Ethereum costs will as soon as once more be within the highlight. Not simply value motion, however institutional buyers are lastly displaying their playing cards. The US spot Ethereum ETF begins to attract severe weight, and the charts are responding. So, what’s Ethereum value forecast?

Ethereum value forecast: Why are Ethereum costs rising?

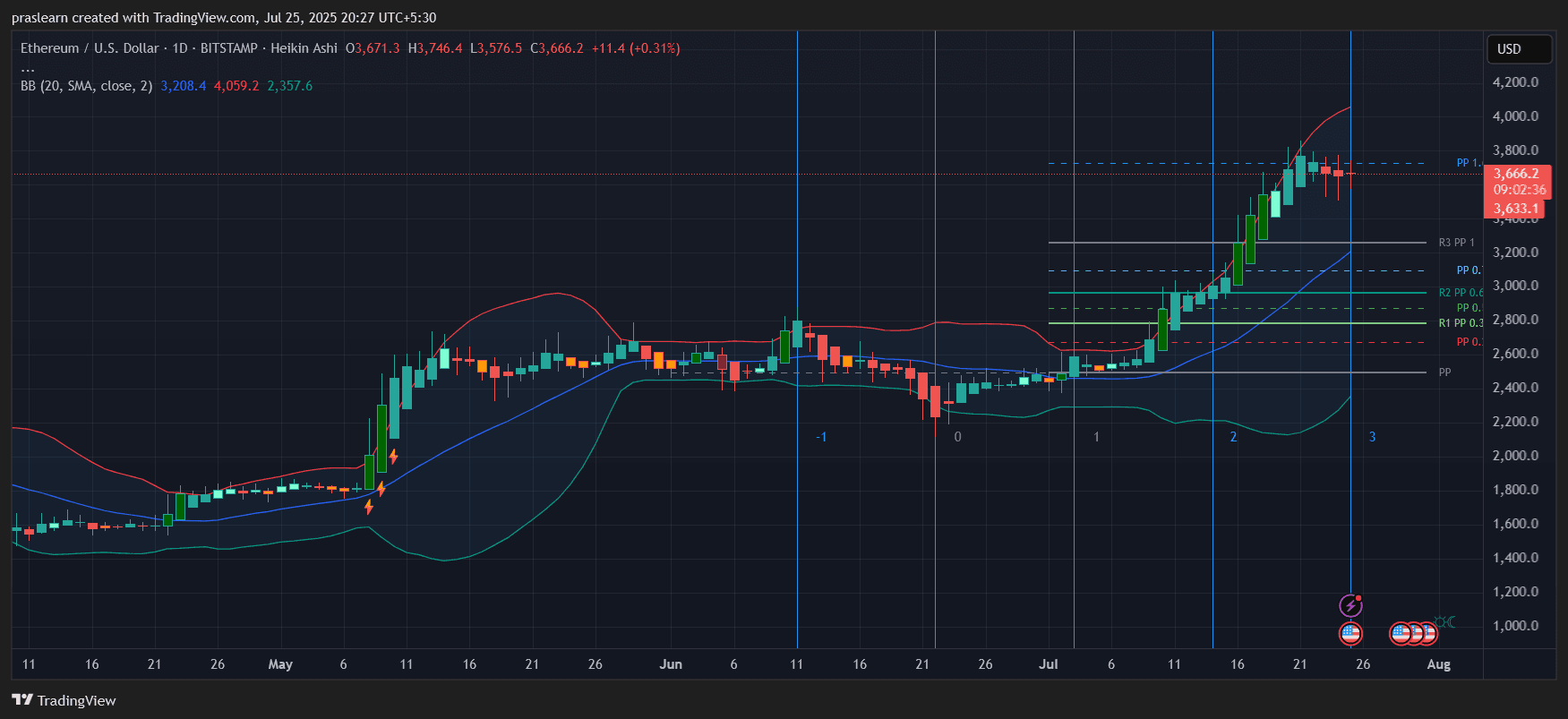

eth/usd day by day charts – TradingView

Let’s check out the chart first. ETH costs have been on a pointy rise since late June. The hikin reed candles are clear, steady, and principally bullish inexperienced. Extra importantly, Ethereum costs stay persistently on the mid-bollinger band, an indication of robust momentum. ETH Value not too long ago touched an higher bollinger band that was near $3,750, then pulled again barely to $3,660, suggesting a cooling part after a very expanded rally.

But it surely’s right here. This isn’t only a random transfer. Ethereum costs fell at main resistance ranges, resembling $3,200 and $3,400, and barely hesitated. The pivot level signifies that ETH is at the moment consolidated slightly below the R3 degree. It’s often the area the place sensible cash decides whether or not to guide income or drive breakouts.

If the ETH value exceeds the $3550 assist, you might see a clear push in the direction of $3,900, or in some instances $4,200 over the subsequent few weeks. On the draw back, a drop beneath $3,400 signifies that the bull is exhausted and could possibly be adopted by a $3,200 regional retest.

Is the Ethereum ETF driving this surge?

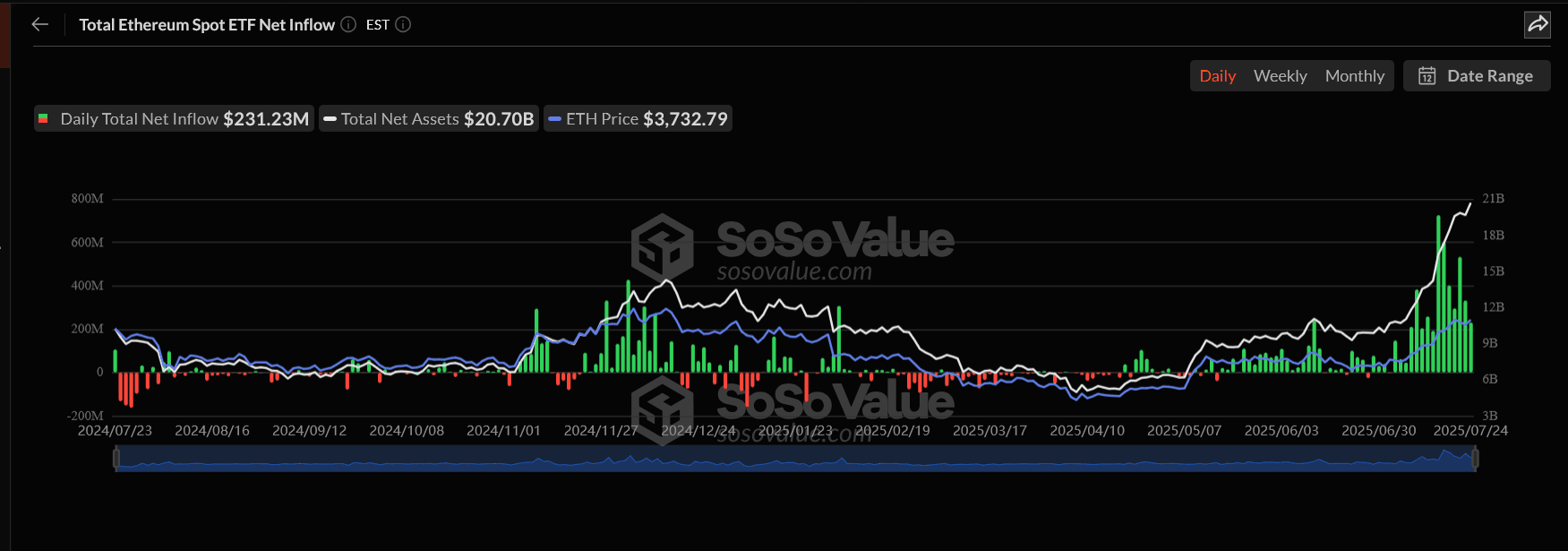

Complete ETF ETF influx: Picture supply: socal

completely. The ETH ETF story is not speculative. It is right here, and the numbers inform the story.

As of July twenty fourth, cumulative internet inflows into Ethereum Spot ETFs reached $8.888 billion. Simply that day, the influx totaled over $231 million. It is not retail cash. That is an institutional conviction and is spreading quickly. ETF at the moment owns greater than $20.7 billion in ETH, accounting for nearly 5% of Ethereum’s complete market capitalization.

Such shopping for strain would not simply assist costs. Change the general market construction. There are few circulating cash. The volatility tightens. Demand begins to exceed provide.

The influence is already proven. ETH’s day by day quantity has skyrocketed over $2.1 billion in ETF buying and selling alone. This kind of liquidity injection builds the inspiration for long-term value will increase and stability.

Ethereum ETFs are injecting actual momentum into the market. With over $8.8 billion in cumulative inflows and $231 million added per day, institutional income are not seen demand.

These ETFs soak up the circulating provide and naturally put upward strain on the worth. It additionally brings stability and legitimacy by ETH, which is engaging not just for merchants but in addition for long-term asset managers who’ve beforehand averted crypto on account of uncertainty amongst regulators.

This kind of sustained influx shifts ETH from speculative property to portfolio staples. If the present pattern holds, ETF-driven demand may create new value flooring starting from $3600 to $3700. From there, there may be probably a break of over $4,000, particularly if the day by day influx is over $200 million. The extra capital flows into the ETF, the stronger the acquisition wall might be, and you’ll arrange Ethereum for a breakout rally of over $4,200 in Q3.

What’s Ethereum value forecast?

If this ETF continues its momentum, the ETH value won’t solely get well $4,000. There could possibly be a brand new value vary being created there. Based mostly on present chart setups, a push to $4,200 is technically efficient, particularly if ETF inflows common over $200 million a day. That degree coincides with Fibonacci’s targets with expanded Bollinger projections from the final swing low in early July.

Nonetheless, do not ignore short-term fixes. If ETF hype is quickly cooled, Ethereum costs may be traced to the $3,200 zone earlier than reopening upwards.

Ethereum costs are not traded with simply emotional and tech upgrades. It’s now supported by severe capital by regulated ETFs. It modifications the sport. The charts are bullish, however the inflows actually take a look at this pattern. So long as these numbers proceed to climb, the roads above $4,000 are large open.

Commerce with OKX and win huge

Commerce ETH and commerce probabilities to win and take part within the OKX McLaren giveaway marketing campaign.

- An actual McLaren expertise

- Particular ETH buying and selling rewards

- Problem-free onboarding for brand spanking new customers

Commerce ETH on OKX at the moment and develop into a part of what’s subsequent for Crypto.

$eth, $ethereum, $ethprice, $ethereumprice, $ethetf