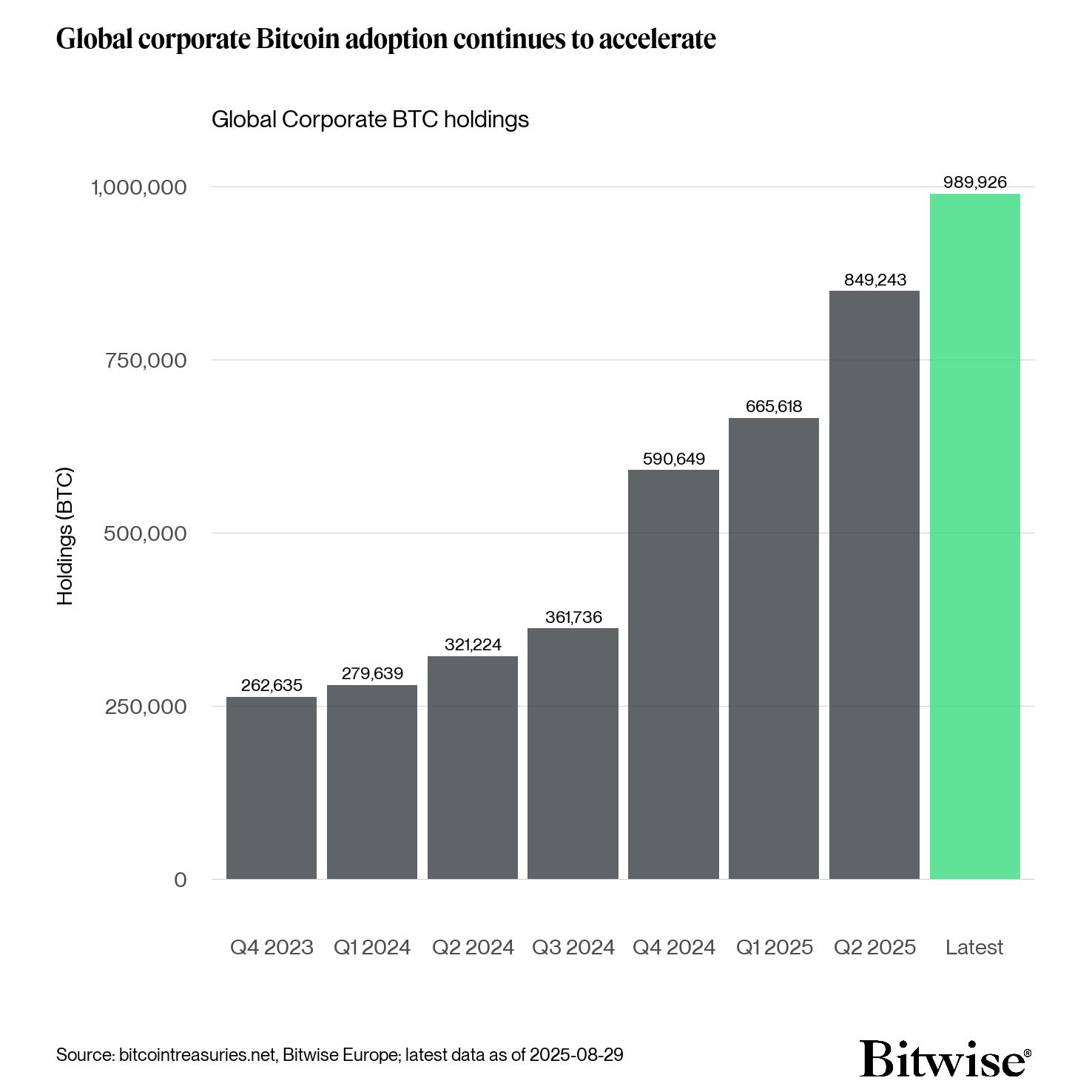

On August 29, Bitwise’s European analysis director André Dragosch famous that Bitcoin’s company adoption is accelerating at a historic tempo. He mentioned that in July and August alone, 28 new Bitcoin financing corporations had been established, with over 140,000 BTCs growing the whole holdings of the corporate.

That determine is roughly equal to the whole quantity of recent Bitcoin mined in a 12 months (roughly 164,000 BTC), highlighting how demand from the Treasury is delivered sooner than it’s produced.

The accompanying Bitwise Chart confirmed a pointy upward curve highlighting the more and more treating Bitcoin as a reserve asset within the Michael Sailers Technique (MSTR) mildew.

Added 140,600 BTC to Bitwise (Bitwise/x) from July to August

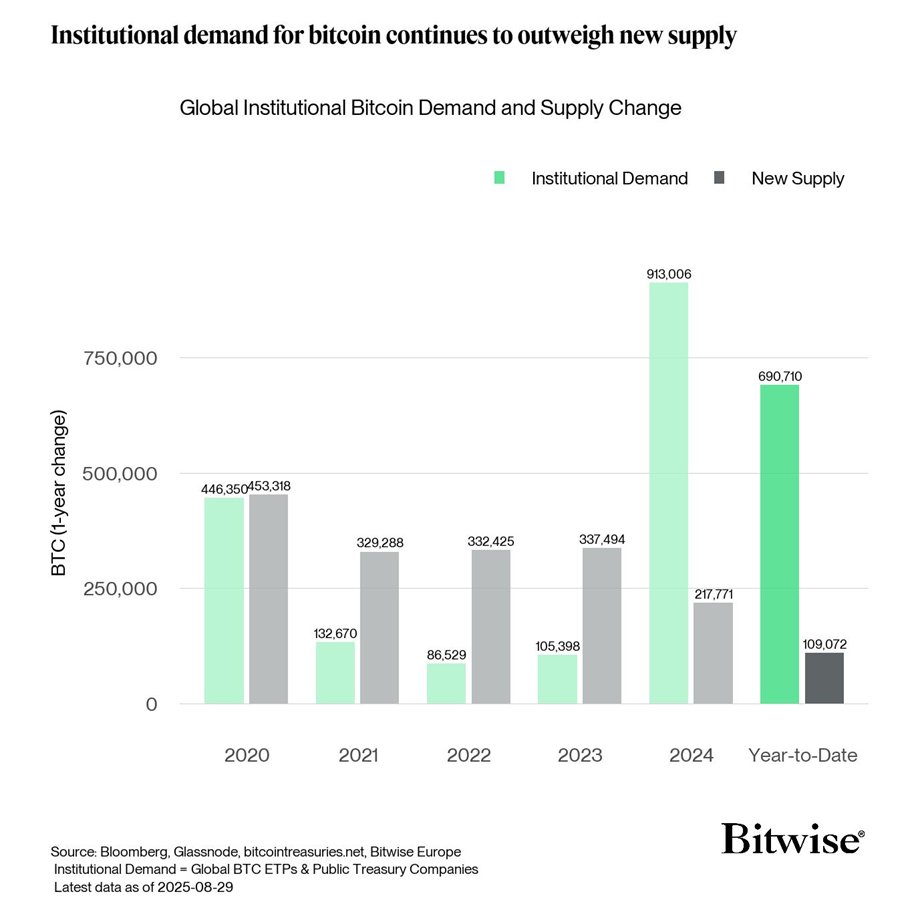

Some time later, Dragosch labored on a preferred narrative amongst analysts the place Bitcoin may “prime out” in 2025 because of beforehand seen post-harving cycle patterns. He argued that such considering overlooks the dimensions of as we speak’s institutional demand.

Demand for services exceeding 6x extra provide in 2025, bitwise information reveals bitwise/x).

His chart reveals that as of August 29, 2025, institutional demand has absorbed over 690,000 BTC in comparison with new provide of BTC of over 109,000, indicating that demand is about 6.3 occasions larger than the provision.

Though Dragosch described it as almost seven occasions extra, the precise ratio nonetheless reveals a rare imbalance that challenges comparisons of historic cycles. For traders, semi-driven provide dynamics are much less necessary within the present period of institutional adoption.

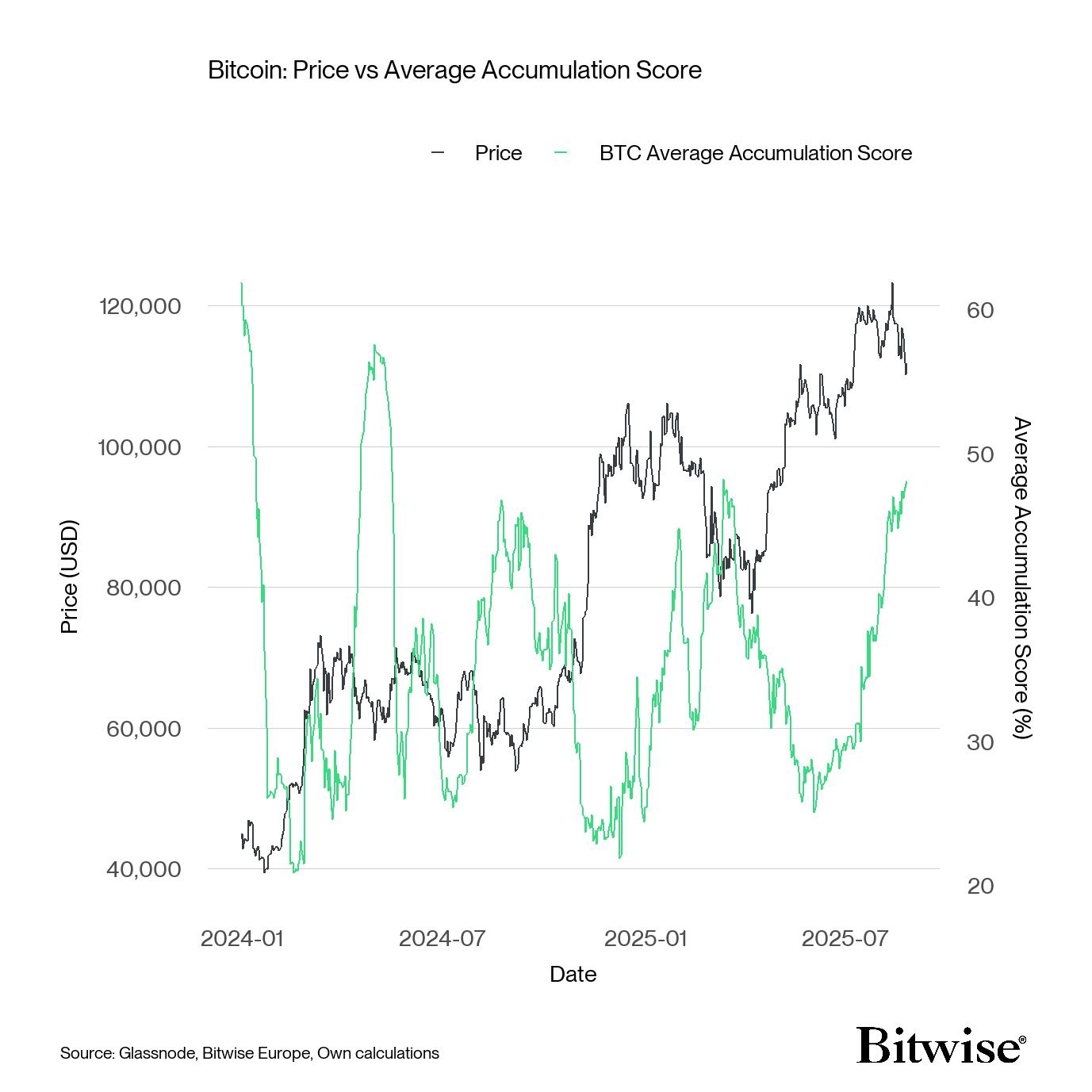

Two days in the past, on August twenty seventh, Dragosh identified a retail buy as one other driver. He mentioned accumulation charges throughout all Bitcoin pockets cohorts (from small homeowners to whales) have reached their highest degree since April. In his phrases, traders appear to be “accumulating mercilessly.”

The hooked up bitwise chart reveals a pointy upward motion between pockets teams, suggesting that retail demand is lined up in institutional movement. Traditionally, synchronized accumulation throughout the cohort has usually preceded main upward actions, and the present setting is noteworthy for bulls.

The Bitcoin Pockets Cohort reveals the strongest accumulation since April 2025 (bitwise/x)

Regardless of the collected information, Bitcoin has hardly modified at $108,716 within the final 24 hours, in keeping with Coindesk information. The market is ready for a extra clearer catalyst.

Highlights of value evaluation

(All the time UTC)

- In line with Coindesk Analysis’s Technical Analytics Knowledge Mannequin, from August thirtieth to August thirty first, between 15:00 and 14:00, BTC traded inside the $2,150 vary, fluctuating between $107,490 and $109,640.

- A considerable amount of buy help appeared at almost $107,800. There, the quantity was above the day by day common and the principle short-term flooring was established.

- The resistance fashioned at round $109,600, with repeated rejection exhibiting strain to profit.

- Within the ultimate 60 minutes of the evaluation interval, BTC swung from $109,250 to $108,700 earlier than closing almost $108,900, indicating a steady degree of help with continued volatility.

Disclaimer: A part of this text is generated with the help of AI instruments and reviewed by the editorial crew to make sure accuracy and compliance Our requirements. For extra data, please refer Coindesk’s full AI coverage.