The quantity of ether within the queue to be sedated has skyrocketed to the best stage since 2023 as facility merchants and cryptocurrency corporations intention to scoop up the rewards of their holdings.

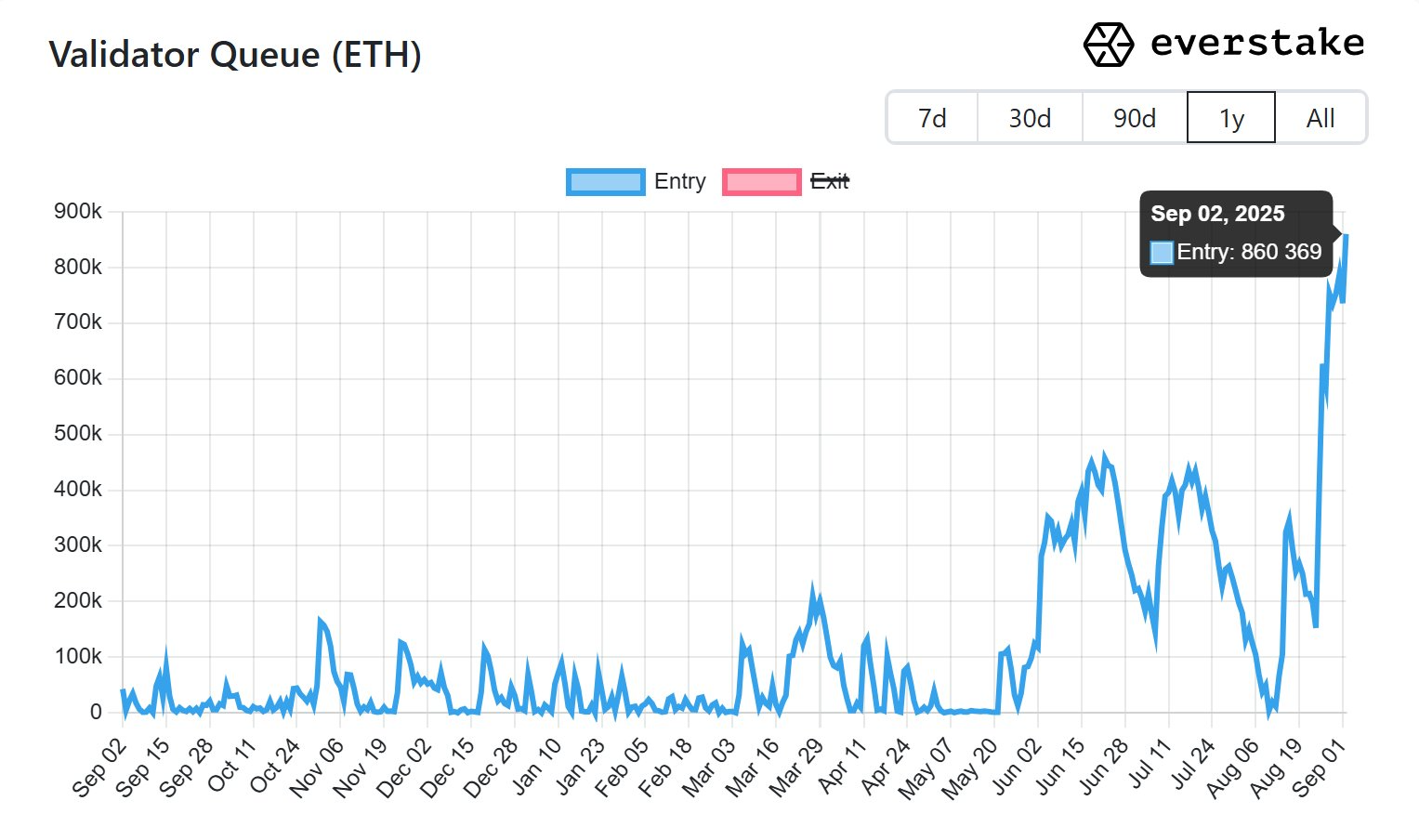

On Tuesday, the Ethereum staking entry queue reached its highest stage since September 2023, with 860,369 ETHs displaying 860,369 ETHs value round $3.7 billion, ready for a wager.

“To be trustworthy, that is fairly spectacular as a result of I have never seen a queue of this measurement since 2023 when Shanghai upgrades allowed drawers,” Staking Protocol Everstake mentioned.

The corporate added that the expansion of validator queues comes right down to a mixture of elements, together with elevated community belief.

“Extra individuals need to be concerned in trusting and guaranteeing Ethereum’s long-term worth.”

Etherstake mentioned there may be additionally a significant market state of affairs as ether costs rise and traditionally low gasoline costs make them engaging and accessible.

Lastly, institutional curiosity is surged as “extra companies and funds are getting into Ethereum staking, bringing numerous companies to the chain.”

The Ethereum staking entry queue has skyrocketed to its highest stage in two years. sauce: Everstake

End kyuritreat from HIGH

The rise in staking provides among the latest fears {that a} surge in staking exit queues will set off a significant sale, following the all-time excessive of belongings on August twenty fourth.

Exit Cu reached parity for the primary time since July after Exit Cu reached an ETH file excessive of over 1 million on August twenty ninth.

Associated: 5 Indications That Ethereum Bull Market Is Not Below 5k

In accordance with UltrAsound.Cash, 35.7 million individuals stake the blockchain, value round $162 billion, equal to 31% of complete provide.

ETH funds purchase and wager amid worth drops

The Ether Company Treasury fund has continued to develop with a complete of 4.7 million ETH, or practically 4% of its complete provide, value round $20.4 billion, with greater than 70 individuals already buying.

Most of those entities have betted or wager their belongings for extra yields on methods which have boosted entry queues in latest weeks.

In the meantime, ETH retreated one other 1.2% that day, dropping to $4,321 on the time of writing.

Ether is at the moment down 12.4% from its all-time excessive on August 24, as retailers proceed to earn income.

journal: Bitcoin to see “one other large thrust” at $150K builds the stress of ETH: Company Secrets and techniques