Partisan fiscal disputes have led to cryptocurrency recovering because the US federal authorities shut down midnight on Wednesday.

Federal deadlock pushes Bitcoin to file highs

It was the third day of the federal authorities closure, however by trying on the market, I could not inform. Shares are totally on the rise, aside from a couple of high-tech firms akin to AI firm Palantir Applied sciences (NASDAQ: PLTR). The broader crypto market has jumped 1.48% since yesterday, with Bitcoin (BTC) at a file excessive of lower than $2,000, bringing the broader crypto market to round $4.2 trillion.

The US authorities ran out of cash in the course of the evening Wednesday and was pressured to shut for 15 years from 1980. Senate Republicans and Democrats had proposed non permanent funding payments to keep away from the closure, however each failed, leaving hundreds of thousands of federal staff within the space. Earlier closures occurred on the finish of 2018 underneath the Trump administration. It was the longest ever, lasting 35 days and costing an estimated $3 billion, in line with Democrats.

Then, simply hours after closure on Wednesday, personnel agency ADP filed a horrible indictment of the earlier Fed’s rate of interest coverage by reporting that the nation’s personal sector misplaced 32,000 jobs. However even that did not shock traders who had been much more bullish in anticipation of extra rate of interest cuts later this 12 months.

“BTC will print a recent all-time excessive subsequent week and can possible hit my third quarter forecast of USD 135,000 quickly after,” stated Jeffrey Kendrick, head of digital property analysis at Commonplace Constitution Financial institution. “This closure is necessary. In the course of the earlier Trump closure (December 22, 2018 to January 25, 2019), Bitcoin was in a unique place than it’s now, so it was very uncommon.”

Market Metric Overview

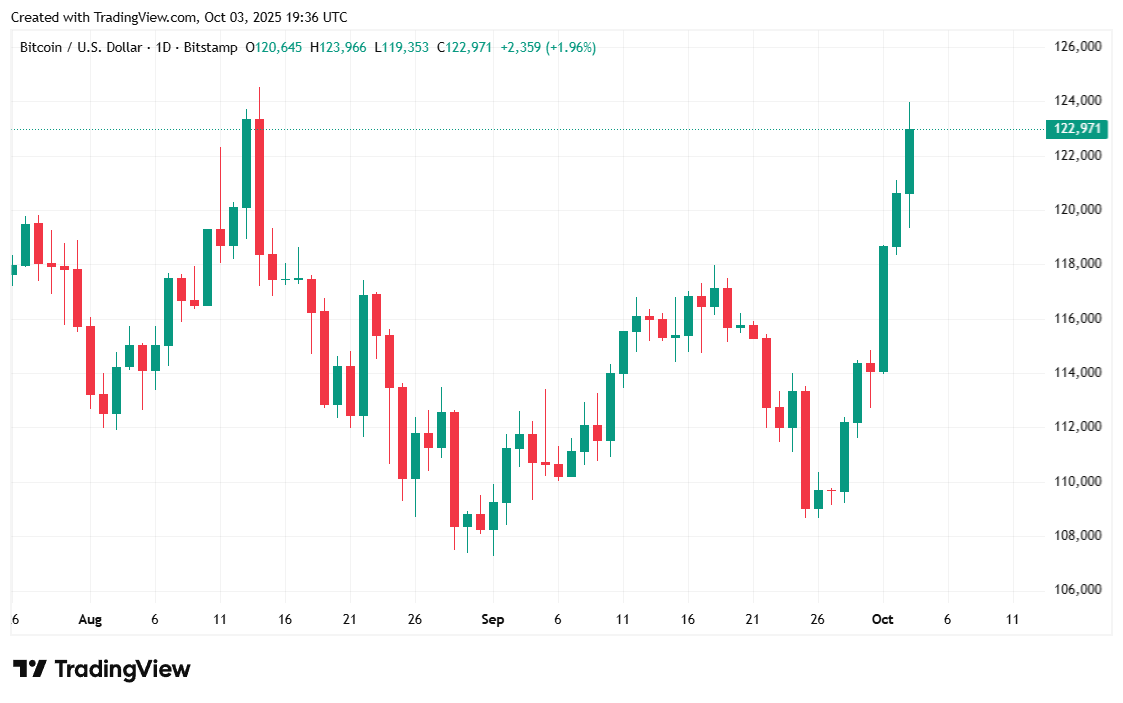

Bitcoin elevated by 1.62% over 24 hours at $122,958.26 at reporting, and elevated by 12.55% over 7 days based mostly on CoinmarketCap knowledge. Digital property have fluctuated between $119,344.31 and $123,944.70 since yesterday.

(BTC Value/Commerce View)

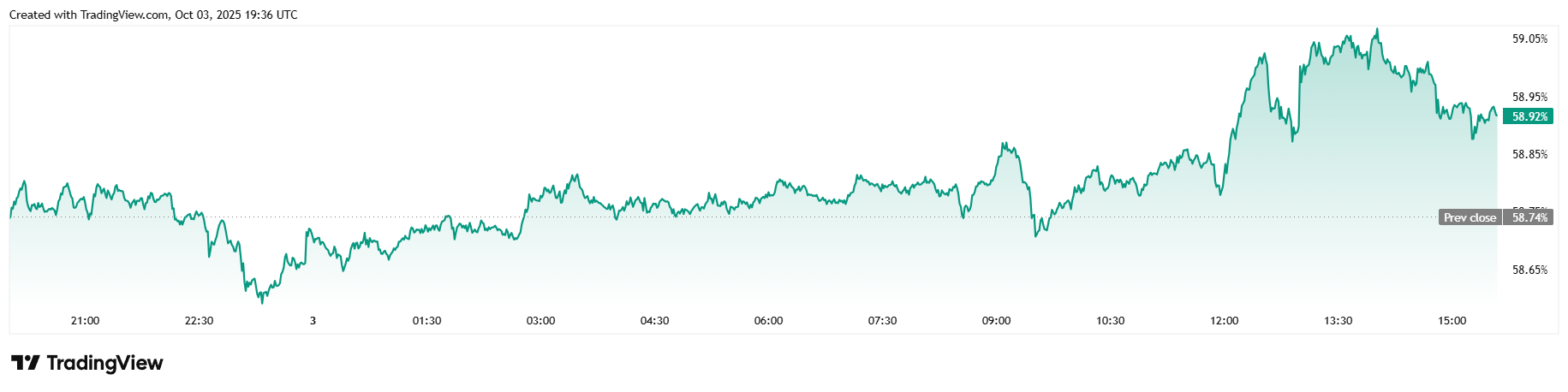

The 24-hour buying and selling quantity rose 19.25% to $870.9 billion, whereas the market capitalization rose 1.44% to $2.44 trillion, together with the worth. Bitcoin’s dominance rose 0.31% to 58.91% as cryptocurrencies surpassed many of the Altcoin market.

(BTC dominance/commerce view)

Complete curiosity on Bitcoin futures rose 1.03% to $8,9630 million in 24 hours, in line with Coinglas, with Bitcoin liquidation leaping to $211.58 million since yesterday. Lots of them had been quick liquidations, tilting the dimensions at $153.36 million, with the remaining coming from Lengthy, explaining that the general liquidation is lower than $58.22 million.