Bitcoin fell to $108,000 on Thursday, falling 3.6% in 24 hours and practically 7% per week, based on Coingecko information.

The decline prompted widespread losses throughout the crypto market, bringing Ethereum down 8% to $3,887, bringing the four-week lack of ether to 23%.

The sale noticed a surge in liquidation, wiping out greater than $1.1 billion in transactions over 24 hours. Most of it was a protracted wager that might go up over $1 billion and costs would rise.

Dogecoin fell 7.6%, buying and selling near $0.23, whereas Solana fell 7.7% to $197.52. Each tokens have fallen 21% over the previous seven days, rating them because the worst efficiency of the week within the high 100.

Pullback additionally lined up with weaknesses in US shares. The commercial averages for the S&P 500, Nasdaq and Dow Jones all resulted in pink on Thursday.

Long run holders dumped Bitcoin whereas the ETF was silent

Bitcoin’s newest rally, with a postform-high $117,000, has been reversed to what analysts describe because the traditional “purchase rumors and promote information” sample. GlassNode analysts mentioned Thursday that Bitcoin is now “indicating indicators of fatigue” as demand for ETFs stalled and long-term buyers started to face as much as income.

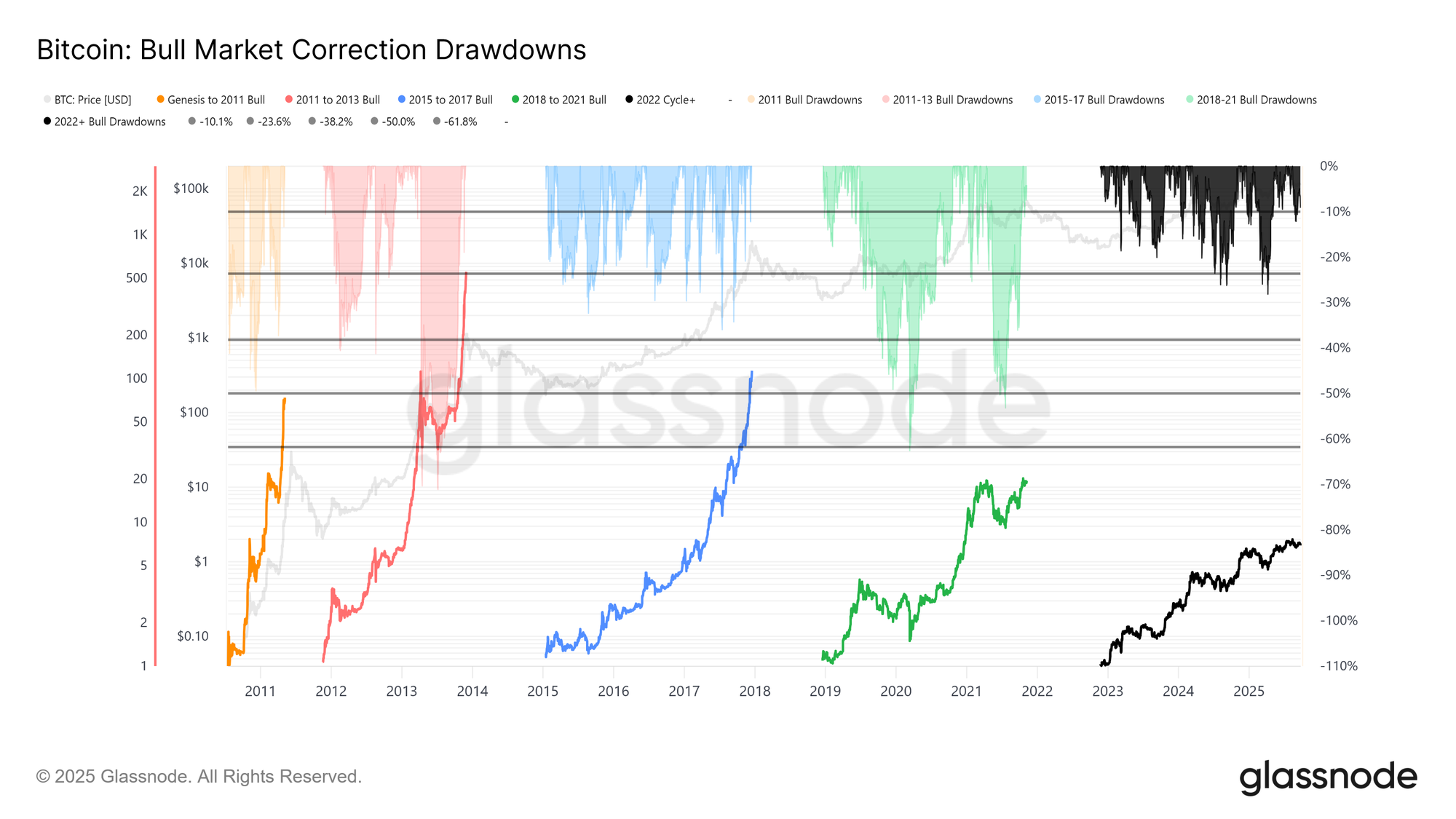

The present decline fell from $124,000 to $113,700, equaling an 8% decline. That is milder than the 28% drawdown of this cycle and the 60% drop seen in earlier ones. Nevertheless, analysts additionally observe that Bitcoin’s volatility has been shrinking over time, resembling the gradual climbs seen between 2015 and 2017.

Supply: GlassNode

The cycle lasted about 1-030 days, however was shy in regards to the 1-060-day interval seen within the final two. Capital’s deployment has moved in three waves since November 2022, growing CAP to $1.06 trillion, based on on-chain information. Presently, capital inflows are $678 billion, virtually $2383 billion within the final cycle.

This wave would not all come directly. Each time greater than 90% of the cash that moved have been profiting, it was the highest. The code has simply left the third spike like that. Lengthy-term holders promote 3.4 million btc, already promoting extra BTC than in previous cycles.

The ETF circulation, which helped take in that provide firstly of the 12 months, fell off the cliff. Across the FOMC, long-term holders have been decreasing at a charge of 122,000 BTC per thirty days, whereas internet ETF inflows fell to close zero from 2,600 btc/day. It created a weak atmosphere as gross sales strain rose and new demand dried up.

Futures and choices revealed market vulnerabilities

The spot market first collapsed. When Bitcoin fell, buying and selling quantity exploded, and skinny order books have been unable to deal with the circulation. It pushed the value as much as beneath $113,000, inflicting a pointy flash of futures. Open curiosity fell from $44.8 billion to $42.7 billion, with stacked merchants compelled to depart, increasing the autumn.

Coinglass’ HeatMaps confirmed main liquidation clusters starting from $114,000 to $112,000, clearing leveraged longs. This created a short-term ground close to $111,800. Right here, the fee base for short-term holders belongs.

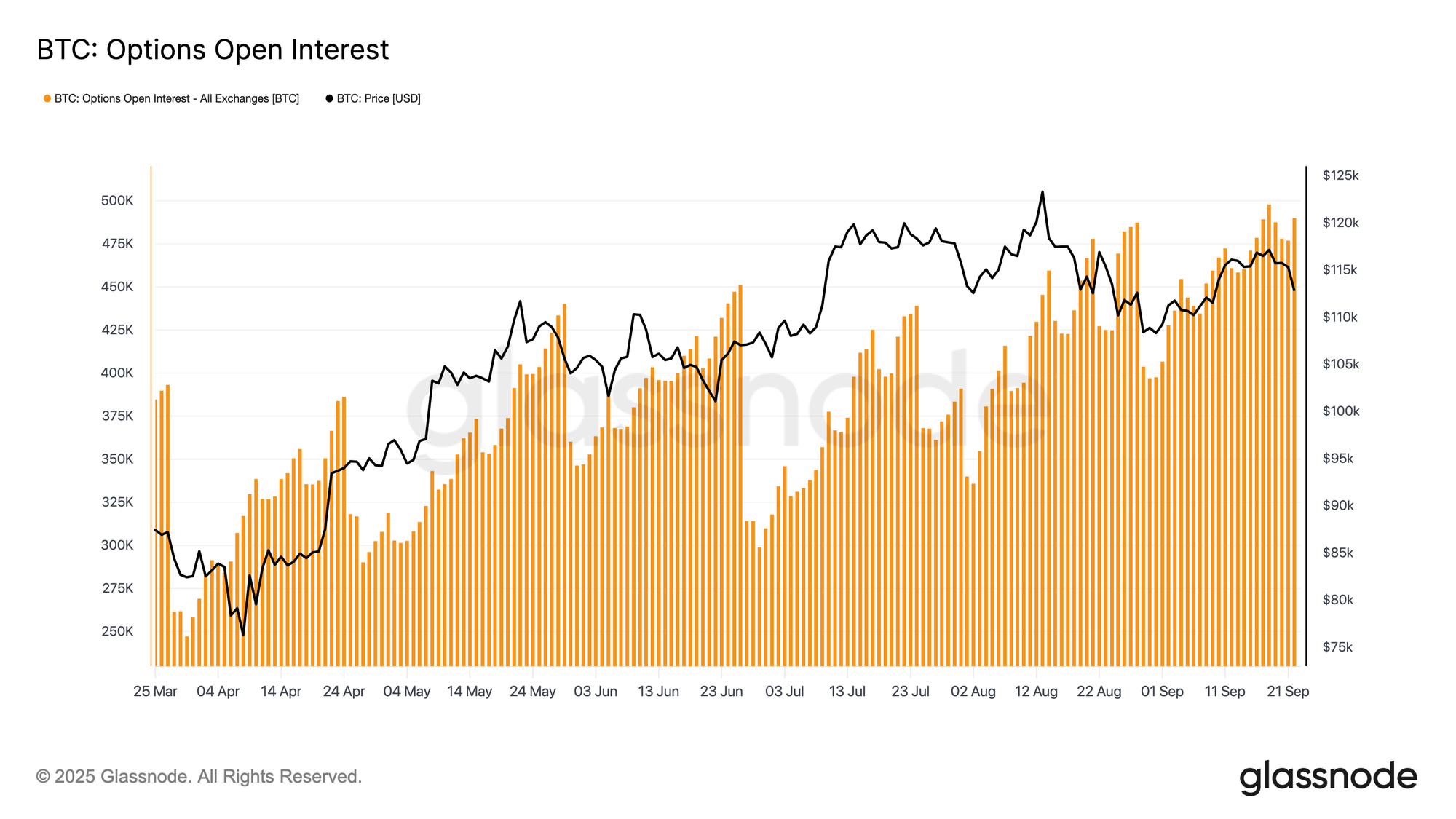

Nevertheless, costs stay unstable. The danger degree nonetheless hovering round $117,000, and and not using a stronger buy, the value may very well be even better. Within the choices market, volatility surged earlier than FOMC, and it cooled when charge reductions have been confirmed.

That did not final. Sunday’s futures accident reignited horrifying buying and selling. Per week of implicit volatility jumped, and strain unfold to lengthy contracts. On Friday, the 1W skew was spiked from 1.5% to 17%, indicating that merchants scrambled for draw back safety.

That rush was actual. Two days later, the most important liquidation since 2021 appeared in the marketplace. The put/name quantity ratio has since dropped as merchants cashed out places and moved them to cheaper calls. Nonetheless, skew information exhibits that the market remains to be leaning in direction of extra places, holding safety costly and cheap.

Complete choices open curiosity remains to be near document highs. Most of them might be reset after expiration on Friday morning. Till then, sellers have been pinned to the height gamma zone and compelled to hedge all of the small actions.