For years, monetary advisors saved their crypto allocations under 1%, treating Bitcoin as a speculative footnote fairly than a portfolio element. These days are coming to an finish.

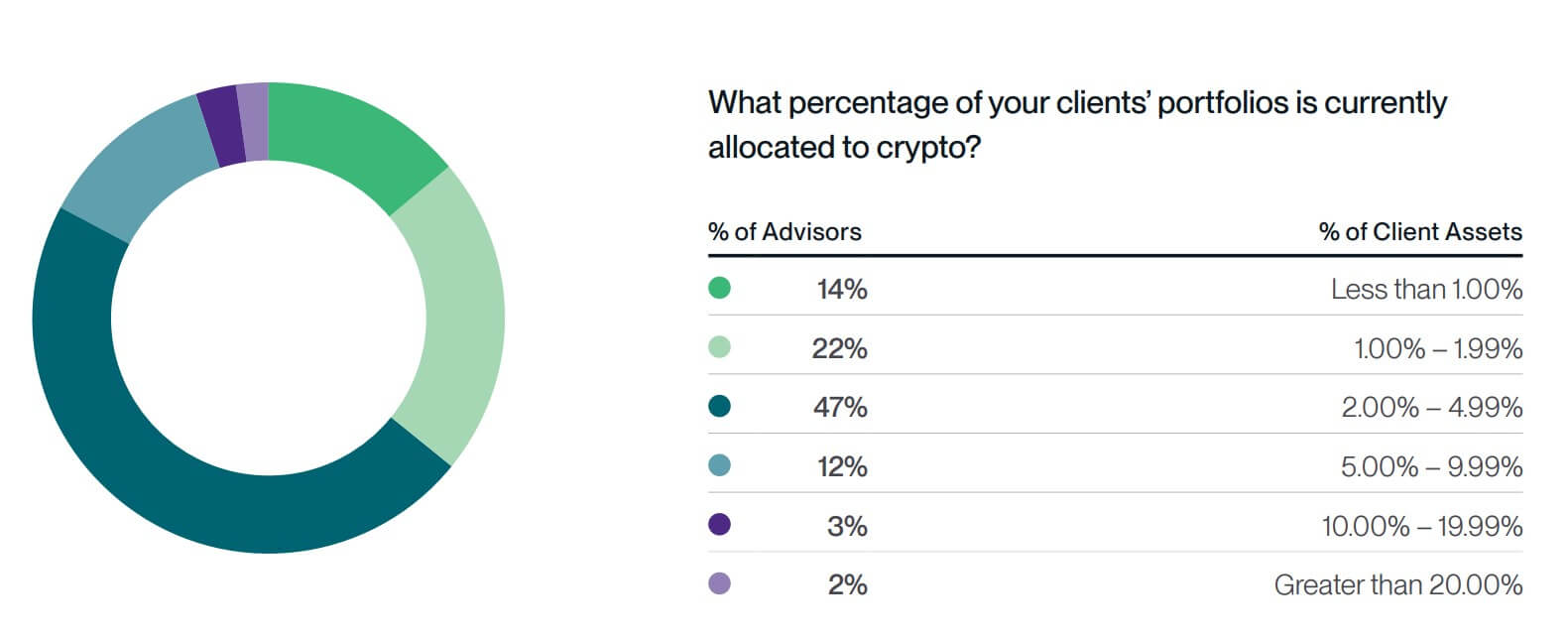

Based on Bitwise and VettaFi’s 2026 benchmark examine, 47% of advisor portfolios with crypto publicity at present allocate 2% or extra, whereas 83% cap their publicity at lower than 5%.

This distribution tells a extra correct story. 47% of advisors with crypto publicity are within the 2% to five% vary, and 17% are above 5%. Regardless of being a minority, these advisors make sense as a result of they’re getting previous the “toe dip” and constructing what asset allocators understand as an actual sleeve.

This modification will not be occurring in isolation. Main custodians, information businesses, and institutional buyers have revealed clear allocation steerage that treats cryptocurrencies as a risk-managed asset class fairly than a speculative wager.

Constancy Institutional analysis means that even when Bitcoin goes to zero, a 2% to five% Bitcoin allocation can enhance retirement outcomes in an optimistic state of affairs and hold earnings losses to lower than 1% within the worst case state of affairs.

Morgan Stanley’s Wealth CIO recommends as much as 4% for aggressive portfolios, 3% for development portfolios, 2% for balanced portfolios, and 0% for conservative earnings methods.

Financial institution of America mentioned 1% to 4% “could also be acceptable” for buyers prepared to tolerate increased volatility because it expands advisors’ entry to crypto exchange-traded merchandise.

These will not be fringe gamers or crypto-native funds. They’re the businesses that retailer trillions in consumer property and set guardrails on how monetary advisors construct portfolios.

When Constancy publishes modeling that reaches 5% and Morgan Stanley clearly stratifies allocations in accordance with threat tolerance, the message to advisors is obvious. Cryptocurrencies deserve a 1%+ placeholder, however buyers nonetheless have to measurement cryptocurrencies extra like high-volatility sleeves than core holdings.

Distribution reveals the place advisors really landed

Bitwise/VettaFi information reveals particular band allocations.

Amongst portfolios with crypto publicity, 14% maintain lower than 1%, and 22% are within the 1% to 2% vary, which is taken into account the normal “toe dip” zone. However now, with 47% allocating between 2% and 5%, the allocation is beginning to perform as a legit portfolio element.

Moreover, 17% are pushing their allocations above 5%, 12% are within the 5% to 10% vary, 3% are between 10% and 20%, and a couple of% are above 20%.

Survey information reveals why most advisors are caught at 5%. Volatility issues leap from 47% in 2024 to 57% in 2025, whereas regulatory uncertainty stays at 53%.

Regardless of this, practically one in 5 advisors managing crypto exposures decided that risk-adjusted returns had been justified above conventional guardrails.

That higher tail is necessary. This means that some advisors, maybe these serving youthful shoppers, extra risk-tolerant portfolios, or shoppers with robust beliefs about Bitcoin as a retailer of worth, are treating cryptocurrencies as greater than satellite tv for pc holdings.

They’ve constructed positions massive sufficient to meaningfully transfer portfolio outcomes.

From speculative publicity to risk-tiered sleeves

Conventional methods for incorporating risky asset lessons observe a predictable arc.

First, instructional establishments keep away from it altogether. And we permit it as a small, customer-driven hypothesis, sometimes 1% or much less. Lastly, combine it into your formal asset allocation framework with express sizing suggestions tied to your threat profile.

Cryptocurrency is coming into its third part. Morgan Stanley’s hierarchical construction is textbook logic. Deal with property as belonging to a diversified portfolio when sized appropriately, fairly than merely as one thing that’s allowed for hypothesis.

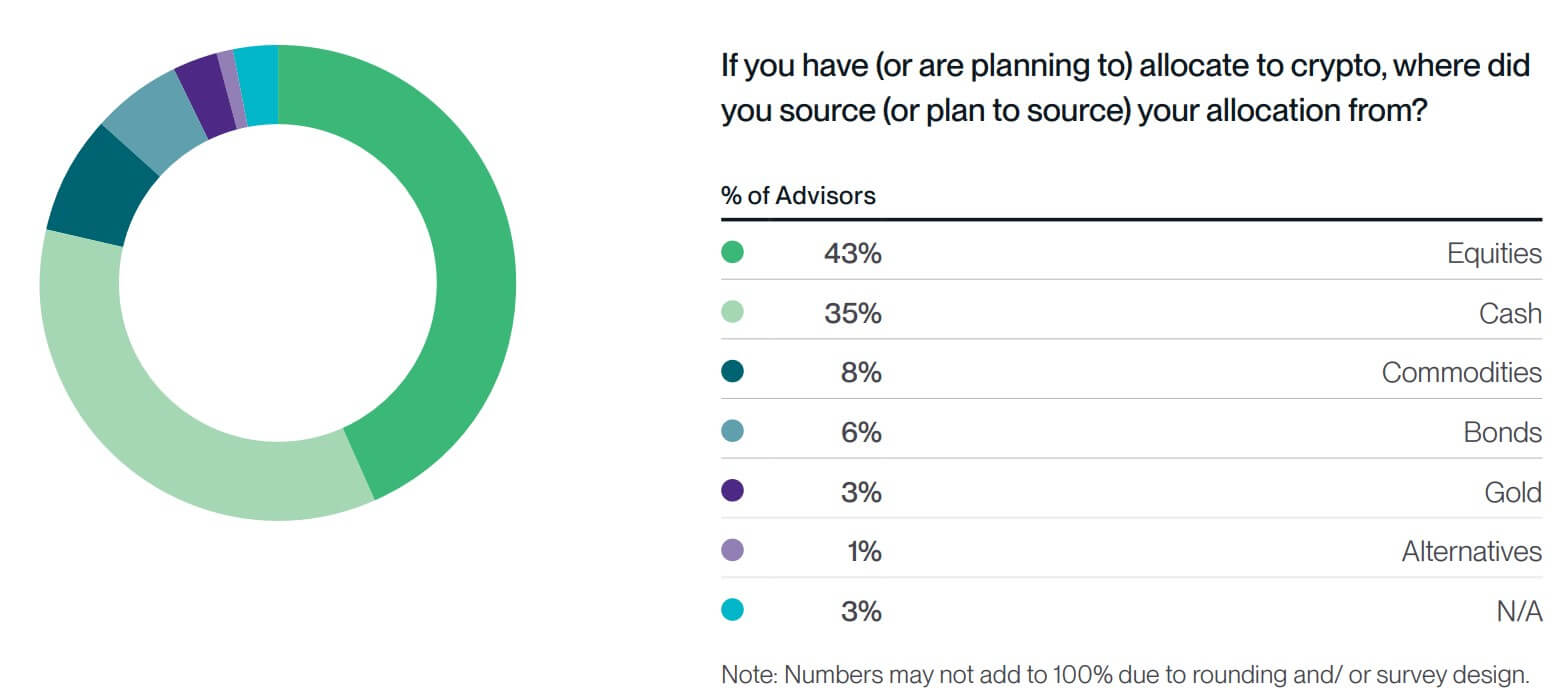

The Bitwise/VettaFi examine reveals this logic mirrored in conduct. When advisors allocate funds to cryptocurrencies, 43% come from fairness and 35% from money.

Substituting shares for shares means that advisors are treating cryptocurrencies as a development allocation with an identical threat profile to shares. Financing from money suggests a perception that idle capital ought to be invested in property with significant return potential.

Infrastructure enabled the shift

Altering conduct from 1% to 2% to five% required infrastructure.

Based on a Bitwise/VettaFi examine, 42% of advisors now have the power to buy cryptocurrencies of their consumer accounts, up from 35% in 2024 and 19% in 2023. Main custodians and broker-dealers are enabling entry at an accelerating fee.

The examine revealed that 99% of advisors at present allocating to cryptocurrencies plan to keep up or improve their publicity in 2026.

This persistence is an accepted attribute of the asset class from experimentation. Relatively than sustaining allocations to property that advisors view as speculative gambles, advisors make allocations after they imagine these property have a structural position.

Private beliefs result in professional suggestions. The survey discovered that 56% of advisors at present personally personal cryptocurrencies, up from 49% in 2024 and the very best stage because the survey started in 2018.

Advisors first have a perception after which prolong that perception to their shoppers’ portfolios.

Product tastes are additionally refined. When requested which cryptocurrency publicity they had been most taken with, 42% of advisors selected index funds over single-coin funds.

This diversification orientation reveals that advisors are excited about crypto publicity in the identical method as rising markets or asset lessons the place focus threat is necessary, and that broad publicity is sensible.

Institutional investor allocator actions are accelerating

Advisor shifts replicate institutional allocators.

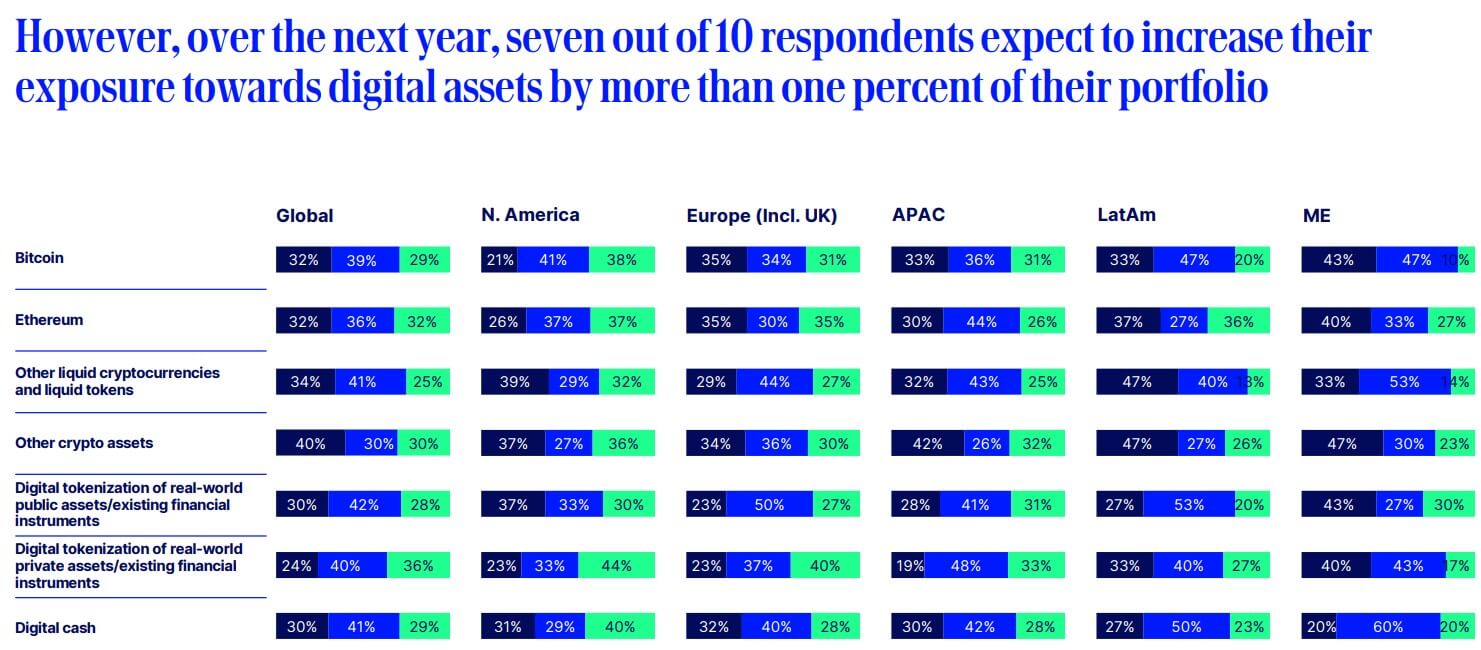

Greater than 50% of establishments at present hold their exposures under 1%, however 60% plan to extend their allocations to greater than 2% throughout the subsequent yr, in accordance with State Road’s 2025 Digital Asset Survey.

The typical portfolio allocation throughout digital property is 7%, with a goal allocation anticipated to achieve 16% inside three years.

Hedge funds have already crossed that threshold. Based on a examine by AIMA and PwC, 55% of worldwide hedge funds maintain crypto-related property, up from 47% a yr in the past.

The typical allocation share for individuals who maintain cryptocurrencies is round 7%. The higher hem is pushing the common up. Some funds deal with cryptocurrencies instead allocation to their core.

Why measurement issues

In portfolio development, deal with sizing as a confidence sign.

A 1% allocation is ok for those who fail, however not very helpful for those who succeed. For an advisor managing a $1 million portfolio, 1% Bitcoin publicity means $10,000 of threat.

If Bitcoin doubles, your portfolio will improve by 1%. A halving would trigger the portfolio to say no by 0.5%. Though computationally beneficiant, the affect is minimal.

At 5%, the identical portfolio has $50,000 in danger. If Bitcoin doubles, 5% might be added to your complete portfolio, and if it halves, 2.5% might be subtracted. That is important for annual efficiency and is enough to worsen over time.

Bitwise/VettaFi information reveals that almost half of advisors with crypto publicity have constructed positions within the 2% to five% vary, with their allocations appearing as actual sleeves.

Regardless of clearly recognizing volatility threat and regulatory uncertainty, the truth that 17% exceed 5% means that for some portfolios, the potential returns justify taking up extra focus threat than conventional steerage would permit.

Analysis that drives consensus and new baselines

Giant asset managers don’t publish allocation steerage in isolation.

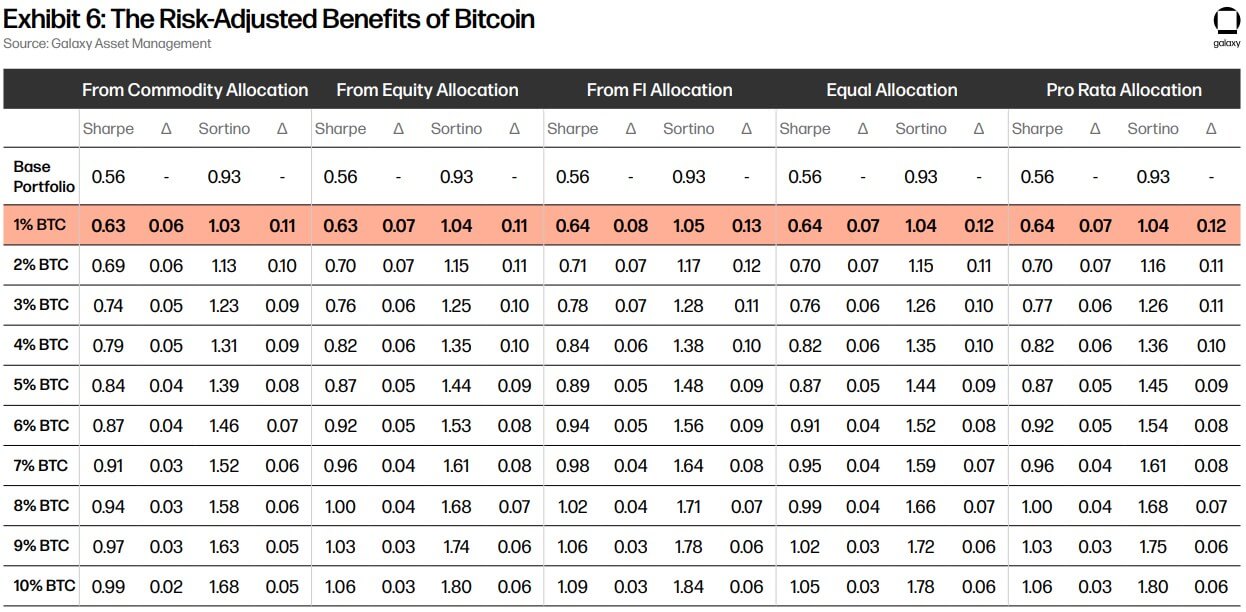

Invesco’s multi-asset examine clearly stress-tests Bitcoin allocation. Invesco and Galaxy have revealed a white paper modeling allocations from 1% to 10%, giving advisors a framework for contemplating acceptable positions.

In modeling work, the dialog modifications from “Ought to I embody this?” “How a lot is affordable given your threat price range?” When Constancy fashions a 2% to five% allocation and quantifies draw back safety, it treats Bitcoin like an rising market fairness allocation, an asset with excessive volatility however defensible portfolio logic.

The truth that a number of corporations are concentrated in an identical vary means that the modeling is producing constant outcomes. This convergence offers the advisor confidence that 2% to five% will not be an outlier advice.

The 1% allocation served a objective. This permits advisors to say to their shoppers, “Sure, you will get the publicity” with out taking up any significant threat. This permits monetary establishments to experiment with storage and buying and selling infrastructure with out committing massive quantities of capital.

That step is full. Spot ETFs commerce with tight spreads and loads of liquidity. Storage options from Constancy, BNY Mellon, and State Road are up and working.

Based on the Bitwise/VettaFi survey, 32% of advisors at present have an allocation to cryptocurrencies of their consumer accounts, up from 22% in 2024 and the very best stage because the survey started.

The info reveals that advisors are responding to the sizing query by transferring from 2% to five%, with a significant minority pushing past that.

They’re constructing the precise sleeve. Giant sufficient to guard the draw back, and huge sufficient to seize the upside if the speculation works.

The 1% period gave cryptocurrencies a foothold in portfolios. The two% to five% period will decide whether or not it turns into a everlasting function of institutional asset allocation.