Bitcoin made a small revenue on Monday morning, however shares had been centered round as NASDAQ set one other document throughout intraday buying and selling.

File shares paired with Bitcoin rise on Monday

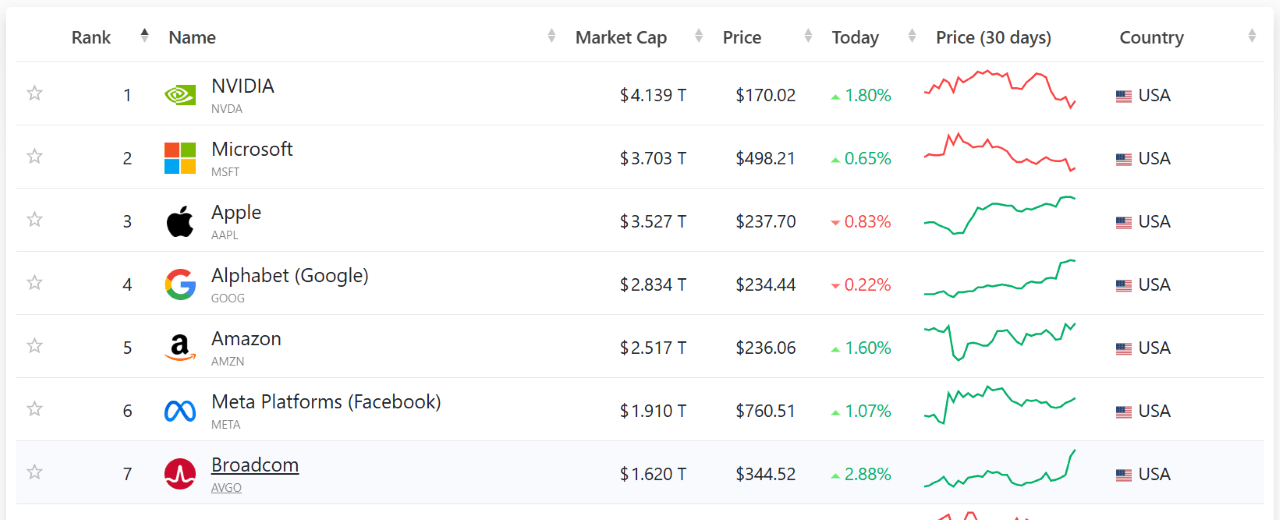

NASDAQ Composite hit a contemporary, excessive of 21,885.62 throughout intraday buying and selling on Monday, exhibiting one other sturdy efficiency of tech shares this yr. AI Chipmakers Broadcom (NASDAQ: AVGO) and Nvidia (NASDAQ: NVDA) led the rally, however tech giants like Microsoft and Meta additionally benefited. Bitcoin (BTC) rose 1%, however is properly under $124,457.12 since final month.

The latest AI growth has sparked the highlight for the $4 trillion big Nvidia, however Broadcom, one other main participant within the semiconductor area, is not far behind. Avago Applied sciences merged with Broadcom in 2016 and the corporate has grown considerably since. Broadcom’s market capitalization is at the moment above $1.6 trillion, in line with Companymarketcap.com.

(Broadcom led the rally on Monday, with NASDAQ reaching an all-time excessive throughout daytime buying and selling/CompaniesMarketCap.com)

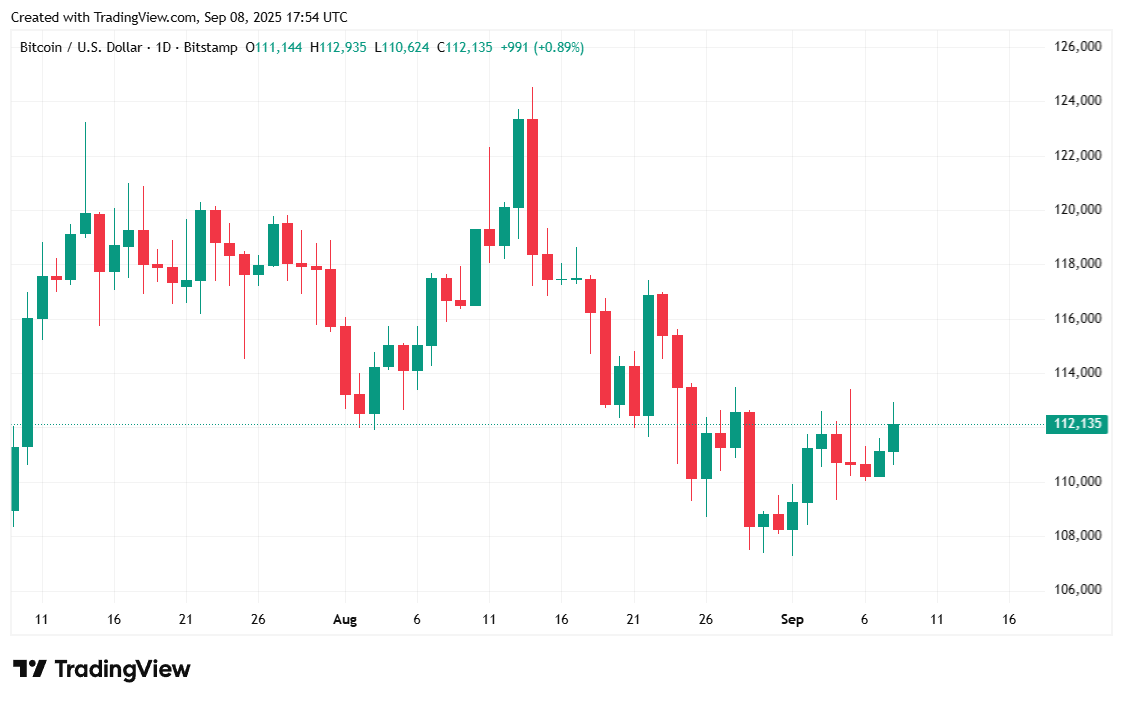

NASDAQ’s document efficiency seems to be towards weak employment knowledge launched final week. And now, taking a look at inflation knowledge scheduled for later this week, will probably be fascinating to see whether or not shares and Bitcoin had been each resilient and poor, as BTC did final week, after two weak employment reviews are revealed.

Market Metric Overview

Bitcoin was up 1.04% at $112,244.75 on the time of writing and three.22% per week, in line with Coinmarketcap. BTC has hovered between $110,630.61 and $112,869.24 since yesterday.

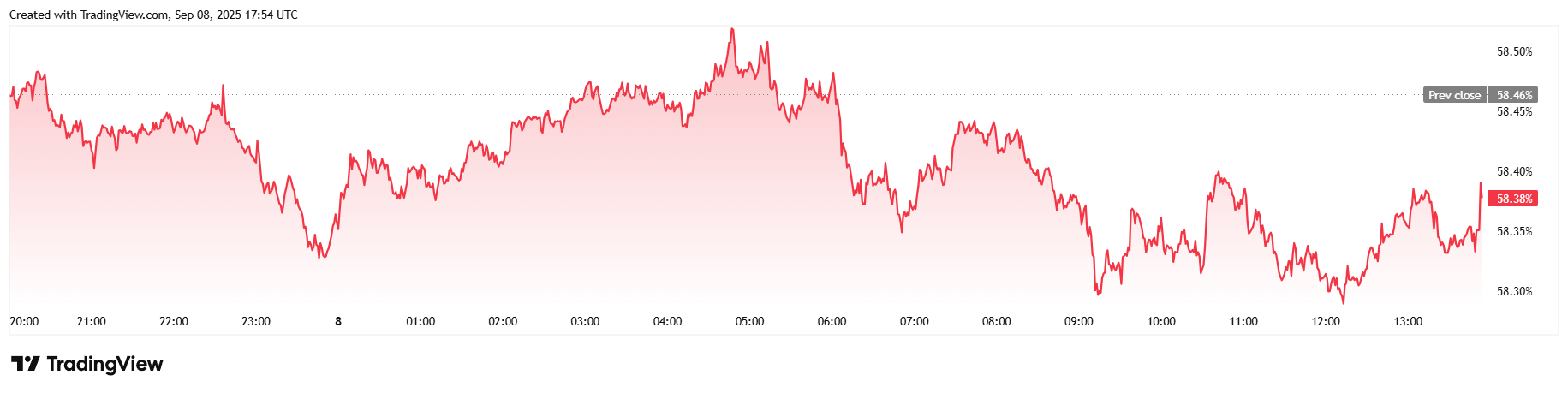

Buying and selling volumes rose 61.13% over the previous 24 hours. This was primarily because of the regular improve after the weekend, reaching thinner than $39.27 billion. Just like costs, the market capitalization rose 1.1% to $2.23 trillion. Nonetheless, Bitcoin’s benefit fell to 58.38%, down 0.17% that day.

Whole open curiosity on Bitcoin futures rose 3.56% over 24 hours to $81.77 billion, in line with Coinglas. Bitcoin liquidation totaled $29.39 million, most of which had been brief liquidation at $23.21 million, with the rest of $6.18 million.