Avalanche enters a brand new chapter in its progress journey with information of partnerships with main corporations and the adoption of funds for Stablecoin in Korea. The waves of on-chain indicators point out a surge in community exercise.

These updates are supported by precise operational proof, comparable to DEX volumes and Bitwise ETF submitting, reasonably than merely “tweets” advertising and marketing. This proof exhibits sturdy demand, liquidity, and institutional advantages.

Increasing affect in Asia

Avalanche (Avax) is main the digitalization of the Asian economic system, a vibrant crypto market with over 15 million accounts for home crypto exchanges, particularly in Korea.

Not too long ago, BDACS partnered with Woori Financial institution to launch KRW1. KRW1 is a Stablecoin that favored 1:1 by the Korean gained. It’s within the pilot section after a profitable POC. Avalanche supplies a safe, quick infrastructure to help KRW1. EXCH, Change providing a Lifetime 0% charge signed with MOU with AVA Labs to pilot on-line and offline Stablecoin funds.

In Japan, it operates in the identical method as Densan (over 65,000 shops) and SMBC, one of many largest banks within the nation. Utilizing tokenized whiskey from Bowmore & Suntory and Toyota Blockchain Lab’s Bowmore & Suntory and Automotive Finance Fashions, Avax combines custom with innovation and proves engaging to world corporations.

“The principle differentiator of the avalanche is its confirmed historical past of success at establishments. From tokenization of KKR’s Healthcare Fund in 2022 to Stubcoin in Wyoming in 2025, these have been persistently glorious and sophisticated tasks within the business.” Justin Kim | Asia Head AVA Labs is shared in a brand new report from Tiger Analysis.

Explosive Community Efficiency, Avax Eyes $42

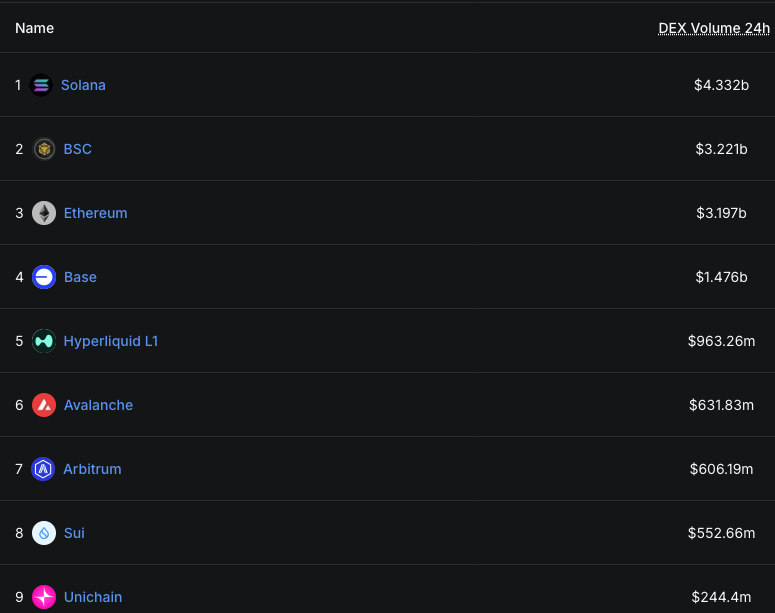

In 2025, the avalanche is “firing on all cylinders.” Community transactions surged, driving file exercise throughout L1. Avalanche’s Dex quantity reached $12 billion in August, reaching $630 million within the final 24 hours, surpassing Arbitrum and SUI (SUI). This exhibits an eight-fold enhance over the previous two months.

Avalanche dex quantity. Supply: x

The Avalanche RWA is price greater than $450 million. Initiatives like Grove Finance goal $250 million institutional credit, and Skybridge tokenizes $300 million in funding funds. Uptop is increasing its NBA loyalty program.

Moreover, Wyoming launched FRNT, the primary state-backed stubcoin for sensible use, with the Exit Pageant employed sensible tickets for 500,000 members. These numbers are usually not simply dry knowledge. They show that Avax attracts actual customers, from Defi to Leisure.

The entry of earlier communications heads into Solana’s AVA Labs is anticipated to drive progress and brings advertising and marketing experience to assist Avax compete with different L1s. The Avalanche Basis has appointed Lord Chris Holmes, an skilled in British parliament and expertise coverage, to the board. This appointment will strengthen the reliability of avalanche rules and help world growth.

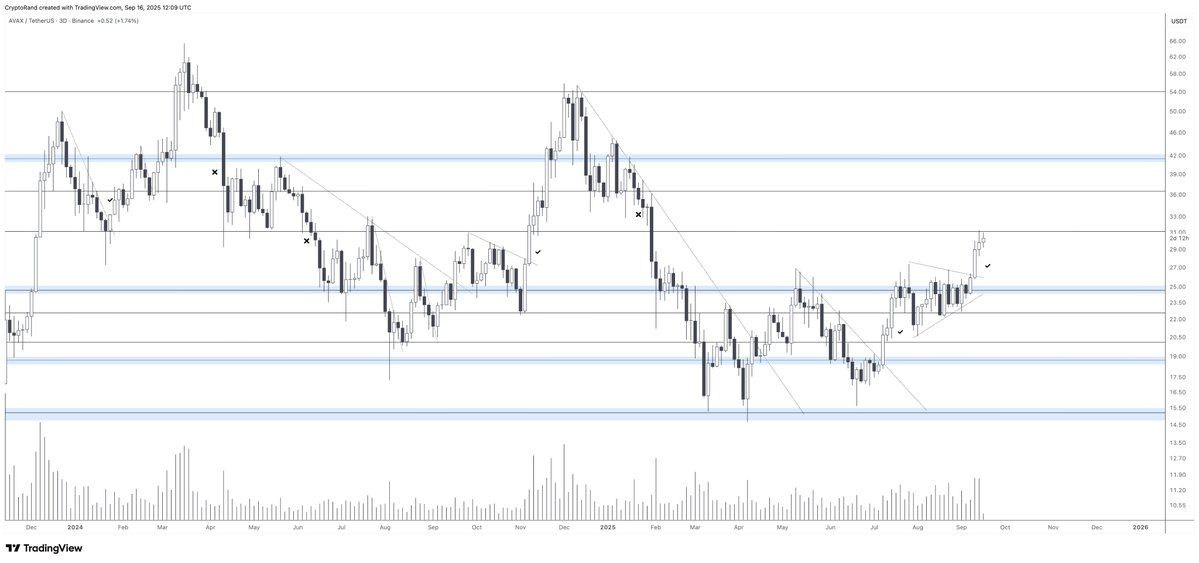

Get out of the pennant

From a technical standpoint, Avax exhibits no indicators of “cooling”. Particularly after breaking out of the bull pennant sample. Many analysts imagine their subsequent aim is $42 with strong help of $27. On the time of writing, Avax is buying and selling at $31,82, a rise of 6% over the previous 24 hours. Avax surged to $30, the very best since February. This expanded its institutional scope following information of two $500 million Treasury bond transactions.

avax worth chart. Supply: rand on x

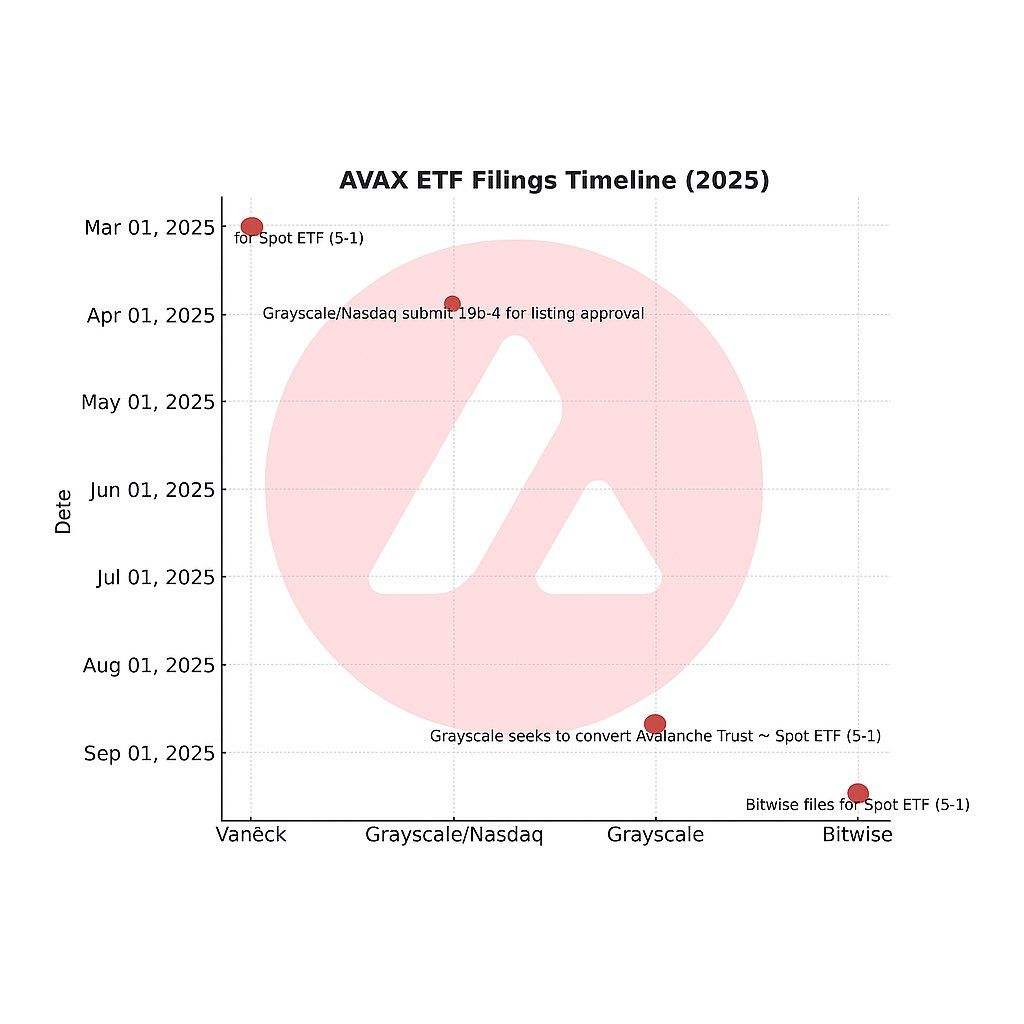

This optimistic prediction comes from sturdy community alerts and expectations of institutional inflow through Avax ETFs. 4 Avax ETFs have been submitted and await approval in 2025. If the SEC provides inexperienced gentle, facility capital can drive Avax to new heights, much like the influence of the Bitcoin ETF.

A listing of pending Avax ETFs. Supply: x

Because the avalanches broaden stubcoin funds for Korea and Japan, a surge in post-avax was first made in Beincrypto.