Change-traded funds primarily based on spot Bitcoin are seeing a big inflow of liquidity. Regardless of the consensus throughout the phase that “crypto winter” has begun, there’s a good likelihood that the bearish shedding streak will finish in January 2026.

Bitcoin Spot ETF: Largest inflows since October tenth

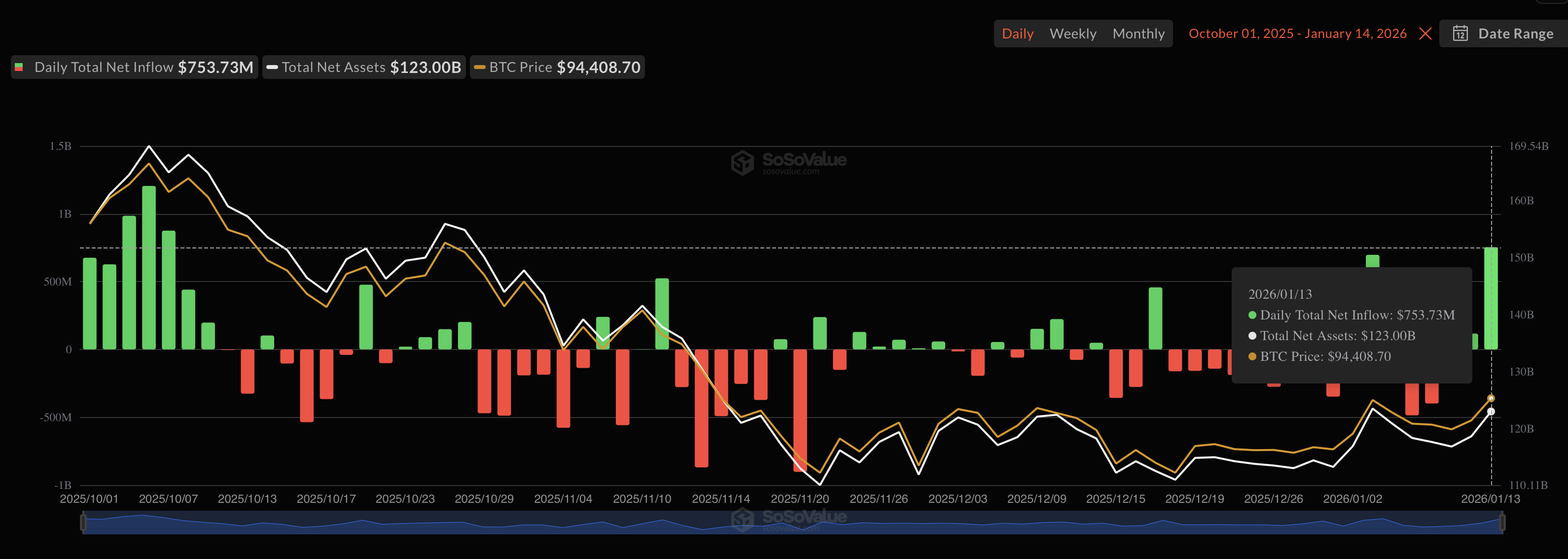

Bitcoin Spot ETF — A U.S. registered exchange-traded fund product primarily based on spot Bitcoin (BTC) Holdings — Seeing essentially the most vital inflows because the market crash on October tenth. Yesterday, in simply 24 hours, buyers injected $753 million into this class of belongings.

That being mentioned, the January thirteenth session was the best for Bitcoin (BTC) Spot ETFs from October 7, 2025 onwards. On the weekly timeframe, this week noticed its highest worth since mid-October.

For the reason that starting of this yr, the Spot Bitcoin ETF class has collectively grown by $660 million in AUM.

Bitwise’s NYSE, BlackRock’s IBIT, and particularly Constancy’s FBTC are the highest gainers over the previous 24 hours. A complete of roughly $7,000 was allotted to the three funds. BTC yesterday.

Investor optimism in direction of Bitcoin (BTC) may be attributed to optimistic regulatory and macroeconomic bulletins within the US.

Bitcoin (BTC) Costs are at virtually two-month highs

Because of this, Bitcoin (BTC) Worth rose to $95,700 at present, its highest since mid-November. The most important cryptocurrency rose 3.1% at present, whereas the remainder of the market gained 3.2%.

Within the final 24 hours, Bitcoin (BTC) is predicted to liquidate $300 million, 99% quick. For Ethereum (Ethereum), the Ether worth elevated by 5% to $3,283, which brings this indicator to $220 million.

In accordance with CoinGlass information, the biggest liquidation was a $12 million lengthy ETHUSDT on Binance.