Bitcoin costs entered 2026 in a battle between the identical patrons and sellers that saved the value depressed till late 2025. Costs have been nearly flat for the previous 30 days, down about 0.6%, indicating that neither facet is in management.

In comparison with the earlier 12 months, it’s nonetheless down about 7%. This strain stability reached a stalemate. Nonetheless, if the appropriate circumstances current themselves, a 1% and even 3.5% transfer from right here may decide the following path.

Purchaser and vendor pressures collide inside a symmetrical triangle

Bitcoin trades inside a symmetrical triangle on the each day chart. This form signifies that the market is caught between high and low costs, suggesting a battle between patrons and sellers. Capital actions will not be serving to the upside.

Chaikin Cash Move (CMF) has been trending downward since December tenth. For individuals who aren’t acquainted, CMF measures the sum of money flowing into and out of a property. Whereas BTC value has been in an uptrend from December 18th to December thirty first, CMF has hit new lows and is at the moment exhibiting a bearish divergence. This means continued capital outflows and promoting strain.

Capital Outflows: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

This unfavorable capital move is partially offset by overseas change outflows.

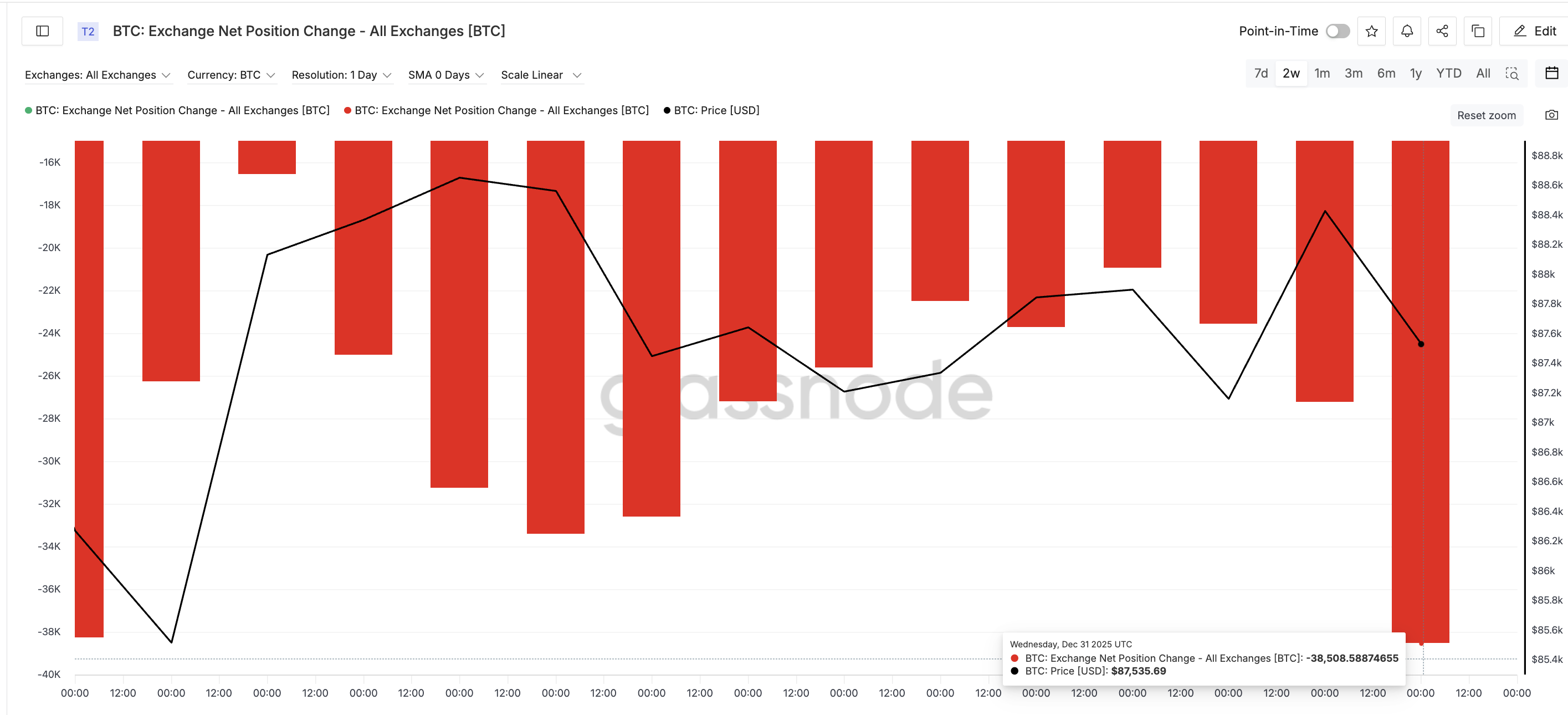

Adjustments within the change’s internet place point out that cash are leaving the change. It usually signifies accumulation. The change outflow quantity on December nineteenth was roughly 16,563 BTC. By January 1st, they’d risen to 38,508 BTC.

Rising shopping for strain: Glassnode

This is a rise of roughly 132%. Pushing the coin out of the change helps stabilize the value and protects the decrease trendline of the triangle.

Good cash highlights indecision

Good Cash Index measurements affirm the shortage of path. The Good Cash Index compares how massive an knowledgeable dealer’s positions are relative to the broader market. The road is carefully connected to the sign line with no clear separation. This means that giant merchants are ready for a breakout and haven’t guess in both path but.

Even the sensible cash is not positive: TradingView

The triangle stays impartial till a breakout happens.

This matches what’s within the CMF and change move knowledge. Sign strain flows out. Assist for change withdrawal alerts. These cancel one another out and keep the BTC value. And even probably the most knowledgeable merchants do not know who will win.

Heatmap and Bitcoin value ranges reveal set off window

A value-based warmth map highlights clusters the place probably the most patrons made their final buy. These clusters usually act like assist or resistance. The closest resistance zone is round $88,082 to $88,459, the place there are round 200,035 BTC.

BTC Heatmap: Glassnode

Bitcoin is buying and selling round $87,480. If the day’s closing value rises by about 1%, the value will transfer above that zone. That might act because the preliminary bullish set off and conclude the higher triangle break. On the BTC value chart, the extent matching this cluster is $88,300, which must be damaged first.

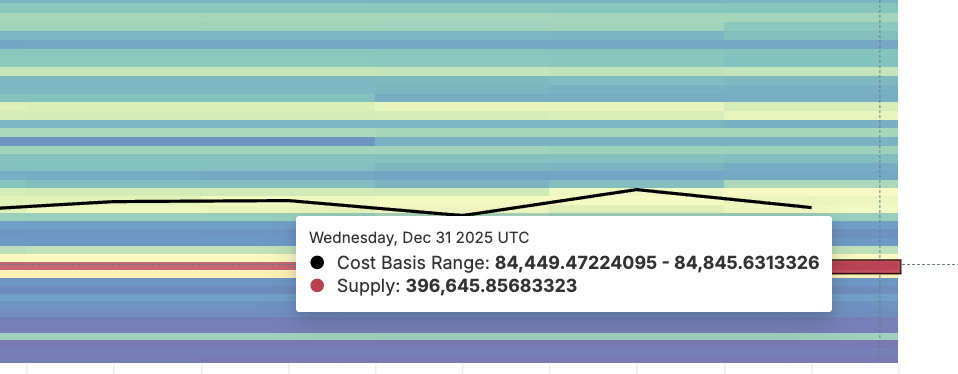

Within the brief time period, it appears to be like just like the draw back stage will turn out to be stronger (it is going to be more durable to interrupt out). The closest high-cost foundation assist is at $84,449 to $84,845, leaving round 396,645 BTC there.

Assist cluster for BTC: Glassnode

On the value chart, the closest stage to this cost-based assist is $84,430. Bitcoin value would wish to fall by round 3.5% to check this territory. Subsequently, bearish validation lies decrease and requires extra strikes to substantiate.

Bitcoin Value Evaluation: TradingView

The chart and warmth map match. A break above $88,300 would be the first bullish sign. If the closing value of the day is cleanly above, the main focus adjustments to $89,500 after which $90,690. After shedding $84,430, the setup flips utterly to the draw back, indicating that the vendor has received the battle.

The put up Bitcoin faces its largest battle in 2026 — a 1% transfer can clear up eternally appeared first on BeInCrypto.