Ethena’s artificial greenback, USDe, misplaced greater than $2 billion in market capitalization after briefly dropping its greenback peg on Binance. This flash occasion uncovered structural dangers in crypto stablecoin plumbing.

In response to crypto slate In response to the info, USDe’s market worth decreased from $14.8 billion on October 10 to $12.6 billion by October 12.

This decline coincided with a pricing glitch on Binance that additionally affected wrapped belongings comparable to wBETH and BNSOL, briefly severing their hyperlink to the underlying tokens.

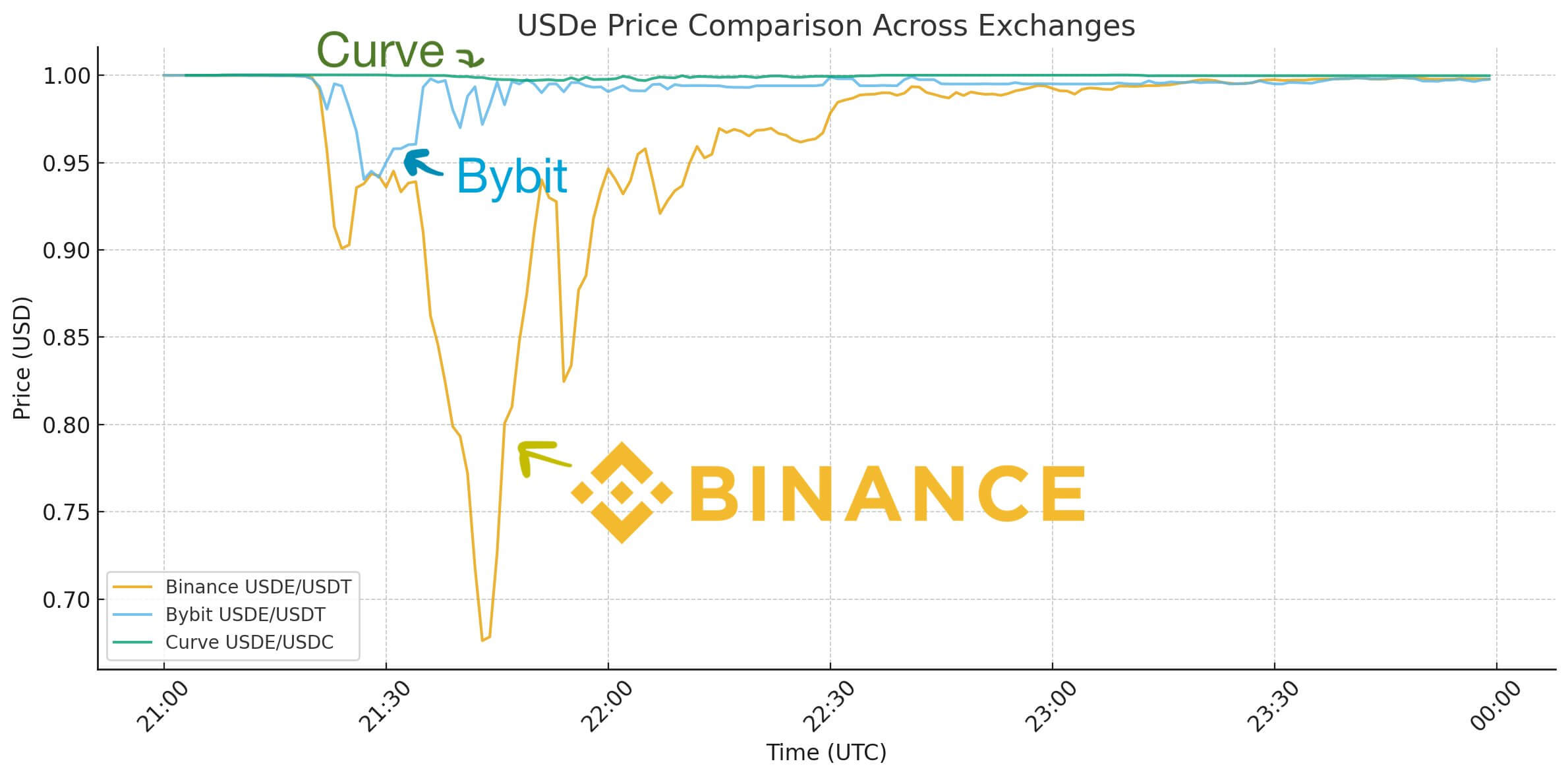

USDe briefly fell to $0.65, however has since recovered to parity. Binance later introduced that it had compensated customers greater than $283 million for losses associated to the incident.

Within flash depeg

The USDe value motion comes amid one of many largest crypto liquidation occasions of the 12 months.

Cryptocurrency markets plunged after US President Donald Trump promised to impose 100% tariffs on imports from China, wiping out over $20 billion in open curiosity in digital belongings. Because of this, the frenzy to safe-haven belongings like gold has depleted threat urge for food and uncovered weaknesses within the leveraged crypto market.

USDe’s construction depends on foundation buying and selling, shorting perpetual futures whereas holding lengthy spot publicity by means of reserves in USDT and USDC. When funding charges fall sharply, this mechanism reduces returns and places redemption strain on the system.

Nonetheless, the mission claims that Depeg is unique to Binance and never systemic.

Haseeb Qureshi of Dragonfly identified that USDe is “not depegging” globally.

“USDe fell on every CEX, however not throughout the board. Bybit hit $0.95 at one level however rapidly recovered, whereas Binance unpegged a ridiculous quantity and took eternally to regain the peg. Throughout that point, the curve fell by simply 0.3%.”

Moreover, Ethena Labs founder Man Younger confirmed that Mint and Redemption stays operational and has processed $2 billion in redemptions inside 24 hours.

He additionally identified that main on-chain liquidity swimming pools of belongings comparable to Curve, Uniswap, and Fluid have low divergence, with $9 billion of collateral (largely USDT and USDC) remaining instantly redeemable.

With this in thoughts, Younger stated:

“I do not assume it is correct to explain this as a depegging for USDe when a single venue was out of the deepest liquidity pool the place no uncommon value actions occurred.”

Why this issues to Bitcoin

Though USDe just isn’t marketed as a standard stablecoin, its rising position within the monetary plumbing of cryptocurrencies signifies that even small mispricing can have a disproportionate impression.

Final weekend’s disruptions demonstrated how venue-specific glitches can ripple by means of the market and trigger substantial losses.

And since USDe is at present included into a number of DeFi protocols and centralized exchanges, short-term variations between its market worth and the greenback can spill over into different liquidity swimming pools.

Such disruptions might trigger pressured liquidations in lending markets, cut back the liquidity of the BTC and ETH buying and selling pair, and warp the reference costs used throughout decentralized platforms.

In gentle of this, OKX founder Star Xu warned that the market wants to comprehend what USDe represents: a tokenized hedge fund and never a “1:1 pegged stablecoin.”

In response to him:

“Though these funds usually make use of comparatively low-risk methods comparable to delta-neutral foundation buying and selling and cash market investing, they nonetheless carry inherent dangers comparable to ADL occasions, currency-related incidents, and custodian safety breaches.”

Xu identified that platforms utilizing USDe as collateral want to use adaptive threat administration as an alternative of treating USDe like a standard stablecoin. He argued that ignoring the structural nuances of belongings creates systemic publicity to the broader crypto market, doubtlessly turning native flaws into sector-wide crises.