Bitcoin (BTC) slipped once more underneath the $120,000 value mark final week, and retreated after hitting a brand new all-time excessive of over $124,000 final week. As of the most recent market knowledge, BTC has fallen by round $115,557, 2.5% over the previous 24 hours, about 7% beneath its peak.

This value motion means that belongings are presently consolidated after latest gatherings, with market contributors rigorously watching the subsequent route transfer.

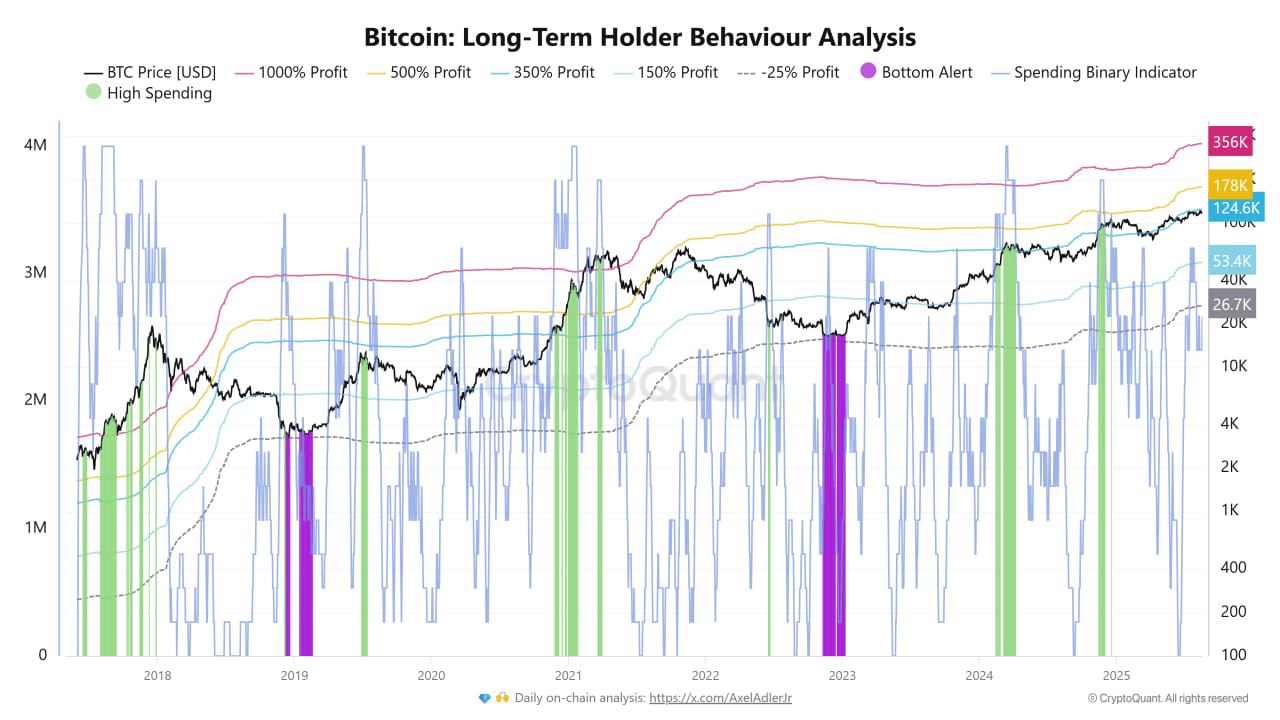

In the meantime, analysts are turning to sign on-chain knowledge on Bitcoin’s potential trajectory. One such perspective comes from Pelinaypa, a contributor to Cryptoquant’s fast take platform.

The findings spotlight that whereas revenue acquisition begins, present gross sales ranges are beneath the historic extremes seen at previous bull market peaks.

Lengthy-term holder sign monitoring

In accordance with Pelinaypa, LTH evaluation makes use of a number of metrics to measure the cost-based relationship between Bitcoin value and long-term holders.

A revenue and loss band starting from 150% to 1,000% above the price base helps you identify when Bitcoin will enter the zone within the high-risk zone available on the market. As BTC approaches the +500% band, it usually coincides with a rising gross sales exercise and supreme cycle peak.

The evaluation additionally incorporates expenditure binary indicators that mirror the depth of LTH gross sales, which often presents “backside alerts” that happen throughout deep corrections, showing close to the highest of the market.

In a assessment of previous cycles, Pelinaypa pointed to 2017 and 2021. There, a hunch within the naked market adopted by huge long-term holder gross sales, with the 2022-2023 backside marking the $15,000-$20,000 vary within the $15,000-$20,000 vary.

At the moment, Bitcoin is inside a revenue band of 150%-350%, leaving potential house for additional development, however as belongings method a better band, the danger of the market is increased. Analysts mentioned that we are able to see the inexperienced revenue bars immediately, however far beneath the degrees noticed at earlier cycle peaks.

Bitcoin market outlook: short-term, medium-term, long-term

In summarizing the potential situation, Perinaipa prompt that Bitcoin could possibly be in scope within the quick time period, as long-term holders are restricted in revenue acquisition.

Nevertheless, if accumulation and wider demand continues, costs can transfer within the $124,000-$178,000 vary, akin to the upper revenue thresholds of the LTH mannequin.

Relating to the mid-term outlook, which was prolonged till late 2025, analysts warned that if long-term holder gross sales are strengthened, like in 2021, Bitcoin could possibly be nearing the highest of the cycle. In such a situation, belongings might peak above $150,000 earlier than the subsequent main revision.

Trying ahead to 2026, the dearth of latest backside alerts means that somewhat than shifting right into a confirmed bear market, the market remains to be within the late levels of the continued bull cycle.

Particular photos created with Dall-E, TradingView chart