Written by Omkar Godbole (all occasions Jap Time except in any other case famous)

After Bitcoin, the digital forex market appears to have turn out to be much more slippery. $BTC$87,910.88 It fell 7% final week, the largest drop in two months. Nonetheless, there’s a silver lining within the bullish derivatives guess, which is now at a discount value.

The decline pushed the worth beneath a gradual climb, what technical analysts name a “bullish pattern line,” capping a step-like rise from $20,000 in early 2023 to an all-time excessive of $126,000 final October.

This sample reinforces considerations raised by Bitcoin’s sharp decline from all-time highs. Meaning we’re in a bear market (verify the TA part). To this point, follow-up slides have been tame. Bitcoin costs have rebounded from a weekend low of round $86,000 to round $88,000.

Nonetheless, the general image appears bleak, with institutional investor urge for food for crypto waning together with bearish messages from the charts. U.S.-listed spot ETFs recorded web outflows of $1.33 billion final week, essentially the most in 11 months, in line with SosoValue knowledge. Monday’s income was simply $6.84 million.

“There is no such thing as a energy left in cryptocurrencies, partially as a result of speculator cash and a spotlight appears to be solely targeted on treasured metals (primarily gold and silver),” Alex Kupczykevich, chief market analyst at FX Professional, mentioned in an e-mail.

Some observers imagine the cash will return as soon as the gold and silver rally ends. For those who share the same bullish view, $BTC Name choices, by-product contracts that provide massive upside potential for a small preliminary price, provide one of the best ways to guess on it.

Matthew Siegel, head of digital asset analysis at VanEck, mentioned these name choices look low cost as a result of everyone seems to be piling into the places, which give draw back safety.

“Formally, draw back safety is a crowded commerce. Everyone seems to be paying a premium for places, however the upside publicity (calls) is buying and selling cheaply. If there’s proof for a pullback, the amount floor is providing a reduction,” Siegel mentioned.

In different information, Rick Rieder, chief funding officer of worldwide fastened revenue at BlackRock, who manages about $2.4 trillion in consumer funds and helps decrease U.S. rates of interest, has been floated as a candidate to succeed Jerome Powell as Fed chair, when his time period ends in Could.

In conventional markets, gold and silver have been each buying and selling at lifetime highs, whereas the greenback index was at its lowest since September final 12 months.

South Korea’s benchmark inventory index, the Kospi, continues to rise, rising 20% year-to-date after a stable 75% rise final 12 months. Oddly sufficient, that is vital as a result of for a few years new highs within the Kospi have triggered Bitcoin’s draw back. Be alert!

Extra info: For an evaluation of as we speak’s exercise in altcoins and derivatives, see Crypto Markets As we speak.

what to see

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- cryptography

- macro

- January 27: US ADP Employment Weekly Change (Prev. 8K)

- January 27: US S&P/Case-Shiller residence value change in November (1.3% YoY). In comparison with the earlier month (earlier month -0.3%)

- income (estimated primarily based on FactSet knowledge)

token occasion

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- Governance votes and calls

- January 27: Zebec Community, Sprint, Houdini Swap, and Cryptic take part in an X Areas session on why privateness issues.

- January 27: Courageous’s Brendan Eich, Cardano’s Charles Hoskinson, and Mythigal Video games’ John Linden be part of the X Areas session.

- January 27: PancakeSwap hosts an Ask Me Something (AMA) session on Venus Protocol.

- unlock

- Activate token

- January 27: Theo Community plans to make an announcement associated to the launch of thGOLD.

convention

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

market actions

- $BTC Shares rose 0.38% from 4:00 pm ET on Monday to $88,326.08 (24 hours: -0.18%).

- $ETH Up 0.1% to $2,929.56 (24 hours: +0.22%)

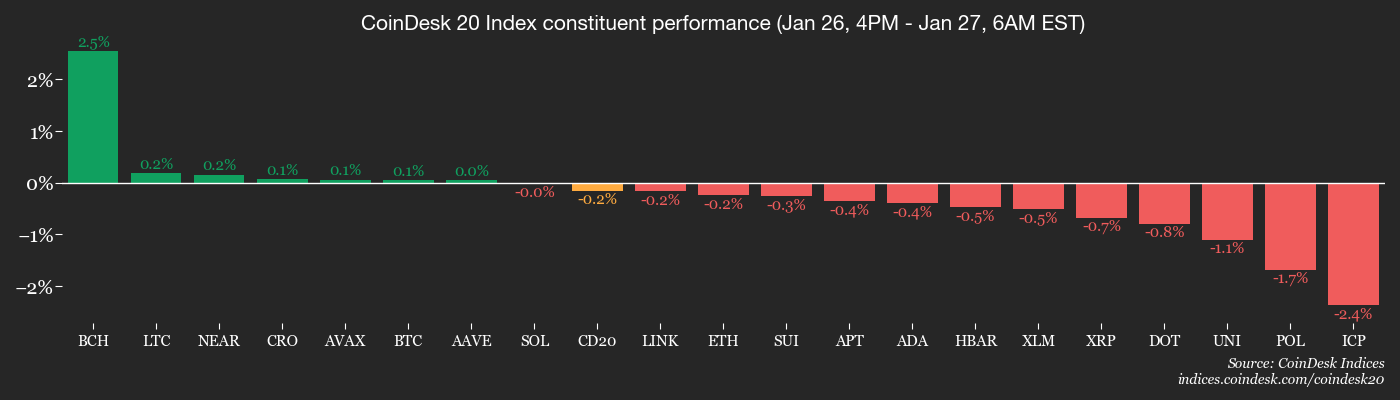

- CoinDesk 20 fell 0.58% to 2,683.47 (24h: +0.32%)

- Ether CESR complete staking rate of interest will increase by 4bps to 2.85%

- $BTC Funding charge on Binance is 0.0074% (8.068% p.a.)

- DXY stays unchanged at 97.01

- Gold futures unchanged at $5,082.10

- Silver futures fell 2.82% to $112.25.

- The Nikkei 225 rose 0.85% to shut at 53,333.54.

- Hold Seng closed 1.35% greater at 27,126.95.

- FTSE rose 0.4% to 10,189.88.

- The Euro Stoxx 50 rose 0.22% to five,970.72.

- The DJIA rose 0.64% to shut at 49,412.40 on Monday.

- The S&P 500 rose 0.50% to shut at 6,950.23.

- The Nasdaq Composite Index rose 0.43% to finish at 23,601.36.

- The S&P/TSX Composite Index closed 0.16% decrease at 33,093.32.

- The S&P 40 Latin America Index rose 0.36% to finish at 3,604.49.

- US 10-year authorities bond rate of interest rose 1bps to 4.221%

- E-mini S&P 500 futures rose 0.25% to six,999.00

- E-mini Nasdaq 100 futures rose 0.56% to 25,994.50.

- E-mini Dow Jones Industrial Common futures unchanged at 49,518.00

bitcoin statistics

- $BTC Dominance: 59.67% (-0.07%)

- Ether/Bitcoin ratio: 0.03307 (-0.28%)

- Hashrate (7-day shifting common): 921 EH/s

- Hash Worth (Spot): $39.22

- Whole price: 2.38 $BTC / $208,632

- CME futures open curiosity: 120,620 $BTC

- $BTC Gold value: 17.2 oz.

- $BTC Market capitalization in opposition to gold: 5.87%

technical evaluation

Bitcoin has damaged out of the principle pattern line assist of the bull market. (Buying and selling View)

- This chart exhibits Bitcoin value fluctuations beginning in 2023.

- Costs fell greater than 7% final week, with a big pink candle breaking by way of the pattern line representing a step enhance from 2023.

- The so-called breakdown confirms bear market considerations.

crypto property

- Coinbase International (COIN): Monday’s closing value was $213.48 (-1.60%), pre-market was $215.10, +0.76%.

- Circle Web (CRCL): $70.90 (-0.60%), +0.56% to shut at $71.30

- Galaxy Digital (GLXY): $31.28 (-1.94%), +0.38% to shut at $31.40.

- Bullish (BLSH): $35.66 (-0.25%), +1.04% to finish at $36.03

- MARA Holdings (MARA): $9.98 (-4.95%), +0.70% to shut at $10.05.

- Riot Platform (RIOT): Ended at $16.23 (-6.08%), +1.42% at $16.46

- Core Scientific (CORZ): Ended at $19.05 (+1.38%)

- CleanSpark (CLSK): $12.44 (-9.26%), +0.88% to shut at $12.55

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Ended at $46.58 (-5.21%)

- Exodus Motion (EXOD): Closed at $14.72 (-1.80%)

crypto asset firm

- Technique (MSTR): $160.58 (-1.55%), +0.46% to finish at $161.32

- Try (ASST): $0.79 (-9.76%), +2.56% to finish at $0.81

- SharpLink Gaming (SBET): unchanged from pre-market, ending at $9.38 (-3.79%)

- Upexi (UPXI): Closed at $1.89 (-5.50%)

- Gentle Technique (LITS): Closed at $1.29 (+1.57%)

ETF circulation

spot $BTC ETF

- Day by day web circulation: $6.8 million

- Cumulative web circulation: $56.48 billion

- whole $BTC Holding quantity ~1.29 million objects

spot $ETH ETF

- Day by day web circulation: $117 million

- Cumulative web circulation: $12.45 billion

- whole $ETH Holding quantity ~6.02 million

Supply: Farside Traders

whilst you have been sleeping

- India and the European Union signal landmark commerce deal, decreasing tariffs on most objects (Reuters): India and the European Union have signed a commerce deal that may minimize tariffs on 96.6% of things by worth to spice up two-way commerce and cut back dependence on the US.The deal is anticipated to double EU exports to India by 2032 and save European firms about 4 billion euros (about $4.8 billion) in tariffs.

- Bitcoin-to-silver ratio approaches ranges final seen throughout the FTX capitulation (CoinDesk): Bitcoin-to-silver ratio nears 780, beneath its 2017 peak and approaching November 2022 ranges. $BTC I hit all-time low. This convergence may sign elevated vulnerability of silver in comparison with Bitcoin.

- President Trump presses panic button in Minnesota (Wall Road Journal): Because the home scenario worsens after one other loss of life in Minnesota, the Trump administration has begun reorganizing its immigration group to rebuild ongoing operations.

- Australian company regulator warns of dangers from speedy innovation in digital property (CoinDesk): The Australian Securities and Investments Fee (ASIC), the impartial authorities company that acts because the nation’s company regulator, has recognized dangers from speedy innovation in digital property.