Bitcoin could also be getting ready for an additional recession as information alerts on the chain keep gross sales stress. A latest report from Cryptoquant exhibits a rise in sell-offs between Spot and Futures merchants.

If this development continues, BTC dangers sliding past the important thing $110,000 value mark.

Bitcoin gross sales stress will likely be strengthened

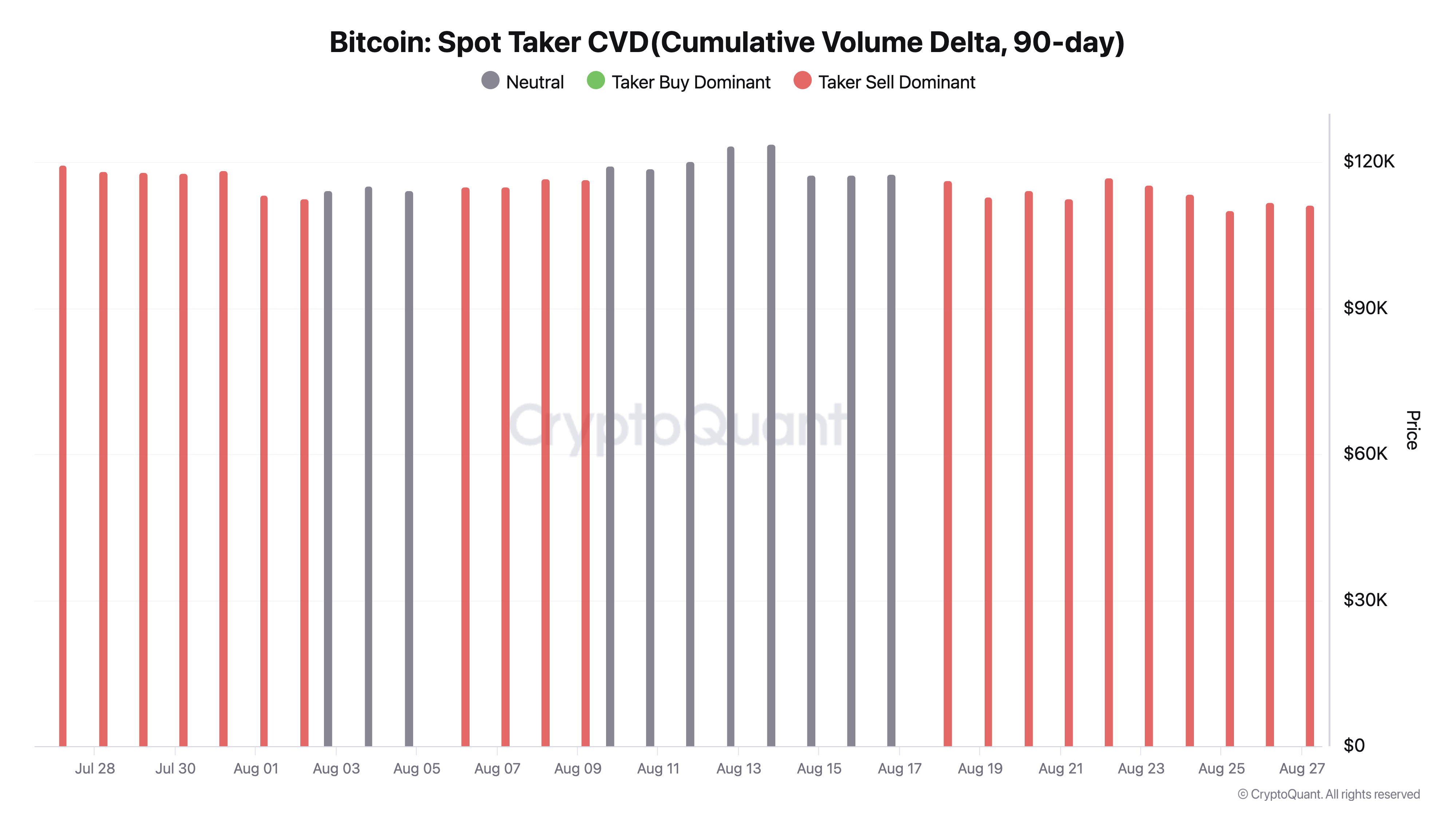

In response to a not too long ago revealed report on Cryptoquant, Bitcoin has skyrocketed in promoting from each Spot and Futures merchants, as mirrored in Spot Taker’s Cumulative Quantity Delta (CVD, 90 days) and Taker’s Purchase and Promoting Ratio.

Spot Taker CVD, which tracks whether or not market takers are primarily consumers or sellers, has turned the pink the other way up after months of buy-side domination. This shift has up to date gross sales stress, a traditionally preceded revision.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s every day crypto publication.

BTC Spot Taker Cumulative Quantity Delta. Supply: Cryptoquant

This displays a cooling of aggressive shopping for curiosity and a rising motivation amongst BTC spot merchants, informing market fatigue.

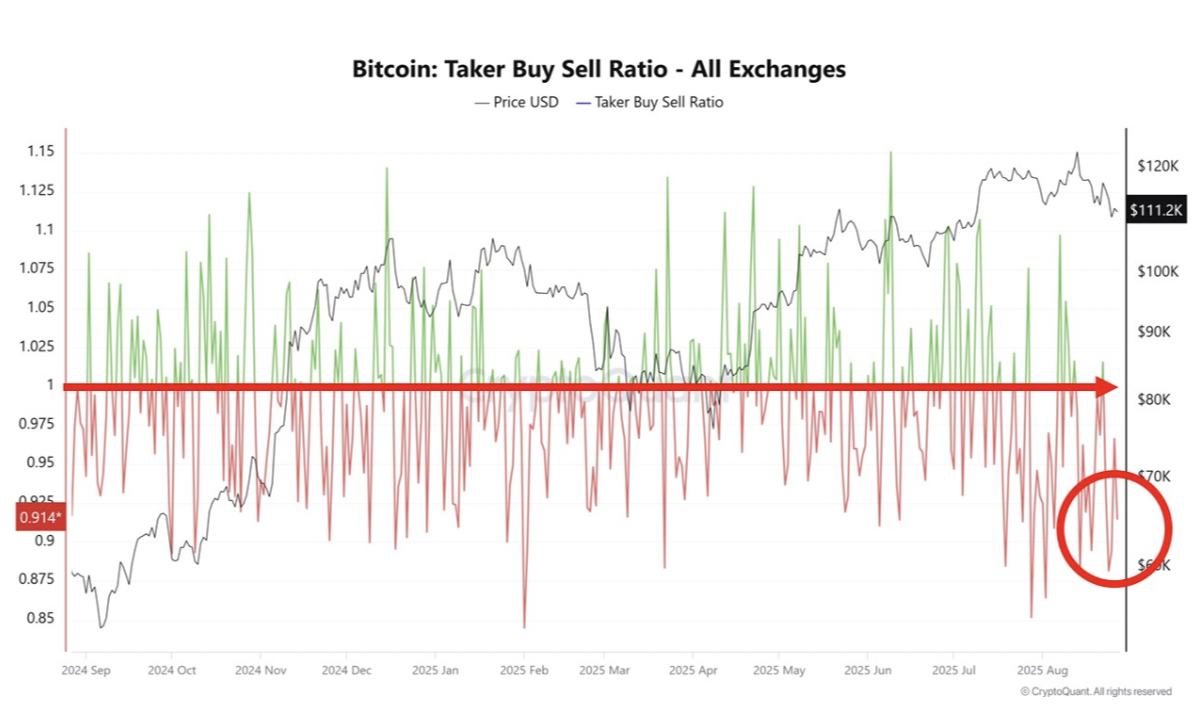

Moreover, in line with the report, BTC’s Taker Purchase/Gross sales fee fell to 0.91, beneath the long-term baseline of 1.0. This exhibits that gross sales orders persistently outweigh purchase orders throughout the coin futures market.

BTC Taker buying and selling fee. Supply: Cryptoquant

Asset taker’s procuring and gross sales ratio measures the ratio of buying and selling volumes within the futures market. Values above point out extra shopping for than promoting quantity, whereas values beneath one recommend that extra futures merchants are promoting their holdings.

This confirms an more and more weakened gross sales pressure and feelings, which may worsen if BTC costs proceed.

Can $112,000 in assist be fueled by contemporary gatherings?

The BTC traded at $112,906 at press and rests at $111,920 on the assist flooring. If demand will increase and this value flooring is strengthened, it may push the worth of BTC to $115,764. A profitable violation of this stage may open the door for the rally to $118,922.

BTC value evaluation. Supply: TradingView

Conversely, if sell-side stress is mounted, there’s a danger that BTC will fall beneath $111,920 and drop to $109,267.

One other dip’s post-bitcoin brace first appeared on Beincrypto as on-chain information warns of spots and futures sell-offs.