Bitcoin market construction is believed to have undergone main modifications because the vital value drop seen on October 10, 2025. For the reason that market debacle, high-end cryptocurrencies have been on one thing resembling a restoration trajectory, however some sectors consider a bearish interval has already begun.

With BTC beneath its 2025 opening value, it’s changing into more and more troublesome to make a bullish case towards the world’s largest cryptocurrency. Moreover, fascinating information factors relating to the related Bitcoin investor demographic have been uncovered, lending additional credence to the opportunity of the start of a bear market.

Are Bitcoin treasury corporations offloading cash?

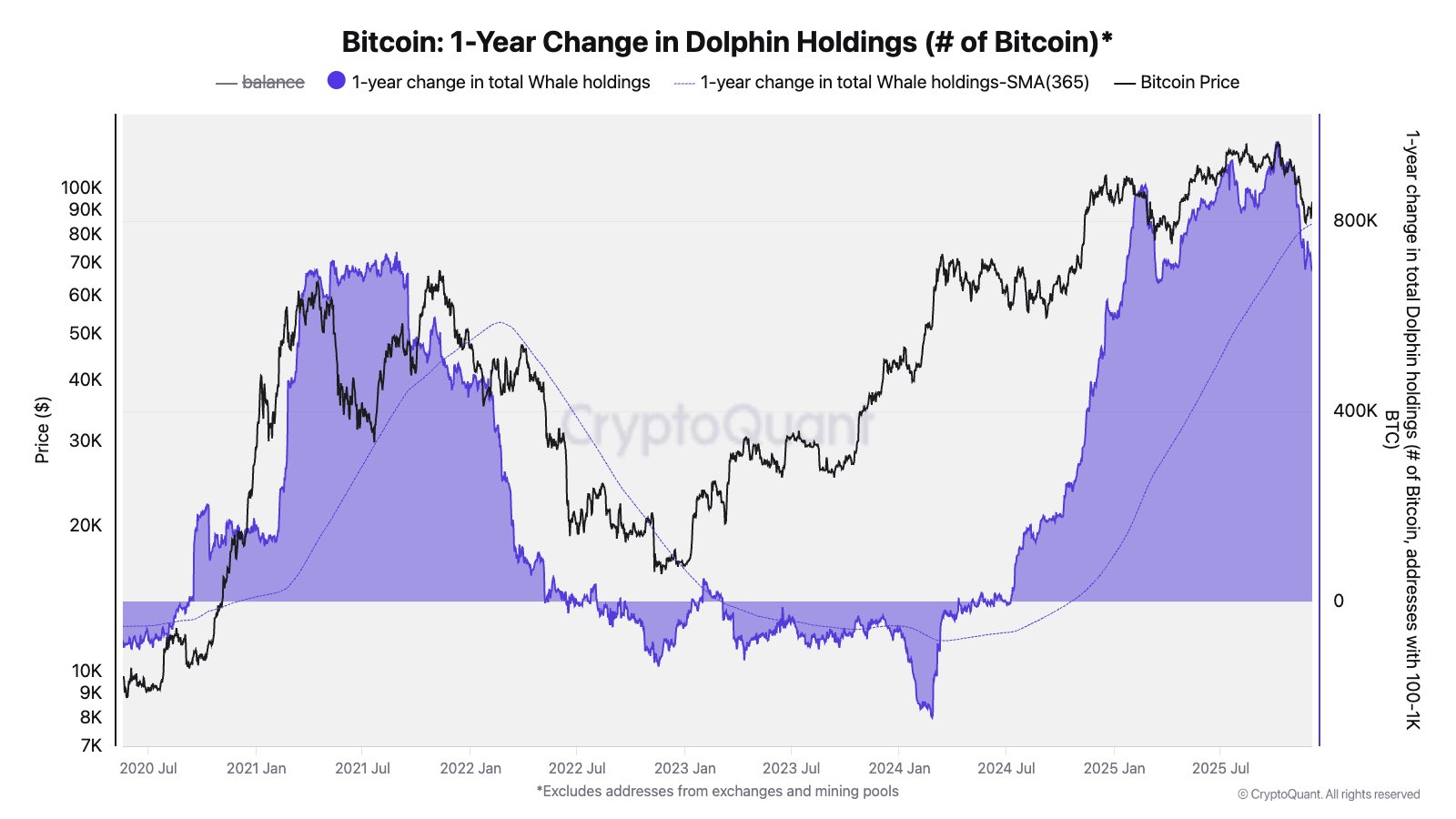

In a brand new submit on X, Julio Moreno, head of analysis at CryptoQuant, shared on-chain insights that help the speculation {that a} Bitcoin bear market has begun. This conclusion relies on the balanced progress of a gaggle of traders often known as the “Dolphins.”

Dolphins consult with a gaggle of cryptocurrency traders who maintain giant quantities of cash and are positioned between small traders (shrimps) and largest traders (whales). Particularly, Moreno described Dolphin as a pockets tackle that holds giant quantities of BTC, starting from 100 to 1,000 cash.

In keeping with the most recent information from CryptoQuant, the expansion in Dolphins’ BTC holdings has slowed over the previous 12 months and seems to be on the decline. Moreno believes this unfavorable change alerts the emergence of a Bitcoin bear market.

Supply: @jjc_moreno on X

Moreno revealed that these Dolphin addresses have been growing by about 965,000 BTC year-over-year when BTC value reached its present all-time excessive of about $125,000. Presently, the BTC value is almost 30% beneath its all-time excessive, and the Bitcoin Dolphins steadiness is round 694,000 cash.

Moreno wrote to X:

This tackle cohort additionally consists of ETFs and U.S. Treasuries, which it has additionally stopped shopping for.

Extra curiously, CryptoQuant’s head of analysis revealed that this group of traders is made up of ETF issuers and monetary corporations which have stopped shopping for Bitcoin. U.S.-based Bitcoin exchange-traded funds have recorded internet outflows in 5 of the previous six weeks, in accordance with SoSoValue information.

In the meantime, BTC and crypto treasury corporations have struggled in latest months, with retail traders shedding tens of billions of {dollars} to the hype. Though there are few reviews on the sale of crypto property, this decline within the Dolphins’ holdings tells a very completely different story.

Bitcoin value overview

As of this writing, the value of BTC is round $89,151, reflecting a decline of over 3% up to now 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall-E, chart on TradingView