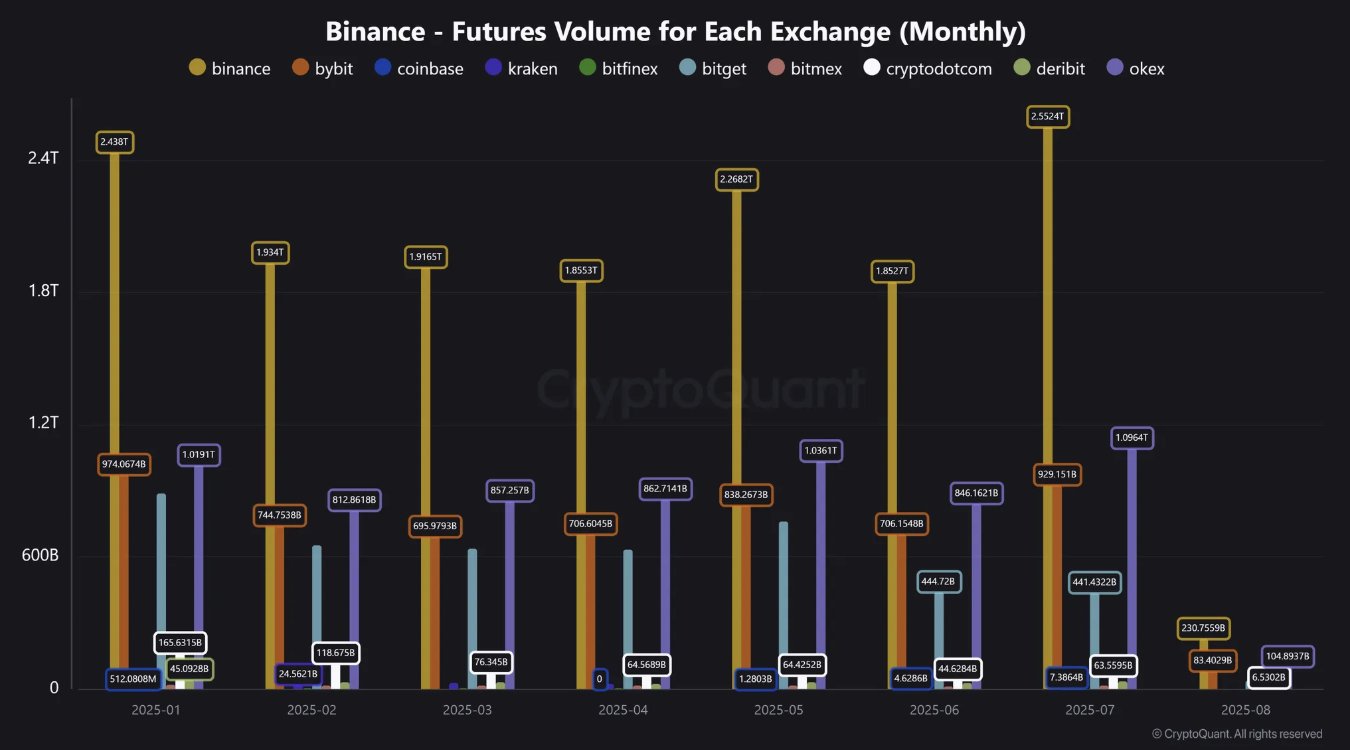

Crypto Derivatives Binance Alternate’s buying and selling quantity surged to a six-month excessive in July, exhibiting elevated buying and selling exercise and doubtlessly volatility following latest market fluctuations.

Binance futures buying and selling quantity reached $2.55 trillion in July, the very best stage since January, crypto analyst Ja Maartun reported Tuesday.

“The amount bounce adopted a month’s speedy value motion for each Bitcoin and altcoin,” he stated.

Different crypto derivatives suppliers Bybit and OKX have been additionally robust at a quantity of $92.9 billion and $1.09 trillion, however Binance accounted for greater than half of the full on all main exchanges, remaining the biggest with a big margin.

“The rise in buying and selling means that extra customers are re-active, most likely on account of latest value breakouts,” analysts stated.

Binance futures quantity reaches an enormous excessive. Supply: Cryptoquant

Participation within the increased derivatives market

Binance is a market chief in crypto derivatives with the very best liquidity and most property, providing 568 pairs. Based on Coingecko, the present each day buying and selling quantity was $82 billion, reaching a four-month excessive of $134 billion a day on July 18th.

Associated: The $100 million Binance Futures Quantity helps dealer’s “Altseason” claims

Greater futures volumes point out extra by-product merchants and establishments are actively taking part out there, which is usually correlated with durations of great value transfers or market uncertainty.

Futures markets additionally play an essential position in value discovery. It is because as quantity will increase, extra merchants are expressing their opinions about future costs. Crypto futures are alternate contracts that will let you infer the long run costs of property similar to Bitcoin (BTC) and ether (ETH) with out really proudly owning the property.

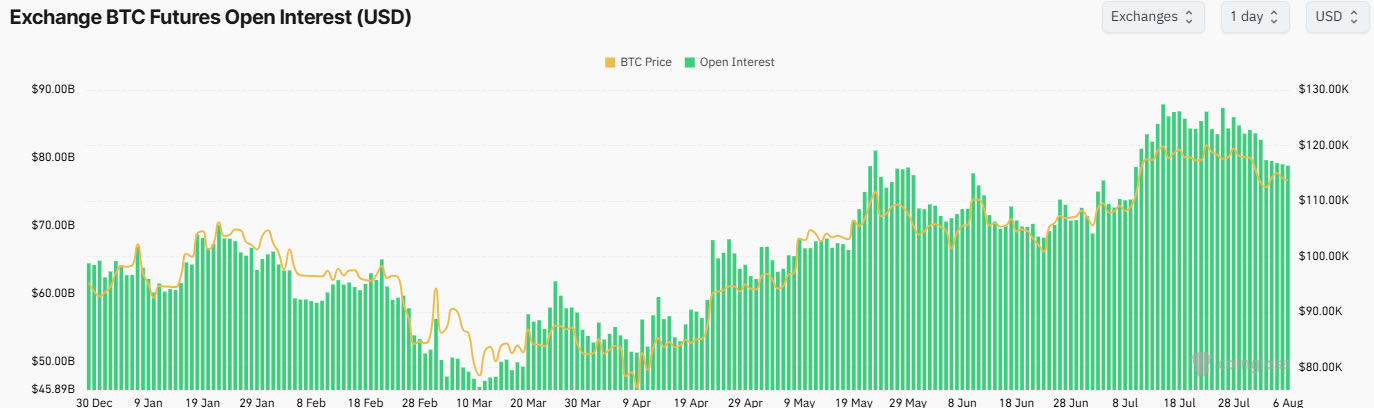

Open curiosity stays excessive

In the meantime, complete Bitcoin futures oi (a measure of the full quantity or worth of open contracts that haven’t but been resolved) stays at round $79 billion. Nevertheless, in response to Coinglas, it fell from a report excessive of $88 billion in mid-July.

Too excessive OI can usually result in a steady stream of leverage flashouts, which may trigger a pointy drop within the spot market.

Bitcoin futures oi oi stays maintained. sauce: Coinglass

journal: As salt merchants brace at a ten% drop, ether may “rip” like in 2021: Company Secrets and techniques