Bitcoin (BTC) on-chain information reveals structural considerations in regards to the sustainability of present gatherings, and defending the $111,000 zone is prime to avoiding any additional downsides.

As GlassNode reported on September twenty fifth, the setback from practically $117,000 following the Federal Reserve charge resolution displays the textbook “purchase rumors and promote information” sample.

Bitcoin’s all-time excessive of $124,000 to $111,012 presents a decline of simply 10.5% in comparison with the earlier 28% correction of the cycle or a 60% drop seen within the earlier bull market.

Nonetheless, the report famous that this floor stage stability masks market fatigue, which requires cautious consideration.

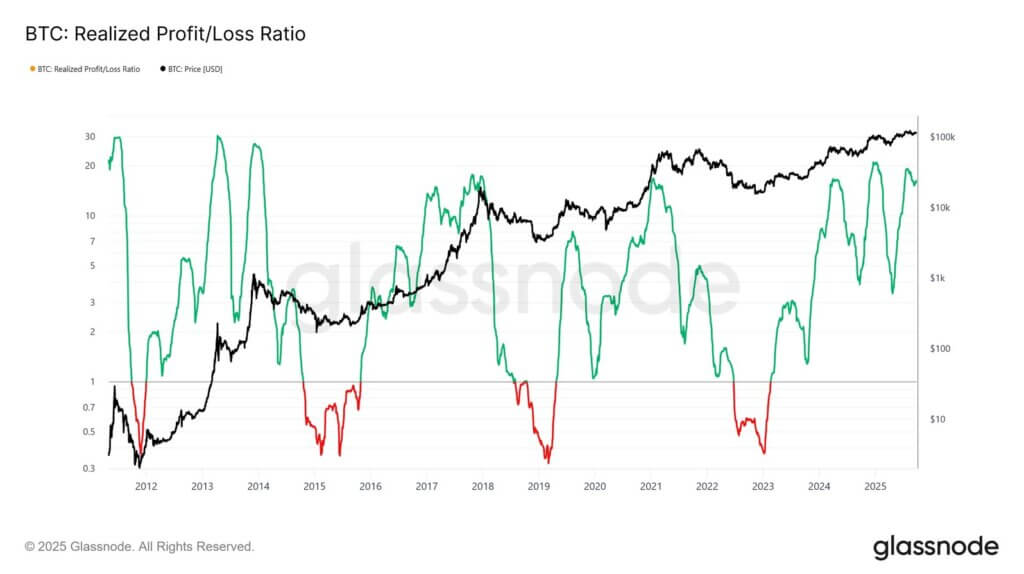

On-chain metrics draw footage of capital movement dynamics. This cycle has absorbed a web influx of $678 billion by realized cap development.

Lengthy-term holders have distributed 3.4 million BTC to earnings, already surpassing earlier cycles, highlighting the magnitude of gross sales stress from seasoned traders. The market construction reveals a fragile stability between institutional demand and long-term holder distribution.

The US buying and selling Bitcoin spot ETF inflow, which beforehand absorbed large gross sales, collapsed to close zero across the FOMC assembly from 2,600 BTC per day.

In the meantime, the distribution of long-term holders surged to 122,000 BTC monthly, creating an imbalance that units a stage of debilitating.

The derivatives market has amplified the corrections by pressured liquidation and derevalization. With Bitcoin falling beneath $113,000, open curiosity on futures fell sharply from $44.8 billion to $42.7 billion, with an aggressive liquidation cluster of $114,000-$112,000 being actively bought.

This derevalization reset cleared extreme leverage, but in addition revealed market vulnerabilities to liquidity-driven swings.

The choices market displays rising considerations a few decline because the revised Put/Name Skew spikes have been spiked from 1.5% to 17%.

The best choice of all time approaches the very best ever excessive, creating gamma overhangs that amplify volatility, particularly on the unfavorable aspect the place sellers are positioned in brief gamma.

As Bitcoin is at the moment buying and selling at $109,466, the $111,800 stage represents a short-term holder value base and served as short-term assist throughout current gross sales.

This technical basis turns into necessary because the market navigates between institutional accumulation and long-term advantages from holders.

Bitcoin’s capability to keep up the brink determines whether or not this modification represents wholesome integration or the onset of a deeper cooling development.

If the institutional demand to offset the continuing long-term possession distribution shouldn’t be up to date, the chance of a bigger worth drop is considerably elevated.