Many within the crypto trade have been repeating a well-recognized chorus in current months: “The four-year crypto market cycle is over.” Bull theorists argue that whereas the four-year cycle could also be over, the Bitcoin bull market itself is just delayed and will final till 2027.

Why the 4-year cycle is coming to an finish

Lately publish On social media platform X, previously often called Twitter, Bull Idea analysts identified that the idea that Bitcoin follows a neat four-year cycle is weakening.

They emphasised that the numerous worth actions over the previous decade weren’t solely attributable to halving occasions. Slightly, it was affected by modifications in international liquidity.

Analysts famous that regardless of the current financial downturn, stablecoins stay extremely liquid, indicating that giant buyers stay engaged available in the market and able to make investments when the proper macroeconomic circumstances come up.

In the US, monetary coverage It’s rising as an necessary catalyst. Whereas the current share buybacks are notable, the larger story lies within the Treasury Normal Account (TGA) stability, which at present stands at about $940 billion, nearly $90 billion above its regular vary, analysts stress.

This extra money is prone to circulate again into the monetary system, tightening funding circumstances and including liquidity that may usually be interested in riskier property.

Globally, this development seems much more promising. China has been injecting liquidity for months, and Japan just lately introduced an financial stimulus package deal value about $135 billion, alongside efforts to simplify crypto rules.

Canada can be transferring in direction of financial easing, and the US Federal Reserve has formally suspended financial coverage. quantitative tightening (QT) Measures – Historic precursors of some sort of liquidity growth.

Political and monetary elements align to create a bullish scenario

Analysts defined that danger property like Bitcoin are likely to react extra rapidly than conventional shares and the broader market when main nations concurrently introduce expansionary financial coverage.

Moreover, potential coverage instruments embody: Further leverage ratio The (SLR) exemption launched in 2020 to present banks extra flexibility to develop their stability sheets is prone to be reinstated, leading to a rise in credit score creation and market-wide liquidity.

There are additionally political elements to contemplate. President Trump has mentioned potential tax reforms, together with eliminating the earnings tax and distributing $2,000 tariff dividends.

Furthermore, the opportunity of a brand new Federal Reserve chair who helps liquidity assist and is constructive on cryptocurrencies might strengthen the circumstances for financial development.

Bitcoin uptrend extension

Traditionally, analysis institutes Provide Administration Buying Supervisor Index After (ISM PMI) crossed 55, the altcoin season continued. In keeping with bull idea, the chance of this taking place in 2026 appears excessive.

The convergence of elevated stablecoin liquidity, Treasury cashback injections into the market, international quantitative easing, the US suspension of QT, potential financial institution mortgage bailouts, pro-market coverage shifts in 2026, and entry of main companies into the crypto sector suggests a really totally different state of affairs than the previous four-year halving mannequin.

Analysts concluded that Bitcoin is unlikely to reverse that development if liquidity expands in the US, Japan, China, Canada, and different main nations on the similar time.

So, slightly than experiencing a pointy rise adopted by a long-term rise, bear marketthe present surroundings factors to a longer-term, broader upward development that might proceed by means of 2026-2027.

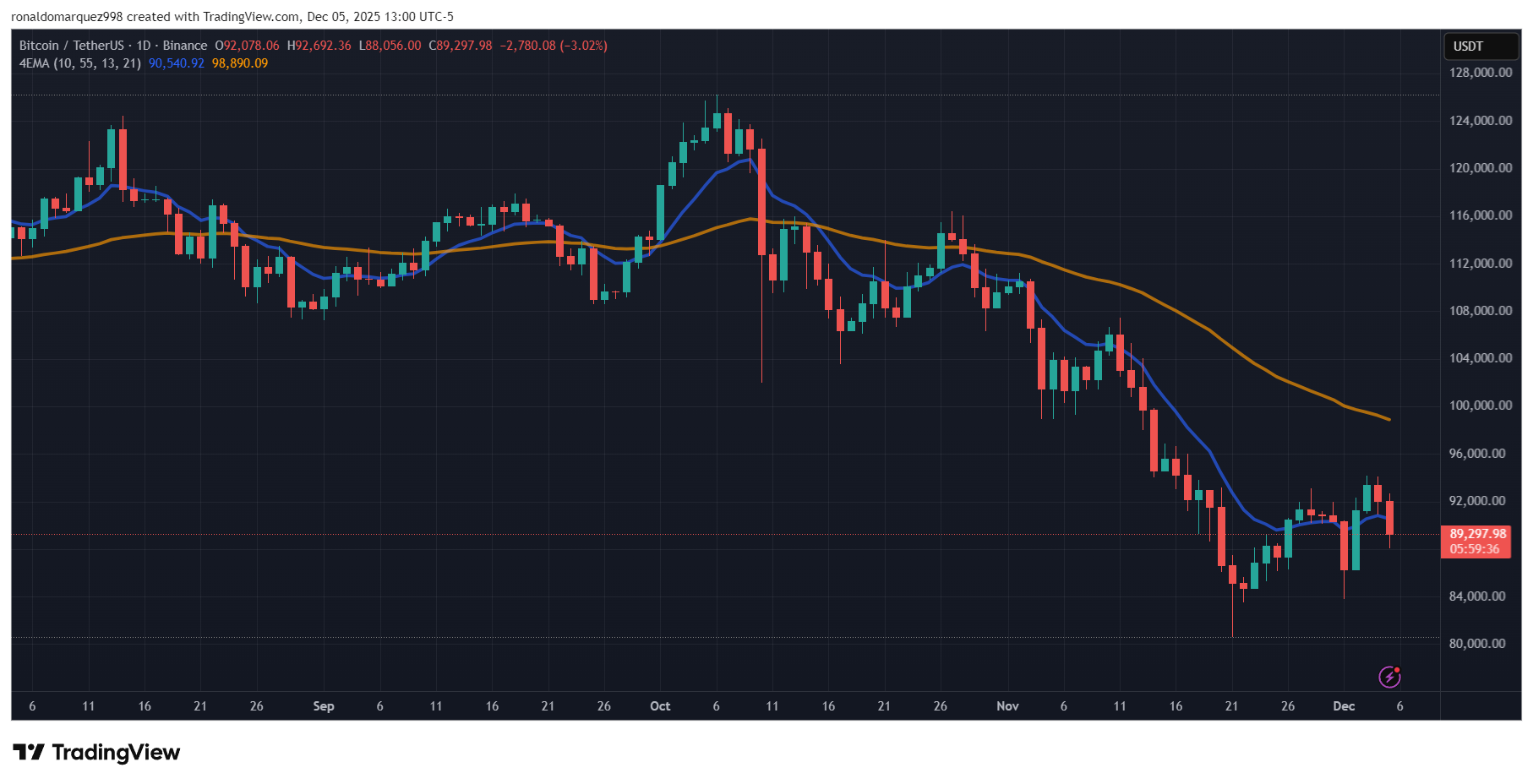

Featured picture from DALL-E, chart from TradingView.com