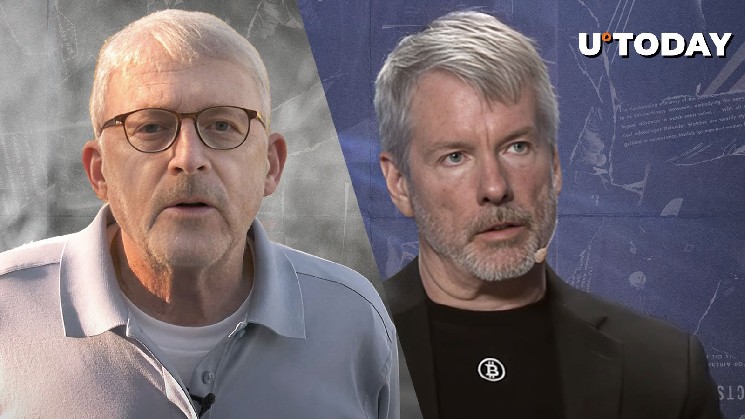

As anticipated later within the cycle, Michael Saylor’s technique of linking the destiny of the corporate to Bitcoin brings out a radical examination. This time, we’re wanting on the inventory worth charts we’re reviewing.

The duty of doing this was taken by legendary dealer Peter Brandt. He just lately posted a weekly view of MSTR, captioning it with an uncompromising query.

The numbers clarify Blunt’s dilemma. Since January, strategic shares have remained in packing containers starting from $330 to $480. On the backside of that vary, it trades at $330.26 from Peaks, which exceeded $480 earlier this yr.

Is that this the highest or an motion break? $ mstr pic.twitter.com/toclmepkkr

-Peter Brandt (@peterlbrandt) September 4, 2025

The transferring common has been flattened and is compressed to a degree the place volatility is just not seen even earlier than the corporate’s Bitcoin accumulation marketing campaign accelerated in 2024.

At present, Michael Saylor’s Bitcoin Technique Standing

Behind this drift is the technique steadiness sheet, which is uncovered to Bitcoin greater than different identified firms on the planet. The corporate owns 636,505 BTC, with a mean worth of $73,765. At in the present day’s worth, its portfolio is value $70,470,000,000. This place reveals an astonishing revenue of round 50%.

The correlation between Bitcoin and MSTR stays vital. The 2 are in shut sync, however the chart reveals hesitation about what number of traders will allocate to Michael Saylor’s technique.

Brandt’s questions actually seize the second. If the MSTR worth falls under $330, it suggests a inventory restrict. Nonetheless, if it rises above $480, the technique is confirmed because the purest bitcoin proxy accessible in conventional exchanges.