It is a phase of the Imperial publication. Subscribe to learn the total version.

Lets sum up a bit in the course of the 12 months?

I discussed K33’s H1 report on An Intro the opposite day, and there’s a lot of fascinating information to digest.

The official transition from H1 to H2 has been marked, together with the truth that the Bitcoin finance firm acquired a whopping 244,991 Bitcoins by the tip of June.

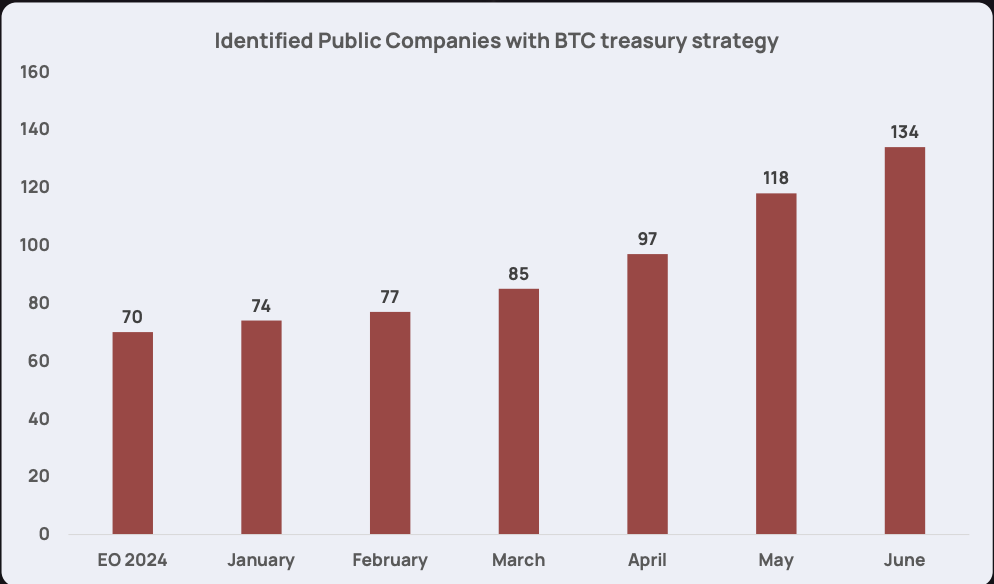

For sure, maybe not shocking, it goes with out saying that the variety of finance corporations has nearly doubled by the tip of the primary half. At the start of the 12 months there have been 70 corporations on their stability sheets that had Bitcoin, which shortly swelled to 134.

Supply: K33

Supply: K33

In keeping with K33, corporations within the US, Canada, Japan and the UK are on the high of the record in the case of corporations pivoting into Bitcoin’s monetary technique, however the whole is made up of corporations from 27 international locations. This provides us a tough thought of how international that is, however the US outperforms the charts with 41 public corporations.

Nevertheless it’s not simply Bitcoin finance corporations or Bitcoin. a Many This 12 months occurred as a result of CEO CARLOS Domingo and Bitwise CEO Hunter Horsely wished to level us out this week.

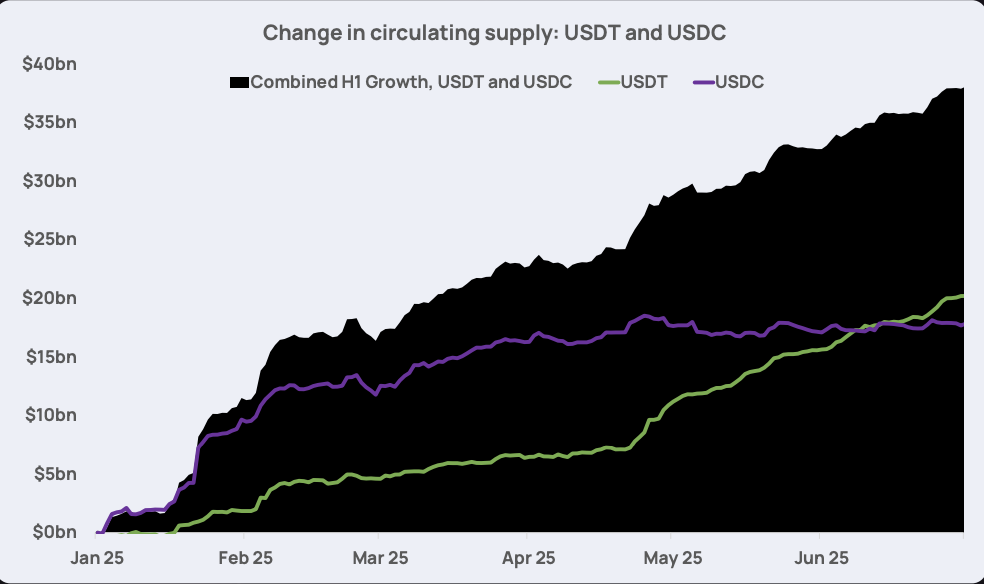

Within the first half of the 12 months, USDT and USDC distribution provides elevated by $38 billion as folks gathered within the Stablecoin story.

Supply: K33

Supply: K33

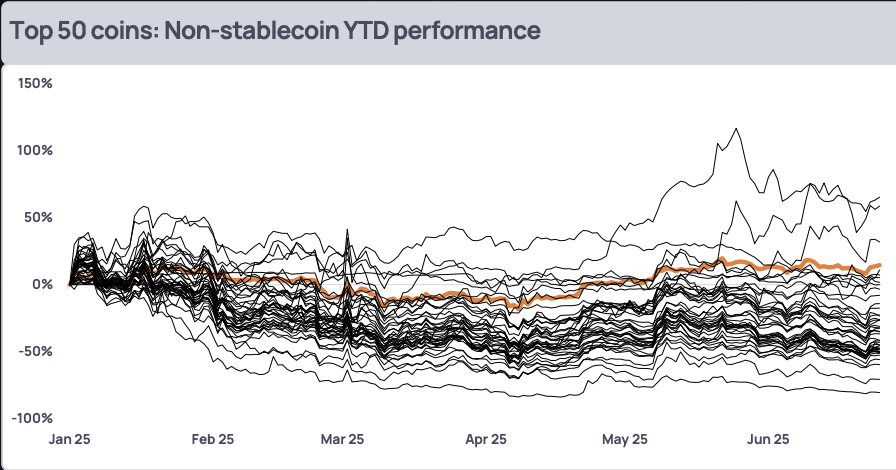

Sadly, when taking stubcoins out of the combo, solely 9 of the highest 50 ciphers who noticed a constructive return in H1 present that altcoins are struggling to discover a foothold in a market dominated by Bitcoin and Stubcoin.

Of these 9, K33 famous that outweighed three distinctly superior Bitcoins: XMR, Hype and Sky.

Supply: K33

Supply: K33

So evidently the momentum for the Altcoin season would not exist but. However wanting forward, if a few of these Altcoin ETFs are authorized, there could also be some hope on the horizon.