Bitcoin’s value motion over the previous week is an ideal illustration of Bitcoin’s efficiency this yr. The main cryptocurrency has skilled unimaginable ranges of volatility all through this week, fluctuating between $90,000 and $86,000 over the previous few days.

The newest market valuations point out that the longer term for Bitcoin value could possibly be bleaker than simply sideways volatility. In line with a notable cycle, the BTC value cycle has turned and is coming into a bear market.

Bitcoin’s cyclical habits will depend on the demand cycle: CryptoQuant

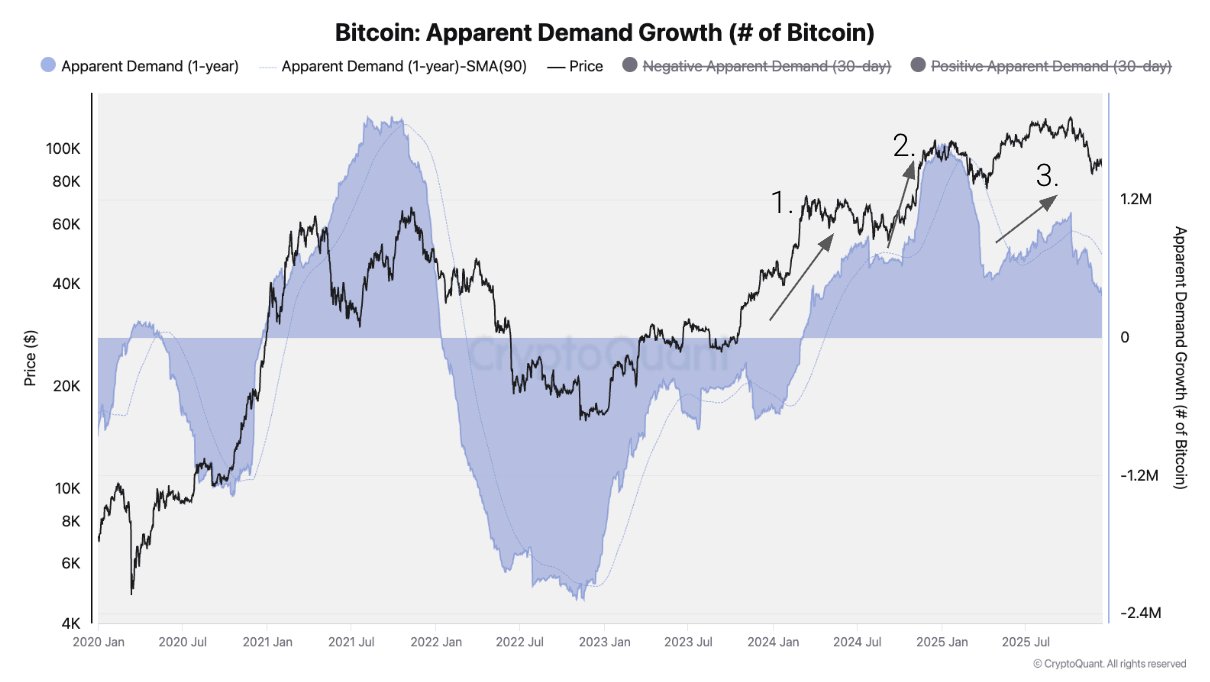

Blockchain analytics agency CryptoQuant hyperlinks the regular decline in Bitcoin costs to the fading demand growth in its newest market report. Information from on-chain platforms exhibits that BTC demand development will gradual into 2025, suggesting the start of a bear market.

CryptoQuant highlighted that for the reason that bull cycle started in 2023, Bitcoin has had three main waves of spot demand, pushed by the US spot ETF launch, the US presidential election outcomes, and the Bitcoin Treasury bubble. Nonetheless, demand development has slowed since early October 2025.

Not surprisingly, this reversal in demand development coincides with the October tenth market disaster, one of many largest liquidation occasions in crypto historical past. Since then, Bitcoin value has struggled to recuperate convincingly, falling to $82,000 in late November.

Supply: CryptoQuant

CryptoQuant additional hypothesized that as most of this cycle’s elevated demand has already been realized, a key pillar of value assist has been eliminated. For instance, a US-based Bitcoin exchange-traded fund (ETF) will change into a web vendor within the fourth quarter of 2025 as a consequence of weak demand from institutional and large-scale traders.

In line with CryptoQuant information, US spot ETF holdings fell by 24,000 BTC in This autumn 2025, which is way from the regular accumulation seen in This autumn 2024. “Equally, addresses holding 100-1,000 BTC, representing ETFs and treasury corporations, have elevated under pattern, reflecting the deterioration in demand seen on the finish of 2021 and the bear market in 2022,” the blockchain firm added.

Along with weaker spot demand, the Bitcoin derivatives market has additionally seen lowered exercise and lowered danger urge for food. CryptoQuant revealed that BTC funding charges have fallen to their lowest ranges since December 2023, an on-chain sign that means merchants are much less prepared to keep up long-term publicity. This pattern is usually related to bear markets.

Finally, the blockchain firm concluded that Bitcoin’s four-year cycle shouldn’t be a halving occasion, however as a substitute will depend on phases of demand, or expansions and contractions in demand development. Principally, bear markets are inclined to happen after BTC demand development peaks and collapses.

What’s subsequent for BTC value?

CryptoQuant revealed in a report that Bitcoin’s value construction is deteriorating as a consequence of weak demand. The flagship cryptocurrency is at the moment buying and selling under its 365-day shifting common, a key long-term assist stage that has traditionally separated bullish from bearish phases.

In line with CryptoQuant, the draw back water mark means that the Bitcoin bear market is probably not as deep as feared. Just like earlier bear seasons, the realized value (at the moment round $56,000) is being acknowledged as a possible backside.

This implies a possible 55% correction from the newest all-time excessive, which is Bitcoin’s smallest ever drawdown (throughout a bear market). In the meantime, the market chief’s intermediate assist stage is round $70,000.

As of this writing, BTC value is round $88,170, reflecting a 3% improve over the previous 24 hours.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView