On-chain buying and selling platform Aster is celebrating over 200,000 on-chain holders of its native token. This follows the launch of Protect Mode, a protected buying and selling function that permits customers to execute excessive leverage perpetual trades with out broadcasting their positions to the market.

200,000+ $ASTER on-chain holders 🎯

A brand new milestone. A rising group emerges. pic.twitter.com/bFamkFwA5Y

— Aster (@Aster_DEX) January 5, 2026

The decentralized perpetual trade relayed this information to X, itemizing 200,642 on-chain holders as of right now. This represents a each day enhance of 0.24%, for a complete of 24.9 million transfers. The platform’s multi-chain perpetual futures buying and selling, which options as much as 1001x leverage and MEV-free execution, drove this progress.

Aster extends protect mode to gold and silver pairs

Aster DEX additional introduced the growth of sealed mode to XAUUSDT (gold) and XAGUSDT (silver) perpetual futures. This permits as much as 100x leverage for on-chain buying and selling of those merchandise.

Protect mode has been expanded 🔥

XAUUSDT (Gold) • XAGUSDT (Silver) is at the moment uncovered with as much as 100x leverage.✨One-tap LONG/SHORT, speedy execution

✨ Orders away from public books

✨ Revenue and loss sharing charge construction🗓 Buying and selling hours:

– 5 days x 24 hours

– The market is closed on Saturday and Sunday… pic.twitter.com/9uwWHKK2r2— Aster (@Aster_DEX) January 5, 2026

Aster stated Sealed Mode is a brand new pair that can proceed to concentrate on privateness, together with orders executed from a public ledger, one-tap lengthy/brief positions, prompt execution, and a P&L sharing charge mannequin. Buying and selling is finished stay and in UTC 24 hours a day, 7 days per week.

Mid-last month, the platform launched a sealed mode with as much as 1,001x leverage on Bitcoin (BTC) and Ether (ETH) pairs. As reported by Cryptopolitan, this mode permits for fast execution and 0 slippage with out putting orders on the general public order e book.

“Protect Mode displays our perception that the way forward for on-chain buying and selling isn’t just about leverage and velocity, but in addition management, discretion, and safety.” Astor CEO Leonard stated: “We’re constructing a buying and selling platform that permits merchants to carry out on the highest stage with out forcing their methods onto the market.”

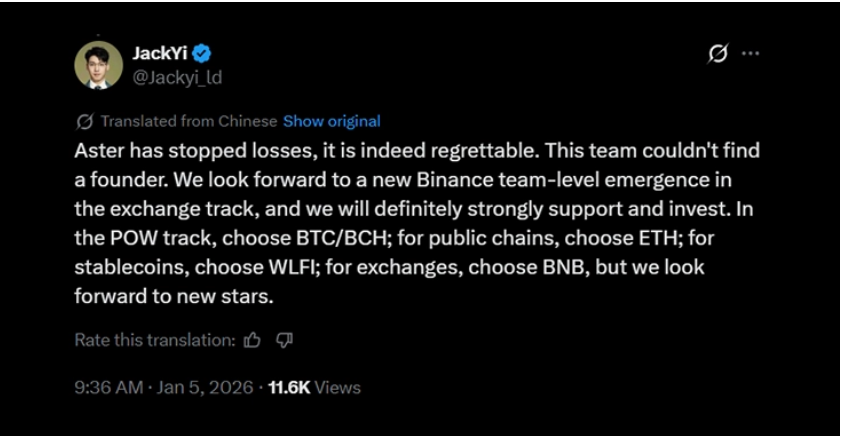

Whereas this replace attracts consideration to personal high-leverage buying and selling, it additionally highlights the dangers, because the platform has seen previous whale losses of over $35 million. Liquid Capital founder Yi Lihua additionally stated in a tweet that he has chosen to desert the Aster decentralized trade undertaking.

A since-deleted tweet revealed that Aster’s founder couldn’t be reached. This made him anxious, so he withdrew from investing.

Supply: through X

Nonetheless, Astor led the best way in general buying and selling quantity with roughly $38.8 billion up to now 24 hours. Hyperliquid follows with a buying and selling quantity of roughly $34.8 billion. Nevertheless, the Hyperliquid platform’s open curiosity is way larger, at the moment at $81.7 billion in comparison with $26 billion for Asters.

Aster rises 10%, however technical indicators present bearish stress

Along with persistent quantity, Aster continues to function by strategic initiatives. The platform introduced its fifth token buyback program in December. Aster Buyback and Burn covers as much as 80% of each day charges.

Astor additionally launched the primary half of the 2026 roadmap. Plans embody launching a layer 1 AsterChain mainnet. ASTER’s staking and on-chain governance plan has been developed. Fiat entrance/exit ramps are additionally being thought-about.

Because of this, Astor began the 12 months with a double-digit soar. The token gained 11.44% within the final week. Yesterday, Aster broke by the $0.78 resistance stage, exhibiting bullish momentum. This triggered a rally in direction of $0.91 to $1.39, analysts stated.

Nevertheless, technical indicators point out that bearish stress is waning, and failure to maintain the $0.78 stage dangers a retracement to $0.70-$0.75. In the meantime, the token has remained regular with a modest enhance of 0.07% over the previous 24 hours, with the coin buying and selling at 0.77.