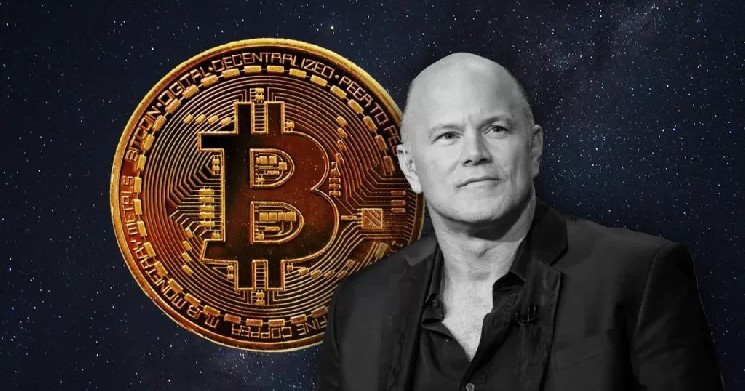

Mike Novogratz, CEO of Galaxy Digital, mentioned the Bitcoin and Ethereum treasury firm mannequin has reached a vital breaking level, and firms that began with this construction at the moment are being pressured to decide on between “remodeling or slowly dying.”

In a podcast with investor and former Trump administration official Anthony Scaramucci, Mike Novogratz argued that merely proudly owning crypto property is not a sustainable enterprise mannequin. With a number of exceptions like Technique and BitMine, finance corporations want to rework into companies that present actual services, Novogratz mentioned.

“Holding the underlying property alone doesn’t create shareholder worth. Administration wants to rework these buildings into actual corporations,” Novogratz mentioned.

In response to the present scenario, about 40% of Bitcoin treasury corporations are buying and selling under the online asset worth (NAV) of the crypto asset. Moreover, over 60% of those corporations bought Bitcoin at costs considerably above the present market price.

The same stagnation is going on on the Ethereum aspect. Novogratz identified that purchases out there have all however stopped, and the one main firm that continues to make common purchases is Bitmine, which has collected greater than 50% of ETH within the $21 billion Ethereum treasury ecosystem.

Novogratz admitted he too bought caught up within the hype. “We now have all been caught up in hype buying and selling in some unspecified time in the future,” Novogratz mentioned, including that the NAV premium is not in play and practically half of the whole Bitcoin treasury house is buying and selling at a reduction. In response to outstanding buyers, the elemental purpose is structural: Bitcoin and Ethereum ETFs give buyers direct entry to the property and not should pay a premium for their very own shares.

Novogratz famous that Technique’s monetary technique, launched in August 2020, has elevated the inventory worth by roughly 10 occasions, however this success stays unprecedented.

“Out of fifty corporations, solely three have truly been capable of implement this mannequin. The remaining should dig themselves out of their very own holes,” he mentioned. Even technique shares are down greater than 50% up to now six months, displaying the mannequin is underneath rising stress.

Requested what he would do if he have been operating a troubled monetary firm, Mr. Novogratz mentioned his first step could be to purchase again discounted shares to bridge the hole between NAV and inventory worth. However the actual resolution, he mentioned, could be to develop a brand new enterprise mannequin primarily based on the corporate’s current human and asset base.

“Should you personal Bitcoin, Ethereum, Solana, you should use that cash to arrange a neobank and create an actual product,” Novogratz mentioned, including that merely “holding cryptocurrencies” is not a marketable technique.

*This isn’t funding recommendation.