Bitcoin treasury firms are getting into a “Darwinian part” because the core mechanics of their once-booming enterprise mannequin crumble, in response to a brand new evaluation from Galaxy Analysis.

The report stated that digital asset treasury (DAT) buying and selling has reached its pure restrict because the inventory worth fell under Bitcoin’s (BTC) internet asset worth (NAV), the issuance-driven development loop was reversed, and leverage was debt.

The breaking level got here when Bitcoin fell from an October excessive of round $126,000 to a low of round $80,000, inflicting a pointy contraction in danger urge for food and drying up liquidity throughout the market. The October 10 deleveraging occasion accelerated that shift, wiping out open curiosity throughout the futures market and weakening spot depth.

“For monetary companies that used shares as leveraged crypto trades, the change is dramatic,” Galaxy stated, including that “the identical monetary engineering that amplified the upside additionally magnified the draw back.”

Associated: Cantor cuts strategic targets by 60%, tells clients fears of pressured gross sales are exaggerated

DAT inventory turns to low cost

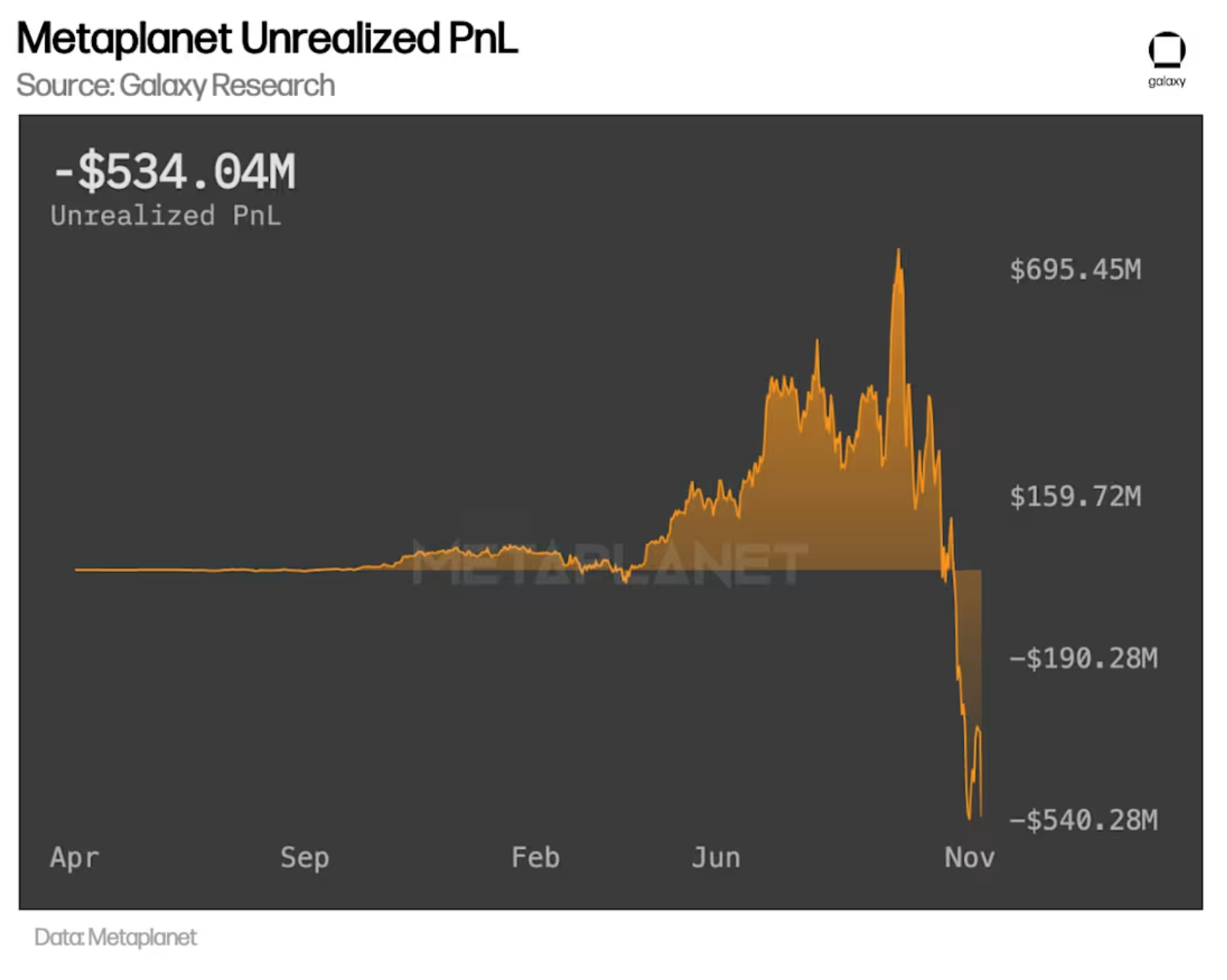

DAT inventory, which traded at a excessive premium to NAV over the summer time, is now largely low cost, though Bitcoin itself is just down about 30% from its highs. Firms like Metaplanet and Nakamoto, which beforehand had unrealized good points of lots of of hundreds of thousands of {dollars}, are actually within the crimson with the typical BTC buy worth exceeding $107,000.

Galaxy famous that the leverage embedded in these firms is uncovered to excessive downsides, with one firm, NAKA, down greater than 98% from its peak. “This worth motion resembles the kind of wipeout seen within the meme coin market,” the corporate wrote.

Metaplanet’s unrealized good points and losses quantity to $530 million. Supply: Galaxy

With publication not potential, Galaxy has outlined three potential paths ahead. The fundamental case is that there shall be a protracted interval of compressed premiums, throughout which BTC per share development will stagnate, inflicting DAT inventory to have a bigger draw back than Bitcoin itself.

The second result’s integration. On this case, firms that issued giant quantities at excessive premiums, purchased BTC close to the height, or have been in debt might face solvency pressures and be acquired or restructured. Within the third state of affairs, if Bitcoin ultimately reaches a brand new all-time excessive, there’s nonetheless room for a restoration, however just for firms that keep liquidity and keep away from overissuing in the course of the increase.

Associated: Can the most important Bitcoin whale actually resolve when the market turns inexperienced or crimson?

Technique raises $1.44 billion to ease dividend considerations

On Friday, Technique CEO Von Leh stated the corporate’s new $1.44 billion money reserve was created to ease buyers’ considerations about whether or not it will likely be in a position to meet its dividend and debt obligations throughout Bitcoin’s downturn. The reserve, raised via a share sale, is designed to make sure no less than 12 months of dividend funds, with plans to increase that buffer to 24 months.

In the meantime, Matt Hogan, Bitwise’s chief funding officer, stated Technique would not have to promote Bitcoin to outlive even when the inventory worth falls, and stated those that say in any other case are “utterly mistaken.”

journal: 2026 is the yr of sensible privateness in cryptocurrencies — Canton, Zcash, and extra