Following a torrid efficiency within the first week of October, Bitcoin value traits have remained largely calm all through this month. In truth, this premier cryptocurrency witnessed a second of bearish motion through the ‘Uptober’ month, which is extensively considered a traditionally bullish month.

Bitcoin costs are more likely to finish the month within the purple on account of vital downward strain in latest weeks. Nonetheless, latest valuations point out that the market chief could also be gearing up for its subsequent large value transfer subsequent week.

Why BTC might make an enormous transfer subsequent week

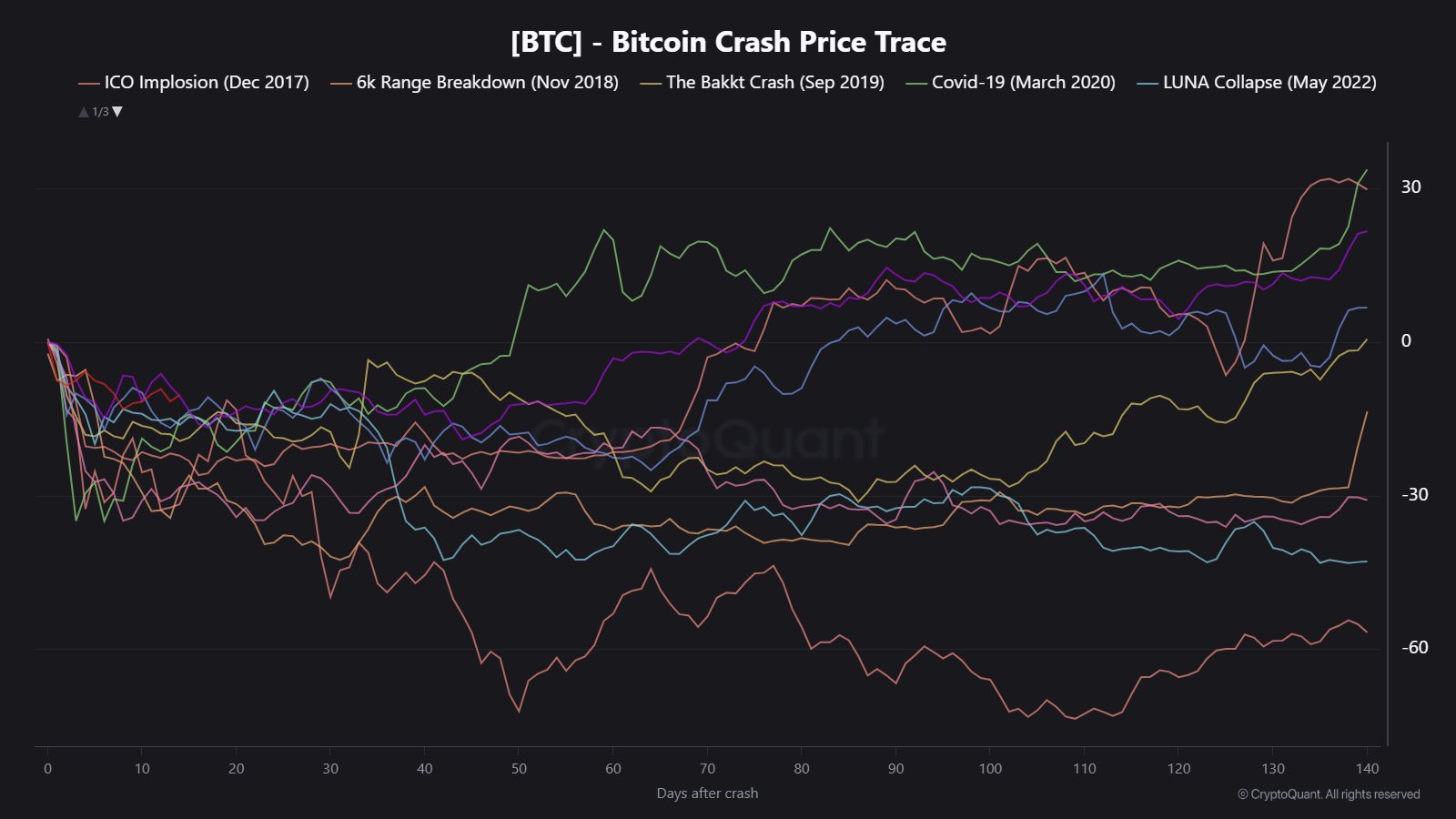

In a latest video on YouTube, cryptocurrency analyst Marthun shared an thrilling speculation concerning the value of Bitcoin, saying that Bitcoin might make its subsequent large transfer subsequent week. This evaluation is predicated on the Bitcoin Crash Worth Hint, which screens the habits of BTC after vital value drops.

In accordance with Maartung’s evaluation, after a pointy drop, Bitcoin costs are likely to consolidate or transfer sideways for about two to 4 weeks earlier than making the subsequent large transfer. The identical has been true for the main cryptocurrency because it fell greater than 16% on October tenth.

Martin famous that the market chief is now 14 days into this consolidation part, which means the subsequent transfer might occur any time from now.

Supply: @JA_Maartunn on X

Analysts additional offered knowledge clues, highlighting that market volatility is trending down for main cryptocurrencies. Martin believes this drop in volatility is an indication that traders are on the sidelines for the subsequent large value transfer.

On the time of this writing, Bitcoin’s worth is round $111,690, reflecting a rise of simply 0.6% over the previous 24 hours.

Stage to concentrate to subsequent transfer

Martin went additional and recognized $112,500 as a key stage to look at if Bitcoin value makes the subsequent large transfer. This value stage is the realized value for brief time period holders (STH) and sometimes acts as a dynamic help and resistance stage.

Normally, when the worth of BTC is under this STH realized value, it signifies that probably the most reactive Bitcoin traders are within the purple. These short-term traders are more likely to offload their property on the break-even value when Bitcoin value returns to its price foundation.

Finally, this decline will put downward strain on the Bitcoin value, with the STH realized value (at present $112,500) turning into a major resistance stage.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView